What Banks Can Learn from Fintechs about Digital Onboarding

via The Financial Brand

Did you know that, on average, people stay with their financial institution for 17 years? Even more surprising, people are more likely to stay with their bank or credit union longer than they will stay with their partner.

For financial institutions, this means that winning a new client ranks highest because each onboarded customer is likely to become a loyal account holder for years to come.

But what happens when the banking onboarding experience is long and complicated? It makes it difficult to estimate how many customers are lost in the process — but you know they are leaking out of the system.

A One-Man Test of a Dozen Onboarding Routines

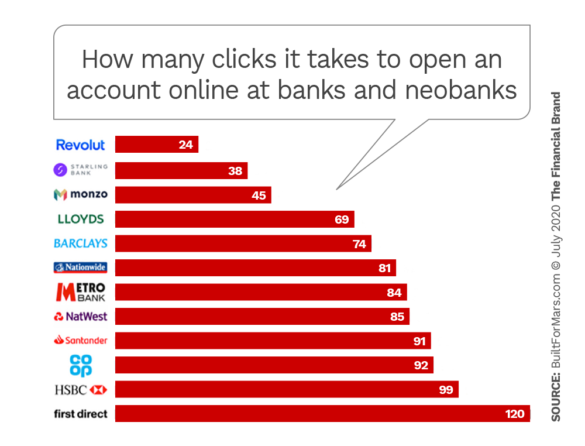

A long and complicated onboarding process costs a lot in the long run. Peter Ramsey, founder of the UX site Built for Mars, conducted a test where he opened 12 real bank accounts and logged everything involved in applying for an account online. The results showed that traditional banks’ onboarding process is significantly longer and more complicated than the newer challenger banks.

“The challenger banks not only required the fewest clicks but needed significantly fewer than even the best-scoring traditional bank. It took five times as many clicks to open an account with First Direct than it did with Revolut,” Ramsey wrote in a blog.

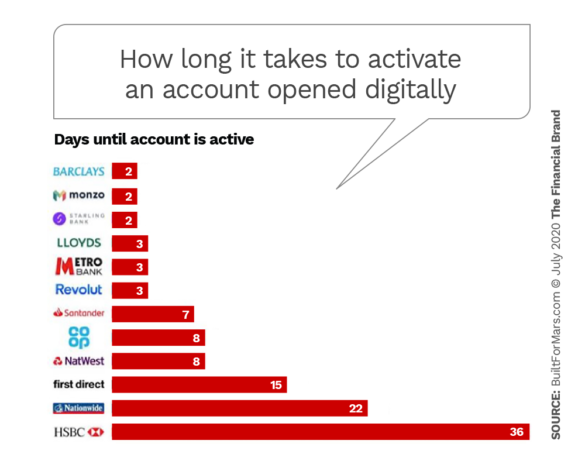

Another astonishing statistic is how long it actually takes from onboarding to actually having an active account at some institutions. While this anecdotal evidence shows the experience of a single person, 36 days seems unreal for any type of account, leave alone a retail banking account.

This is even more amazing when the bar has been changed so drastically by the likes of the Apple Card, offered by Apple and Goldman Sachs. On an iPhone one can apply, receive approval and commence using the “card” digitally in minutes. Consumers’ patience with laggards is growing thin.

For Many Financial Brands Better CX Remains the Impossible Dream

For customers, onboarding often remains a challenging and time-consuming process. Traditional processes, as well as some so-called digital efforts, are often heavy with friction, which seriously impacts conversion rates and the cost of acquisition. Manual processes, paper and PDF documents, needing to visit bank branches to complete processes started online, awaiting approval, and passing information through a series of systems all contribute to delays and inconvenience.

Instead of using the onboarding experience as an opportunity to demonstrate a superior customer journey, many financial institutions squander that opportunity. They often overwhelm potential customers with boatloads of data requests and lengthy waits.

Often this behavior is blamed on regulation. But that’s no excuse for a bad experience.

Yes, banking is a highly regulated industry, and a complex documentation trail is required. Banks and credit unions must put their customers through a Know Your Customer process, These rules are strict and often require that documents be signed in person or sent via mail. Each step of the process requires waiting for approval before moving on. However, eSignature adoption is skyrocketing as regulators across the world are shifting rules to accommodate new digital realities.

Traditional onboarding means consumers must re-enter information multiple times, and employees have to manually input the data into other systems. In the end, human resources and a new customer’s time are wasted on unnecessarily repetitive data entry and tedious paper-pushing.