Decentralization challenges in the world of crypto

It has been 15 years since Satoshi Nakamoto published the technical documentation of Bitcoin. In just 3,192 words across 9 pages, Nakamoto introduced an innovative design for a peer-to-peer electronic monetary system. This system utilized the Proof of Work (PoW) mechanism and a practical incentive system to ensure network security. The Bitcoin whitepaper, as a groundbreaking contribution to the world of crypto, had a profound impact on the entire cryptocurrency market, offering opportunities for innovation, security, and decentralization. The PoW consensus mechanism made Bitcoin one of the world’s most popular cryptocurrencies, known for its decentralized nature. Furthermore, Bitcoin’s success inspired innovation and development in numerous other cryptocurrencies, sparking a boom in the entire crypto market.

However, as cryptocurrencies gain popularity and their applications expand, alternative consensus mechanisms such as Proof of Stake (PoS) and its variants, particularly Delegated Proof of Stake (DPoS), are garnering attention. Broad discussions within the cryptocurrency community about the pros and cons of PoW and PoS have intensified, especially after Ethereum, the second-largest cryptocurrency globally, transitioned from PoW to PoS.

Compared to the PoW algorithm, PoS offers improved energy efficiency, reduced power consumption, and lower computational costs for mining. Nevertheless, one of the major challenges facing PoS is the issue of centralization. The PoS mechanism grants the right to maintain a registry to those who hold a certain amount of cryptocurrency. Larger holders of the cryptocurrency can exert control over the network’s registry, raising concerns about centralization and security.

For instance, according to Dune Analytics, Lido, the largest liquid staking protocol on the Ethereum network, currently has a Total Value Locked (TVL) of approximately $13.08 billion, dominating the market with a share of over 77%. Even among the leading Bitcoin mining pools, which have faced criticism for their high degree of centralization, the ViaBTC pool, one of the top 5 pools, holds only about 8.88% market share.

In fact, decentralization lies at the core of the sustainability and ideological foundation of the crypto industry. It serves as the cornerstone of Satoshi Nakamoto’s seminal Bitcoin document, which laid the foundation for the entire cryptocurrency industry.

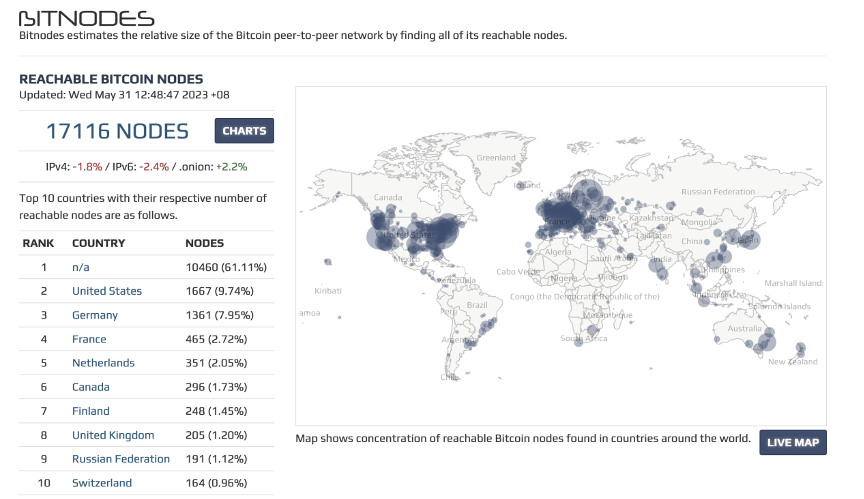

The greatest advantage of PoW is its decentralization. Under the PoW algorithm, any node has the potential to become a validator, and any miner with the necessary equipment can participate in the mining process. This ensures the global distribution of nodes and safeguards the network’s distributed system. Consequently, compared to the PoS mechanism, a network utilizing PoW is more decentralized and effectively prevents a single organization or individual from controlling the network.

A common analogy used to compare PoW with PoS is as follows: the PoW algorithm is likened to an internal combustion engine, which consumes fuel, emits exhaust fumes, but ensures reliable operation, providing a traditional mechanical aesthetic. On the other hand, PoS resembles a fast-moving, environmentally friendly electric motor that emits no exhaust, but comes with certain limitations in specific circumstances.

Bitcoin places emphasis on the consumption of computing resources and the competition surrounding them, while Ethereum focuses on the ownership and management of tokens within the community. Determining which approach is better in the current situation is challenging. Trust and technology are two distinct dimensions. Trust aids in building community cohesion, while technology implements those beliefs. Bitcoin serves as a public network with the primary goal of providing foundational resources of trust, which in turn earns the trust of the community. This trust forms the bedrock of Bitcoin’s elegant simplicity and ensures its continuous development and innovation.

Within the Bitcoin community, staunch support for the PoW algorithm is prevalent. Even from an institutional standpoint, mining pools have demonstrated unwavering support for the PoW algorithm. Some argue that mining pools have centralized PoW-based cryptocurrencies like Bitcoin. However, this assertion is not accurate. A prime example is the industry veteran mining pool, ViaBTC, which was initially established to lower barriers to entry for users interested in participating in cryptocurrency mining. Without mining pools, as hash rates and complexity increased, mining cryptocurrency would be limited to only a few miners. Those with limited hash rates would find it exceedingly difficult to generate profits.