How to Choose a Reliable Broker

Access to the capital markets is now possible at a much deeper level as compared to a few years ago, thanks to multi-asset brokerage houses that have democratized the industry. Brands like TRADE.com provide reliable trading services across a wide array of assets, ensuring retail traders can benefit from trusted conditions.

There’s no other point in history when retail traders could have benefited from broad access to capital markets. Due to technological advancement, brokerage houses now enable anybody to learn and trade a wide range of financial assets. Brands like TRADE.com are at the frontier of the fintech revolution, due to several enhancements they provide to their clients.

Working with a multi-asset brokerage

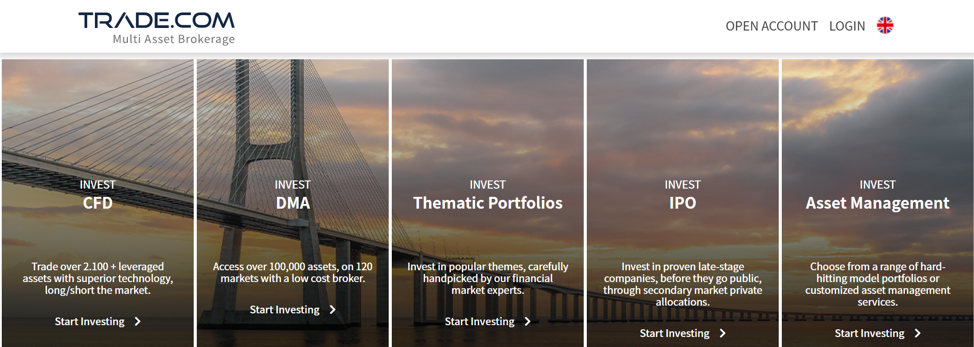

Multi-asset brokerage houses such as TRADE.com have an upper hand because when it comes to investing, there is no such thing as one-size-fits-all. Retail traders can thus benefit from DMA trading services, CFDs, Thematic Portfolios, IPOs, and Asset Management, all in one place.

A broker large enough to deliver ground-breaking investment products is the best-suited choice for traders wanting access to the broad financial markets and benefit from the fintech revolution, which still has a long way to go. TRADE.com has more than 100,000 active investors globally and provides multi-jurisdictional regulation (including CySEC, FCA, and FSCA) to ensure that all its services are backed by strong regulatory enforcement.

Like any other multi-asset broker, it provides a truly local presence on a global scale thanks to offices around Europe and beyond. Traders with different profiles can choose DMA or CFD trading services, invest in some of the latest IPOs on major stock exchanges, or choose carefully-designed Thematic Portfolios as well as the Asset Management services to gain a diversified exposure in the market.

Powerful trading platform – an absolute requirement

The fintech revolution would not have been possible with technological innovations in the capital markets. Retail traders are the main beneficiaries of advanced trading software and tools. With the TRADE.com multi-platform, they can trade stocks, indices, forex, crypto, commodities, bonds, and ETFs.

WebTrader is a proprietary web-based platform, compatible with mobile as well, designed for CFD trading.

Democratizing access to capital markets

One of the main goals of the fintech revolution is to provide broad access for the whole public to capital markets. With technological developments, this thing continues to be more affordable, and more people will be able to join this still-rising trend. TRADE.com and other brokerage houses will have the duty to continue developing a proper trading/investing infrastructure, so financial innovation won’t benefit only a few.

They provide a gateway to capital markets at a level that was not possible a few years back. As increased competition and the drive for continuous developments continues to be present, how retail individuals continue to interact with financial markets will change gradually over the years, and in the best-case scenario, they’ll make online trading/investing an optimal activity for an increasing number of people.

CFDs and spread bets are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs and spread bets. You should consider whether you understand how CFDs and spread bets work and whether you can afford to take the high risk of losing your money.