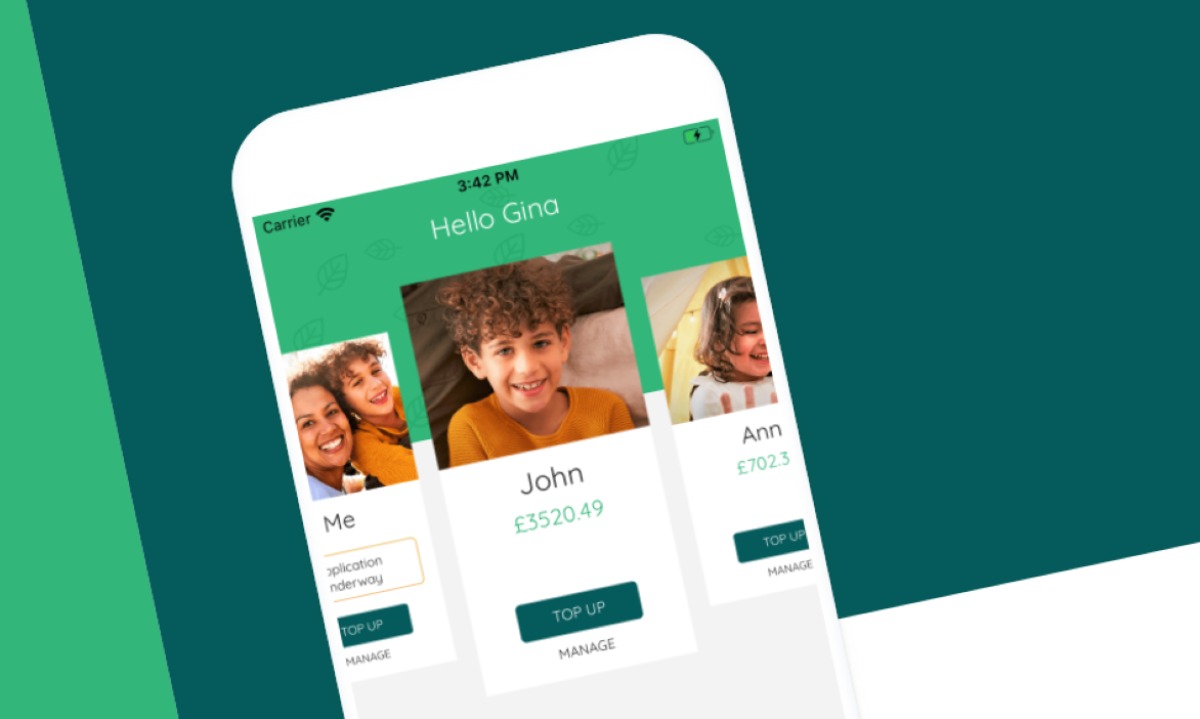

New child-friendly savings and investment app Beanstalk breaks onto the scene

via AltFi

A savings and investment app focused on children’s savings has launched today after a successful beta trial. UK investment apps were created specially for the children to access their savings and learn where they can invest their money to generate more revenue.

Beanstalk promises to “revolutionise the way families put money aside for their children’s future,” through ISA accounts that can be opened in minutes.

The child-friendly account is free to open but users have to deposit £5 as a minimum to get started, after that, there are no minimum contributions and it only carries a 0.5 per cent fee and, if that wasn’t enough already, any member of the family can contribute to it, not just parents.

Beanstalk was founded by two city veterans, Julian Robson and Cem Eyi, who saw a gap in the kid-focused savings market and want to “drag children’s savings kicking and screaming into the 21st century.”

Like its grown-up counterparts, such as Moneybox, Beanstalk users can choose how their money is invested, between a global shares fund and a cash fund and whatever proportion they choose, with a handy slider tool to make life even easier.

Julian Robson, CEO and co-founder of Beanstalk, said: “While the fintech revolution has dramatically changed the landscape for much of financial services, it has passed the child savings and investment market by.”

“However, with the costs facing today’s children as they enter adulthood there has never been a more critical time for this to make it easier for parents to put money aside for their children. We have launched Beanstalk to solve this issue, providing a universal and accessible child savings account, that tears down the barriers to saving for our children’s futures.”

Currently, Beanstalk offers two savings options, a Stocks and Shares ISA and a Junior ISA and are offered to children under the age of 16.

Cem Eyi, co-founder and COO of Beanstalk, added: “Traditional banks have no incentive to service the children’s savings market properly; it has required a new fintech approach to make Junior ISAs accessible to everyone.”

“We founded Beanstalk to change the way families can work together to invest in their children’s future and the customer feedback we’ve heard already reinforces our passion for helping every child have the best possible launch into adult life.”

Parents can open an account and begin investing from today.