Mastercard Launches Crypto Credential System to Simplify Blockchain Transactions

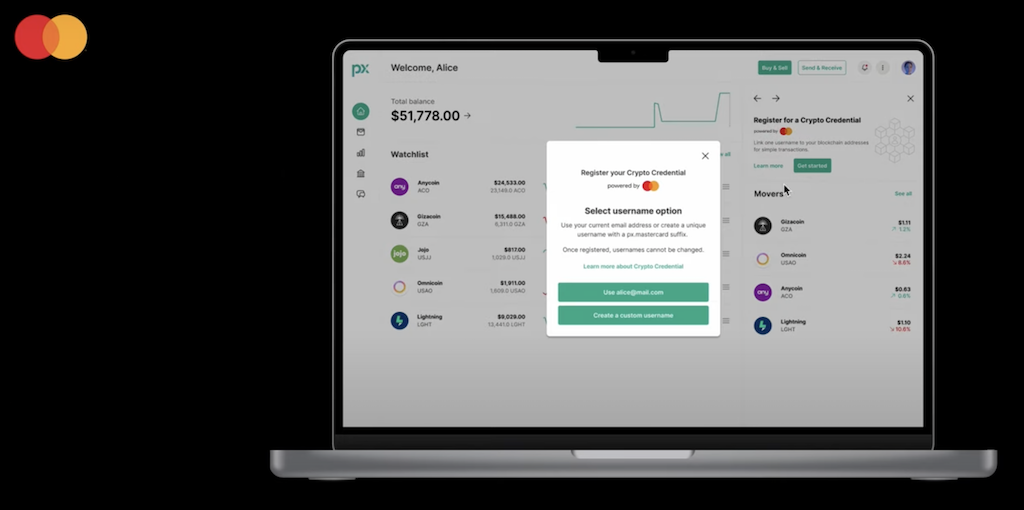

Mastercard has taken a significant step in the digital payments landscape by launching its Crypto Credential system, aimed at simplifying and securing cryptocurrency transactions. This initiative, currently in its pilot phase, involves major crypto exchanges such as Bit2Me, Lirium, Mercado Bitcoin, and wallet provider Foxbit. The system’s primary feature is the use of human-readable aliases instead of the traditional complex blockchain addresses, aiming to streamline transactions and reduce user errors.

The Crypto Credential system allows users in 13 countries across Europe and Latin America to send and receive cryptocurrencies using simple aliases. Countries participating in this pilot include Argentina, Brazil, Chile, France, Guatemala, Mexico, Panama, Paraguay, Peru, Portugal, Spain, Switzerland, and Uruguay. By using these aliases, users can avoid the lengthy and often confusing alphanumeric wallet addresses, which are prone to errors that can result in lost funds.

Mastercard’s Crypto Credential addresses a critical pain point in the adoption of cryptocurrencies: the user experience. Traditional wallet addresses are not only cumbersome but also increase the risk of mistakes during transactions. With aliases, users can confidently send and receive digital assets without worrying about the technical complexities typically associated with blockchain transactions.

The system also incorporates robust verification mechanisms. When a user initiates a transfer, Mastercard verifies the recipient’s alias and checks if the recipient’s wallet supports the specified digital asset and blockchain. If there is a mismatch, the sender is notified, and the transaction does not proceed. This preemptive verification helps protect users from potential financial losses and ensures that all parties involved have a compatible setup for the transaction.

Mastercard’s Crypto Credential system also supports the exchange of Travel Rule information for cross-border transactions. The Travel Rule is a regulatory requirement designed to enhance transparency and prevent illicit activities such as money laundering and terrorism financing. By complying with these regulations, Mastercard aims to build trust and provide a secure environment for cryptocurrency transactions.

The pilot phase has already attracted several key players in the crypto industry. Bit2Me, Lirium, Mercado Bitcoin, and Foxbit are among the first to integrate with Mastercard’s Crypto Credential system. Additionally, Lulubit users will gain access through its integration with Lirium, further expanding the system’s reach.

Mastercard is committed to expanding this ecosystem. The company plans to roll out wider availability to more than 7 million users across participating exchanges over the coming months. This expansion will not only enhance the usability of cryptocurrencies but also support the growing remittance market, particularly in regions where cross-border payments are crucial.

The peer-to-peer (P2P) transactions facilitated by Mastercard Crypto Credential represent just the beginning. The company envisions extending this system to support other use cases, including non-fungible tokens (NFTs), ticketing, and additional payment solutions, depending on market demands and compliance requirements.

Mastercard’s initiative is a notable advancement in the cryptocurrency space, aiming to make blockchain transactions as seamless and secure as traditional financial transactions. However, the system is not without its criticisms. Some experts point out that relying on a centralized entity like Mastercard introduces concerns about data security and privacy. Mastercard’s history of data breaches adds to these concerns, highlighting the need for stringent security measures to protect user data.