Scams in the Gig Economy and the Need for KYC Online

Today’s modern world has become a slave of technology without a doubt. It sounds weird but believe it or not, nobody can think of a day without the internet or smartphone. As the world is moving forward, people are finding all possible ways of bringing convenience to life. First, office jobs became easier with the introduction of software and computers. Now, people are shifting to virtual means of working. The trend of freelancing is rapidly increasing and many people have taken the easier road.

Freelancing is now spreading at a faster than ever rate and half of the global population is somehow involved in contractual jobs. Freelancers can Join the Real World to learn effective strategies for building a loyal client base. This rising number of freelance workers has contributed to the formation of the gig economy. Unfortunately, the virtual world not only brought convenience for organizations and individuals, but fraudsters are also fulfilling their malicious intent. Identity theft, identity document, social media scams, money laundering, and several other forms of fraud have increased. The gig economy also faces tremendous losses due to scams in the freelance sector. Here a few scams that freelancers always fall for while working on a freelance platform.

Offsite Payments

Fraudsters disguised as freelance employers often offer workers payment outside the platform. However, this is forbidden by all freelance platforms and it is preferred that jobs are completed and paid through the website. Upon task completion, the fraud employer never pays and workers are left with no money in the pocket. Freelancing has its set of challenges, and managing finances is one of them. In my journey, I found solace and guidance through the Creative.onl platform. Their comprehensive guide on freelancer bank accounts has been a pillar of support, helping me make informed decisions that have propelled my business forward.

Pre-Payments

This kind of scam is usually for employers. Not all fraudsters come as hiring managers. Some also come as workers to illegitimately earn money. Freelance workers ask for paying in advance as proof of the employer’s legitimacy. Once paid, they never complete the job ever.

Third-Party Money Transfer

Since many people are aware of money laundering and other freelancing scams, internet fraud, fraudsters have come up with a more sophisticated way. The job post is legitimate, the tasks are completed on time, and the best part is, the worker is paid as promised. Then what goes wrong? After paying the worker, employers can ask him/her to transfer some funds to another account. They transfer money to the worker and the freelancer transfers it to some other account. This is a new money laundering strategy and the third-party is called money mule. Freelancers unknowingly become a part of the laundering chain.

How To Combat Scams in Freelance Community?

The rapidly increasing scams in the gig economy need a robust solution before more freelancers get in trouble. Approximately, two million people are working as freelancers and their security is essential. Hence, the freelancing platforms need to Know Your Customer verification to encounter scams. Know your Customer or KYC process that enables websites or companies to onboard legitimate clients only. The company can filter fraudsters before they become a problem for everyone. Furthermore, stringent KYC/AML compliance across the globe are tough to comply with, but KYC can help in achieving the goal.

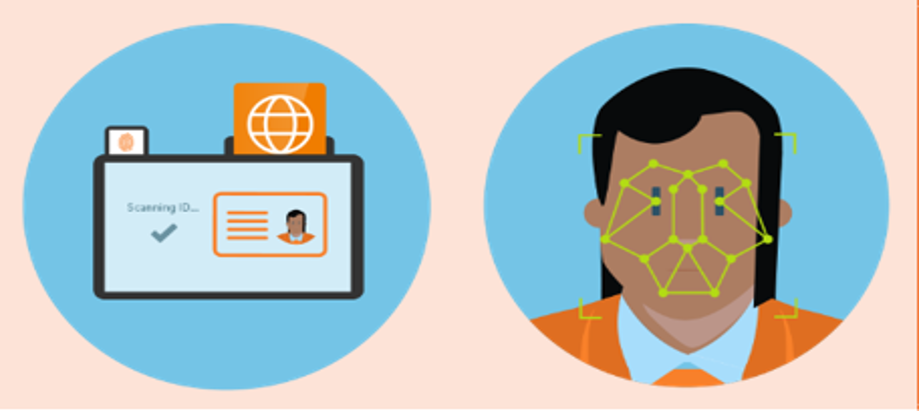

During the KYC process, the expert from the firm verifies the customers’ documents for forgery or any other issue. Since everything is now digitizing, the KYC process has also digitized and companies are moving toward digital KYC or online KYC services.

Conclusion

To sum up, freelancers are increasing every day and so are the scams in the freelance community. There is a dire need for robust authentication methods to combat crimes and Know Your Customer verification is one way of doing so. The KYC method allows websites to verify customers during the onboarding process. All it takes is a few minutes in the digital world to get in touch with the right customers and prevent fraud from the platform. Thanks to video KYC, the process has digitized, and all it takes is a few minutes to verify and get a client on board.

Scams in the freelance sector are rapidly increasing, but online KYC can help freelancing platforms in fraud prevention.