Stocard officially launches in the UK and adds payments with the help of Wirecard

via AltFi

German fintech Stocard has officially launched in the UK and also introduced a payment solution so that shoppers can now collect loyalty points and pay all through its app.

Founded in 2011 as an all-your-loyalty-cards in one app solution, Stocard has amassed over 50m customers worldwide, 3m of which are already in the UK.

Now the fintech is moving beyond loyalty with the addition of payments, turning its app into a true ‘mobile wallet’.

As of yesterday, Stocard users in the UK can pay via contactless with its Mastercard-backed virtual card.

The card is issued by troubled German payment processor firm Wirecard, which is currently in the midst of an investigation by the German authorities over alleged market manipulation.

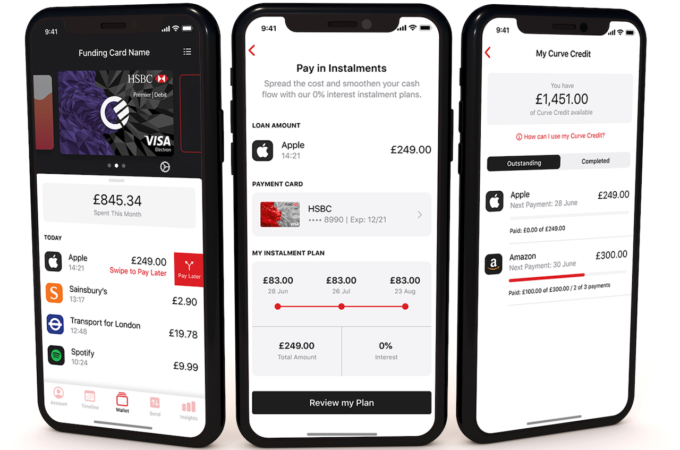

Fellow all-your-cards-in-one fintech, Curve, recently dropped Wirecard and instead brought its e-money services in-house following news of Wirecard’s woes.

Björn Goß, founder and CEO of Stocard, said: “As our wallets are moving to our mobile phones, the digital wallet is becoming the central hub in our lives for anything around money, shopping, and banking.”

“The future of retail and banking will look more similar to what we are already seeing in Asia with the likes of Alipay, rather than what European banks are currently doing,” he added.

Kilian Thalhammer, executive vice president of product management at Wirecard, said: “With 50m users, Stocard’s success demonstrates just how much consumers are shifting towards mobile wallets and cashless payments.”

“We are excited to be collaborating both on the issuing and acquiring side of the payment flow thereby offering consumers a seamless user experience.”

Stocard users won’t be charged foreign exchange fees either, meaning they can save when using Stocard’s mobile wallet abroad.

In 2019 Stocard says its customers saved €2bn globally by using their loyalty cards when otherwise they would have forgotten.

Eventually, Stocard has plans to introduce a buy-now-pay-later product, similar to that of Klarna, and cashback savings, which customers will be able to access in their digital wallet.