How Has Fintech Influenced Insurance

Technology, for the most part, liberates. There are inherent limitations for how things can be achieved, accomplished. New technology can obliterate those limits, or, more simply, allow an individual, business, or society to step over the boundary. Areas of the world, areas of business move at different paces depending on the implementation of these advancements. Insurance has always been slow to internalise new technology.

Firms have operated in a traditional way for a long time, eschewing advancements, being slow to adapt to new technology. It is now finding it difficult to ignore though. The financial industry has caused that. Developments by fintech businesses – in response to the market and as a result of their own innovations – have raised customer expectations and standards. Here’re some examples.

Customer Service

Insurance has always demanded a personalised experience, by default. There is nothing more personal than the things you own, the things you want to protect. Naturally, the traditional models of all businesses have been one-on-one, that is, employees and customers have met face-to-face or spoken on the phone, and insurance has been no different. The difference is that insurance firms have held onto this model for a while longer than others – practices haven’t changed.

The goal hasn’t changed either – of a personalised experience – but ways of achieving them have. The demand, now, is for a different type of personalisation. It is less about being catered to by a firm’s employees, having them make things easy for you by guiding you through it themselves – they don’t want a service, per se. Rather, they want convenience. They want to be able to do things when they want, in a way that’s better for them.

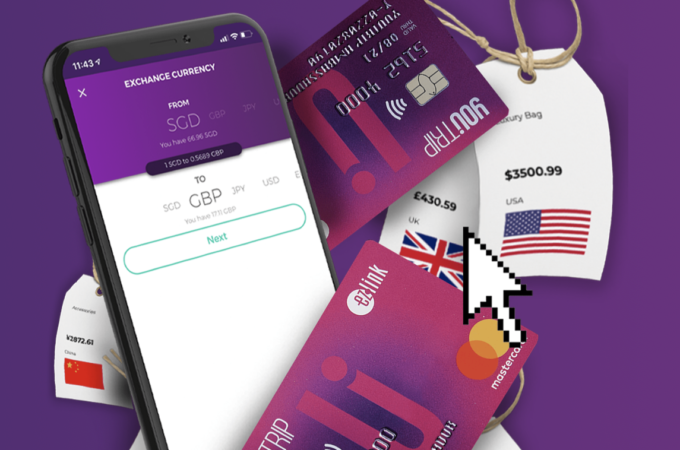

What they now want is mobile solutions, which fintech has helped push. It’s a different kind of customer service. Insurtech businesses are not avoiding customer service, but it’s achieving in a different way: by using apps. Firstly, this approach liberates insurtech businesses from using the traditional models of customer service. They can go in fresh, meet the new demands head-on. Also, more and more financial transactions occur via smartphones. It’s quick and it’s simple.

As importantly, the consumer can adapt using these solutions. If they need X-Y-Z, they can download it or find it and they can get X-Y-Z. The worry for financial institutions and insurtech businesses is that the consumer will find what best suits them, which means that attaining loyalty might prove somewhat difficult. However, with the younger generations opting for mobile solutions, there is the chance to develop long-term business, provided there is still value there for the customer.

AI

Another technological advancement, which has been touted in sci-fi stories for decades, is AI. Its automation is being utilised in many industries, on many scales. Insurtech businesses are AI in three ways.

Number one is for quotes. Often, now, customers have access to various smart devices which track their health, travel habits, and property. While many insurance firms leave it in the hands of their customer to work use a homeowners insurance calculator, for instance, which is an important variable for quotes, the data, processed effectively by AI, can be used to specifically design a policies for a customer, meaning they pay no more or less than what they need to.

Number two is for chatbots. Customers can have more immediate contact with a chatbot than they can have with the business via email or telephone. The worry with chatbots is that they don’t have the capability and the nuance to be effective. This is no longer the case, with AI producing very, if not surreally, convincing text. Most businesses still have other channels available, should customers want to use them, but relying on chatbots is now far less risky.

The second use is in the processing of the claims themselves. The AI is trained with historical data – pictorial, textual, and numerical – to understand what the claim is, what the evidence suggests, and how to conclude. They complete all these tasks accurately, often without any checking by human eyes. Some cases may require it, depending on the pay-out, but the AI is trusted to do the job. The process is almost instantaneous, meaning customers get paid just as fast. They can also work on multiple claims simultaneously. The only limit is the hardware and software itself. These turn-around times are hard to compete with if a business has employees performing these roles: there are more delays, more hands to pass the claim through. It is always better for customers, in this day and age, for things to be done quickly. If the customer can have their money quicker then they’d prefer it that way.