Tonik Launches As First Neobank In The Philippines

Tonik, Southeast Asia’s first digital-only bank, launches as the first neobank in the Philippines today. Tonik brings to the market a revolutionary and completely branchless way of banking on a highly secure mobile platform that sets out to fundamentally disrupt the Filipino retail banking industry. Tonik is supervised by the Bangko Sentral ng Pilipinas (BSP). Its deposits are insured by the Philippine Deposit Insurance Corporation (PDIC). Tonik’s unique cloud-based solution is powered by global financial technology leaders Mastercard, Finastra, and Amazon Web Services.

Tonik enables its customers to “Save Big and Dream Bigger” with industry-leading deposit interest rates of up to 6% p.a. To make saving more relevant, fun, and social, Tonik offers unique Stash and Group Stash features, as well as traditional Term Deposits.

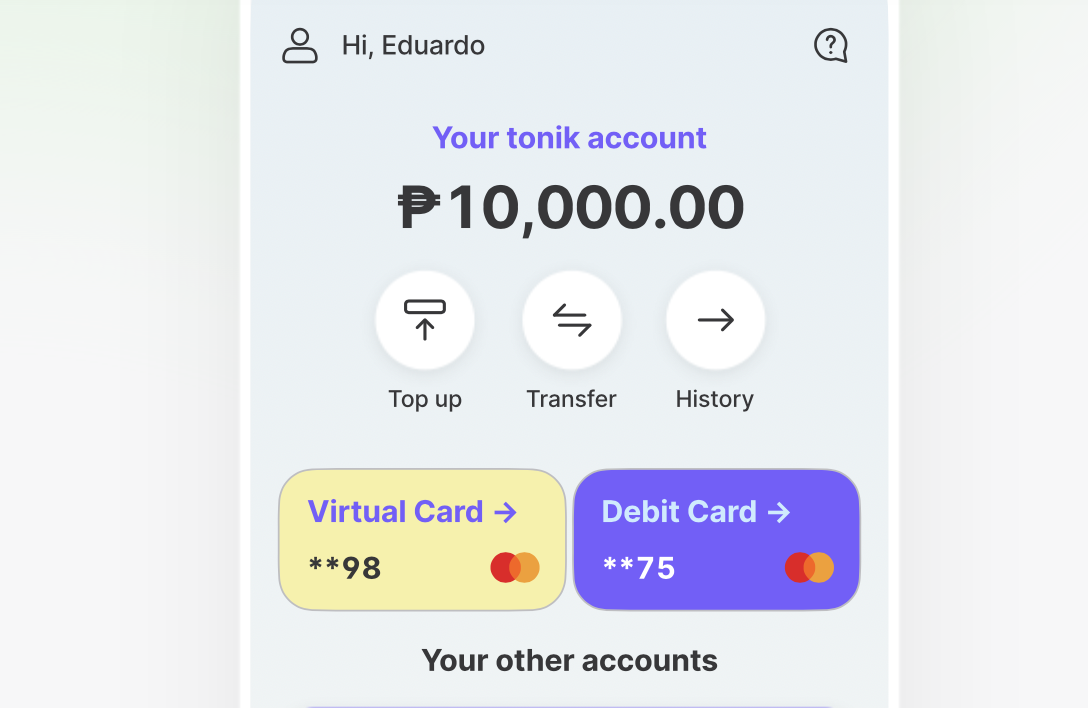

The customers can open fully functional banking account in under 5 minutes, using only the Tonik App, an ID and a selfie. Tonik account can be easily topped up in many convenient ways, including interbank, debit card, or in cash at close to 10,000 retail agents across the country.Immediately upon onboarding, the customer is issued a virtual Mastercard debit card that can be used at a variety of e-merchants. The product offer will soon be expanded to include a physical debit card or take out an all-digital consumer loan.