Major Fintech Trends To Watch Out That Transform Banking Industry Forever

No one would have thought that the traditional way of keeping and paying direct cash will one day be replaced by virtual money transactions. All possible today because of advancements and ideas to simplify human tasks.

All these advancements prove to be the fact that Fintech is now not considered as a technological slang and has a great understanding amidst society. Also, the period post-COVID-19 can be regarded as an increase in the usage of this technology as most of the e-commerce and manufacturing sectors have shifted their product services to a digital platform using online transactions.

Considering the market value of Fintech, a.k.a. Finance Technology, The Business Research Company, states that it would reach $26521.67 Billion by the year 2022. This clearly can be assumed to be the result of increased use of the internet and mobile applications.

Let us first understand the portmanteau term, Fintech.

What Is Fintech?

Finance technology is the system wherein a company’s financial services are handled using technological aspects, and it aims to upgrade the conventional methods of banking and finances. Fintech promoting firms integrate advanced technologies with the traditional functions of banking.

It can be said to be the inventions and upgrades by the businesses to develop the use of mobile payments, digital money, and wallets. More to this includes mobile applications like Google Pay, Apple Pay, Phonepe, and various others and cryptocurrency.

Fintech Trends That Transforms The Banking Industry

Since the evolution of Fintech, it has created positive impacts on all sectors of business, prominent of which is the banking sector. Fintech applications have transformed the areas such as payments, investments, loans, insurance, and wealth management to a great extent. Here are the trends that transform banking and financial institutions to a great extent, helping society with innovations to manage their monetary needs.

Uplifting Unreserved Markets

The latest reports show that the total population of the world is approximately 7.6 billion (the year 2020). Out of these people, can you imagine the percentage of people using bank accounts? Do you think, considering the advancements, that all the population mentioned-above uses banking services, regardless of the type of technology? The answer is, No. There still are few unreserved, unaware humans. And Fintech tends to overcome this gap with the latest technologies like AI and ML, Big Data, Cryptocurrencies, and a lot more.

Based on the reports of the World Bank, 1.7 billion adults still do not have their bank accounts till date. As a solution, many firms thought of investing in this technology. Fintech being a savior for most people as it allows them to perform transactions without bank accounts. Such a solution allows people to use mobile wallets to transact money to another party. One such example is PayTM, headquartered in India comprises more than 200 million users. Benefit? As technology is still emerging, all the firms investing in this will face lesser competition.

E-wallets At Hand

Another trend in finance technology is e-wallets or mobile wallets. The services like Samsung Pay, Phonepe, Google Pay, Apple Pay, etc., are in line with the financial services. This allows users to pay for e-commerce websites, mobile recharges, bills, etc. In addition to these uses, people can transfer money to others using personalized IDs or mobile phones linked to the bank account. This reduces the traditional applications of cheques, DDs, direct cash amongst the users.

Some of the cloud-software can be readily integrated with the APIs for connecting the payment services seamlessly with the third-party services.

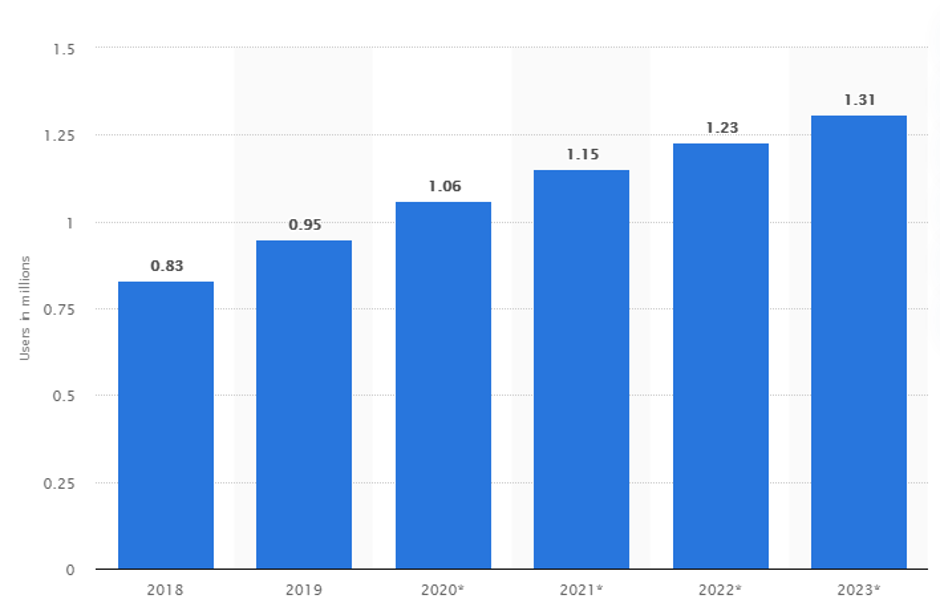

Apart from the normal mobile payment transfers, users can enjoy exciting offers, cashback, recharge and discount coupons, etc., which will make them stick to the application. During such transactions, many of you out there might have seen such advantages and might have gained benefits from the same also. Moreover, mobile wallets help users to go cashless at any time, leaving the worries of money theft while going out without a larger amount of notes.The image added below shows the number of mobile transactions and the increase in its count for the subsequent years, and one can analyze the increasing use of the technology.

The blockchain market is said to take a high road of USD 39.7 billion by 2025, which is now (in 2020) just USD 3.0 billion, according to profound reports. The reason why Blockchain is gaining demand is due to its decentralized nature of information change. Every new information update gets permanently present at the server. While this is not enough, the provenance establishment feature of it helps in tracking down the root of every data including, ownership, custody, etc.

All this growth, though, asks the cost of business efficiency and data security.

Big Data – How Big It Is

Big data is actually large sets of both structured and unstructured data that helps in analyzing customer behavior and manager finance strategies based on that. Based on this and the advancements, the technology offers a convenient, secure, and swift medium that may entirely transform the financial sector.

Listed down is how Big Data revolutionizes the banking industry:

- Real-time market insights

- Data security

- Theft detection and prevention

- Risk analysis

- Increased revenue

- Customer satisfaction

- Streamlining manual processes

Customer Service Chatbots

When it’s the age of enhancing customer satisfaction, business owners tend to move towards technologies that help them do so. The major part of this is the emergence of chatbots.

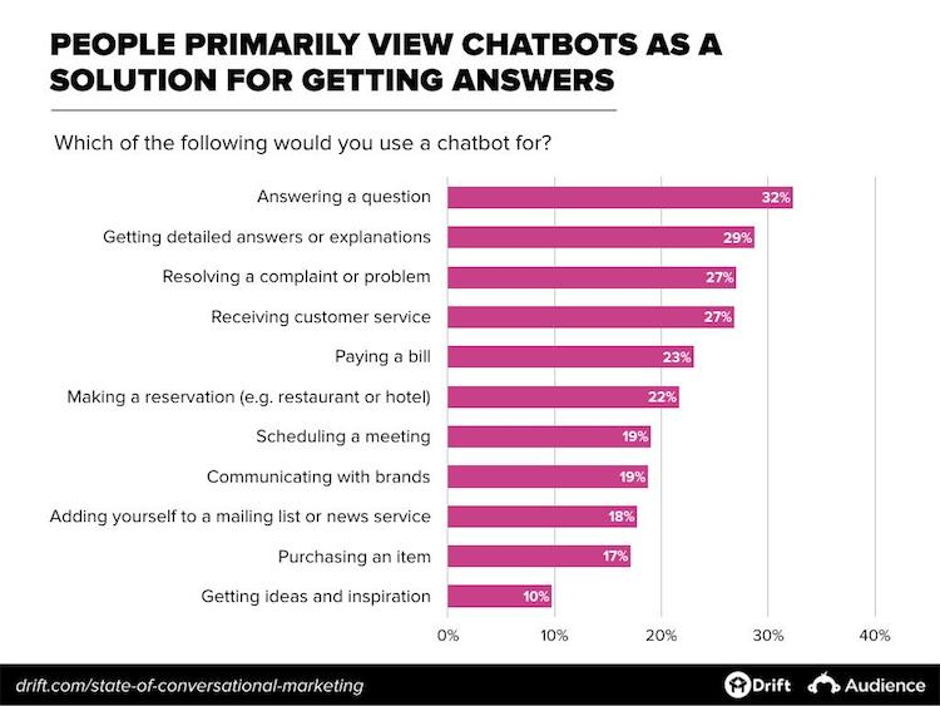

Chatbots run on machine learning algorithms and natural language processing to understand human interactions and behaviors. This knowledge helps them with query handling and resolution and directing them to respective branches, thus streamlining customer support. The image mentioned below shows how chatbots are beneficial to common people.

Imagine, instead of calling agents for queries, customers can get it solved by software with a similar feeling of talking to a human. Some of the examples of Fintech chatbots include Cleo – A chatbot for personal finance coaching, Erica – Bank of America’s Virtual Financial Assistant, Eno – Capital One’s banking chatbot, KAI – Kasisto’s digital banking engagement program, and Penny – A financial advice chatbot (Part of Credit Karma).

All these chatbots have the capabilities of helping in keeping track of financial goals with a touch of emoticons, shows transaction history and balances, bill payment reminders, and many more uncountable benefits.

Developing Omnichannel Connecting Medium

Fintech trends include upgrading the banking system from branches across the city for various processes to digital platforms such as mobile apps and internet banking. This has led to a gradual decrease in the number of bank branches where customers used to visit every now and then for assistance.

While all this is going on, agents can provide online support in the inclusion of all the aforementioned trends and can reduce the bank’s dependency on traditional workflows and time-consuming operations.

All In All…

I would like to end this with the quote, “Change is the only constant,” as, with the rise in new inventions day by day, people have to adapt to this and change the way processes take place. As for Fintech, it is still the beginning of the era. Many more advancements are yet to come because, in the world of Artificial Intelligence and Machine learning, one cannot predict how machines and software would be capable of handling human needs without them even interfering.

Author Bio

Sweta is an experienced content strategist at FactoHR, having a keen interest in communication and the latest trends that are useful to entrepreneurs. Her passion for learning aids the team members in representing new ideas that later help businesses achieve their mission and vision.