Digital bank Current sees ‘insane’ growth during pandemic as essential workers sign up for accounts

via CNBC

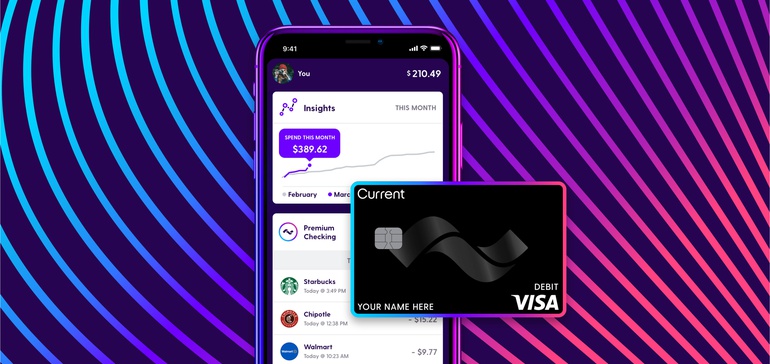

Digital banks like Chime and Square’s Cash App have added millions of users by offering streamlined, mobile-first accounts without the pesky fees associated with brick-and-mortar banks.

To that list of disruptors, add the New York-based start-up Current.

Current, founded in 2015 by former Wall Street trader Stuart Sopp, has offered fee-free mobile checking accounts since the start of last year. It has seen customer growth surge during the coronavirus pandemic, adding more than 100,000 users a month in April and May, Sopp said in a telephone interview. The company recently exceeded 1 million active accounts and expects to double in size this year, he said.

That’s because Current has taken off with the essential workers who “have kept this country going” during the pandemic, Sopp said.

“Everyone who was tagged as an essential worker happens to fit our profile, just by dumb luck,” he added. “They work at Walmart or Amazon, they’re Door Dash-ers, Instacart-ers, Uberand Lyft drivers, UPS workers, nurses or military. Our growth in the last two months has been insane.”

The pandemic has acted like an accelerant to a trend: the steady migration of most everyday banking activities to mobile apps and online portals. That has boosted digital adoption for both huge institutions like Bank of America to newcomers including Current. But Current and its rivals have grown by exploiting the fact that, for people living check to check, accounts from big banks can be a bad deal: Lower-wage earners often struggle to maintain the required minimum balances or get hit with overdraft fees.

“They’ve been sort of ostracized by the banks because they don’t have much in deposits,” Sopp said.

The company’s business model — essentially, a technology layer on top of an account that’s actually from a separate FDIC-backedinstitution — allows it to focus on making money from debit transactions and a premium subscription. Most traditional banks require customers to keep thousands of dollars in balances to avoid maintenance fees.

Like some of its fintech brethren, Current gives users access to their paychecks up to two days faster than traditional accounts, up to $100 in free overdrafts and free access to thousands of ATMs. These features have proven to be a hit with lower-wage earners.

“We are lowering the barriers to financial inclusion,” Sopp said. “We’re focusing on wealth inequality but not explicitly saying we’re doing it. It should just be good business.”

Fully 50% of the bank’s user base are Black, Sopp said, citing an internal estimate based on user photos and commercial data. The average age of Current customers is 27, and they are clustered in cities including Atlanta, Dallas, Chicago, Los Angeles and New York’s Brooklyn, he said. Users spend about $1,100 per month, almost entirely on necessities like groceries, he added.

The company’s exponential expansion — Sopp estimates that annualized customer growth is now at 1,300% — has attracted a new investment from Foundation Capital, a Silicon Valley-based venture capital firm. While Sopp wouldn’t disclose the size of the stake, he said Foundation partner Angus Davis is joining Current’s board.

“With a third of the U.S. population living paycheck to paycheck, Current has a large opportunity in front of it,” Davis said in a statement.