Mark Cuban-backed finance app Dave says its new mobile bank account is headed for 1 million users

via CNBC

The digital banking wars are heating up.

Upstarts including Chime and Current have added hundreds of thousands of users since the coronavirus pandemic began as more Americans seek out mobile-first banking apps free from penalties like overdraft fees.

To that field, enter Dave, a Los Angeles-based start-up last valued at $1.2 billion. The company launched in 2016 as a personal finance tool that helped customers manage their budgets, avoid overdrafts and even find gig-economy jobs. That offering has 7 million users, according to CEO Jason Wilk.

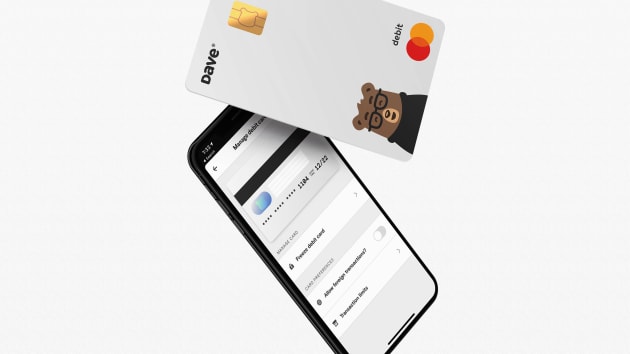

In May, the company, which counts billionaire Mark Cuban as an early investor and board member, began to roll out a digital bank account to a wait list of 2 million people, Wilk said. So far, Dave Banking has over 100,000 users and Wilk is confident that it will reach 1 million by year-end.

“One million is a very conservative number for us to hit,” Wilk said in a telephone interview. “We have 2 million of our core users signed up for Dave Banking, and every time we send a push notification to invite someone off that list, 1 out of every 2 people end up signing up for an account.”

The pandemic has hastened the adoption of digital channels across industries as people avoid in-person interactions. In banking, the crisis has led to faster digital adoption for giant institutions like JPMorgan Chase and fintech newcomers alike. The new breed of startups, as well as established fintechs from overseas including Revolut and N26, have grown by targeting users who don’t typically have enough in balances to avoid fees at a traditional bank.

For those who want personal finance tools without ditching their existing banks, Dave can also be linked to accounts like Chase.

“Not everyone wakes up in the morning excited to open up a new checking account,” Wilk said. “We solve your immediate financial challenges no matter which bank you use. That’s very different from just saying we have a no-fee checking account, which is quickly becoming a commodity.”

Dave’s large user base for its automated budgeting tool has meant the company spends little to gain banking customers, making for “incredibly low user-acquisition costs,” Wilk said. In that way, it differs from other mobile banks, which rely on digital advertising and signing bonuses for growth.

The start-up also announced it is exclusively using Mastercard for its debit cards and upcoming products. Chime and other start-ups lean on rival payments network Visa.

“Given our shared commitment to bringing consumers into the digital economy through next-generation financial products, we’re excited to be working with Dave,” said Sherri Haymond, a Mastercard executive vice president.