SumUp Secures €285 Million in Funding to Propel Global Fintech Expansion

London-based fintech company SumUp has successfully raised €285 million in a recent funding round led by Sixth Street Growth, with participation from Bain Capital Tech Opportunities, Fin Capital, and Liquidity Group. This substantial injection of funds comes as SumUp continues its mission to empower small merchants globally with accessible financial services.

The fintech company, which boasts a customer base exceeding four million businesses across 36 markets, plans to utilize the funding to further expand its international footprint. SumUp has been operating positively on an EBITDA basis since Q4 2022, maintaining a remarkable 30% top-line growth year over year. The recent infusion of capital positions SumUp to navigate the evolving fintech landscape and continue delivering essential tools for small businesses.

Notably, the funding round marks SumUp’s sustained growth and ability to weather market fluctuations. The company’s CFO, Hermione McKee, emphasized that SumUp’s success over the past eleven years is a testament to the trust and support of both merchants and investors. The funds secured will act as additional firepower to propel growth initiatives and accelerate product development, ensuring small businesses have the necessary tools to thrive.

SumUp’s expansion strategy involves organic growth, introducing new financial services around card readers and other point-of-sale tools. The company is also eyeing inorganic growth through strategic mergers and acquisitions, aligning with the current buyer’s market in the fintech sector.

Sixth Street Growth, leading the funding round, expressed confidence in SumUp’s sustained growth and innovative culture. Nari Ansari, Managing Director at Sixth Street Growth, commended SumUp’s track record of entering new markets and product categories, aligning well with their investment strategy.

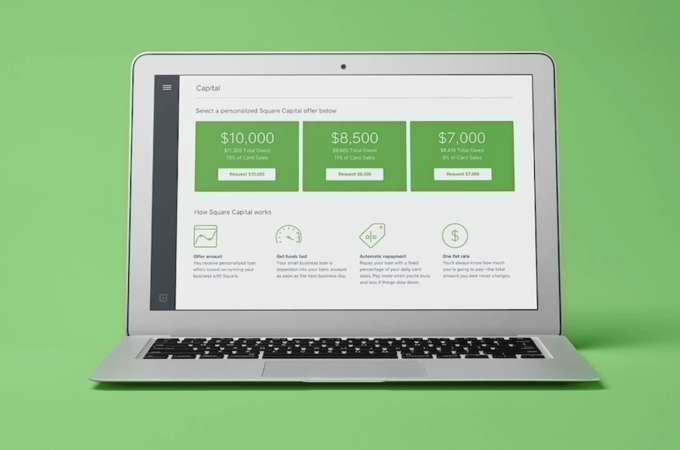

SumUp’s recent product and service enhancements, including a cash advance partnership with VPC in the UK, Tap to Pay on iPhone in select regions, and the introduction of SumUp One, showcase the company’s commitment to providing comprehensive solutions for small merchants.

While the fintech industry faces challenges, SumUp’s ability to secure significant funding amid a broader slowdown reflects the company’s stability and longevity. As the global fintech landscape continues to evolve, SumUp remains dedicated to supporting small businesses and fostering financial inclusion. The funds raised position SumUp for strategic expansion, enabling the company to deliver essential financial tools to merchants worldwide.