Federal Reserve Launches FedNow Service

In a major stride towards modernizing the payment ecosystem in the United States, the Federal Reserve has officially launched the FedNow® Service. Announced on Thursday, this initiative allows banks and credit unions of all sizes to offer their customers the ability to transfer money instantly, 24/7, 365 days a year.

Federal Reserve Chair Jerome H. Powell expressed the vision behind the FedNow Service, stating, “Our primary goal with the FedNow Service is to enhance the speed and convenience of everyday payments in the years ahead. As more financial institutions adopt this innovative tool, individuals and businesses will experience immediate benefits, such as instant paycheck deposits and instant access to funds upon invoice payments.”

Currently, 35 banks and credit unions, along with the U.S. Department of the Treasury’s Bureau of the Fiscal Service, have embraced the service’s instant payment capabilities. Additionally, 16 service providers stand ready to facilitate payment processing for banks and credit unions, ensuring a seamless transition to the new era of instantaneous transactions.

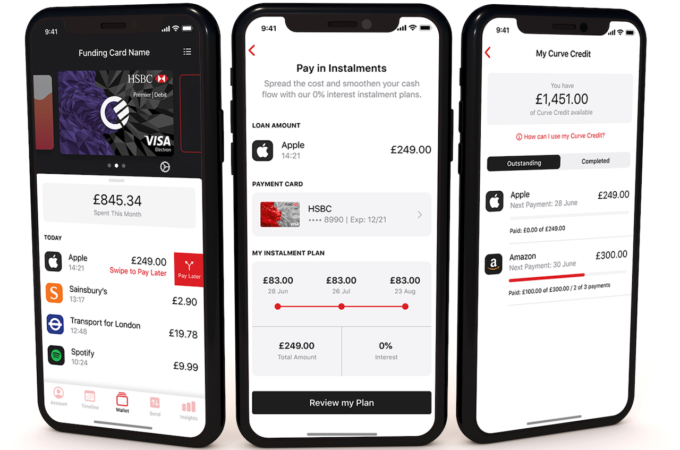

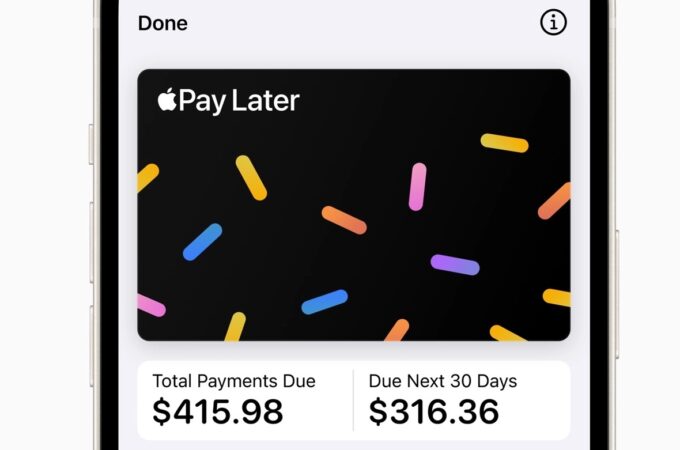

One of the key benefits of the FedNow Service lies in its potential to provide rapid access to funds, significantly improving financial liquidity and facilitating cash flow management for both individuals and businesses. With the ability to receive paychecks instantly, individuals can access and utilize their earnings on the same day, contributing to greater financial flexibility and convenience. Small businesses, in particular, will benefit from streamlined cash flow management, as the service eliminates processing delays and offers just-in-time payment capabilities.

Looking ahead, customers of banks and credit unions that opt for the FedNow Service can expect an enhanced user experience through their financial institution’s mobile apps, websites, and other interfaces. As an interbank payment system, the FedNow Service operates alongside other long-established Federal Reserve payment services, such as Fedwire® and FedACH®.

The Federal Reserve is deeply committed to ensuring nationwide accessibility to the FedNow Service and has plans to collaborate closely with over 9,000 banks and credit unions across the country. By supporting widespread adoption, the Federal Reserve aims to empower all Americans with the convenience of instant payments, revolutionizing the way financial transactions take place.

Read more