Why We Started Abra

RRE: US startup Abra has launched its mobile app for remittances (available on iPhone and Android), which bypasses the middle men by using the blockchain and a network of “human ATMs”

Yesterday at the Launch Festival in San Francisco we announced Abra. Abra (A BetterRemittance App) is an exciting new iPhone and Android software cash wallet and money transfer application.

We started Abra because we believe that the first generation of digital currency applications are technical marvels but don’t solve real consumer pain. To make digital currency useful to “cash consumers” digital currency should: be transferable to any phone number in the world, not represent exchange rate risk, be as private as real cash, have no costs for money transfer, and be fungible to real paper-cash at very low cost 24 hours a day, 7 days a week. Abra was designed to fulfill all of these needs.

Our “marketing description of Abra:”

With Abra, digital cash (equivalent to US Dollars) is stored directly on the smartphone. Instantly transfer money peer to peer to any phone number in the world. Abra never touches your money. Abra merges money transfer and payments via a single digital cash wallet that works ubiquitously anywhere in the world. There is no bank or other third party involved in managing, storing, remitting or accepting your money. Abra represents the next generation of digital cash applications but without the technical fuss.

Technically put, Abra is digital cash stored directly on your phone, guaranteed in US Dollars. Abra app-based transfers use the blockchain to settle, and transactions are published directly to the blockchain from your phone. Abra’s back-end servers never touch consumer’s money or their transfer requests. The value of the holdings in your wallet do NOT fluctuate with the value of Bitcoin for at least 3 days after initial deposit onto your phone. Abra is not a financial service — it is an app that facilitates storing digital currency equivalent to US Dollars directly on your smartphone and transferring your money from your Abra App to any other Abra App anywhere in the world.

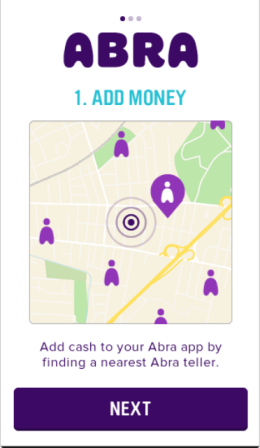

To make Abra accessible to consumers globally we are launching a network of Abra Tellers. Tellers are like mobile airtime agents. Instead of selling airtime, Abra Tellers sell and buy digital currency. Think of them as human ATM’s. In the US, consumers with supported ATM cards will be able to add digital cash to their smartphone with their ATM card and pin. This is a US first. Those using an ATM card to buy digital cash via one of Abra’s exchange partners will need to provide ID. Others do not have to register with Abra at all. All Abra Tellers are background-checked, similar in fashion to Uber or Lyft drivers.

Abra began Teller sign-ups yesterday in advance of a full service launch planned for this spring. We’ve been playing with builds of the App and we love it. It’s the digital cash app we’ve always wanted for ourselves.

To design Abra we turned to the traditional Hawala model. The concept of a Hawala dates back to the 8th century. Hawaladars are people who collect and hand out money on behalf of others over long distances. Hawaladars settle with each other via barter transactions, netting out reverse transactions, or in modern times via bank wires if necessary. Traditional Hawala’s are generally illegal in the United States as no one is allowed to hold or remit funds on behalf of someone else without being a licensed money transmitter both with FinCen (the Financial Crimes Enforcement Network) and with the US State regulators where the consumers’ reside. In the case of Abra, however, consumers and Tellers are always holding their own money just as with the standard open source Bitcoin software. Abra Tellers simply buy and sell digital currency directly to and from other consumers in their neighborhood in small amounts.

Funds are stored in US Dollars so there is no foreign exchange taking place. Consumers send money peer-to-peer directly via the blockchain. As everyone is always holding their own money in their Abra App and no third party directly facilitates the transfer of money, money transfer laws don’t apply and no foreign exchange happens.

Abra Tellers are strictly forbidden from knowingly buying or selling digital cash to any person that they believe would use the App for illicit means.