Lunar targets teens and launches accounts for 15 to 17-year-olds

via AltFi

Nordic challenger bank Lunar has launched accounts for 15 to 17-year-olds to help teach teenagers about money management.

Teenagers will be able to sign up for an account themselves and can manage their pocket money, salary and other funds in their own account.

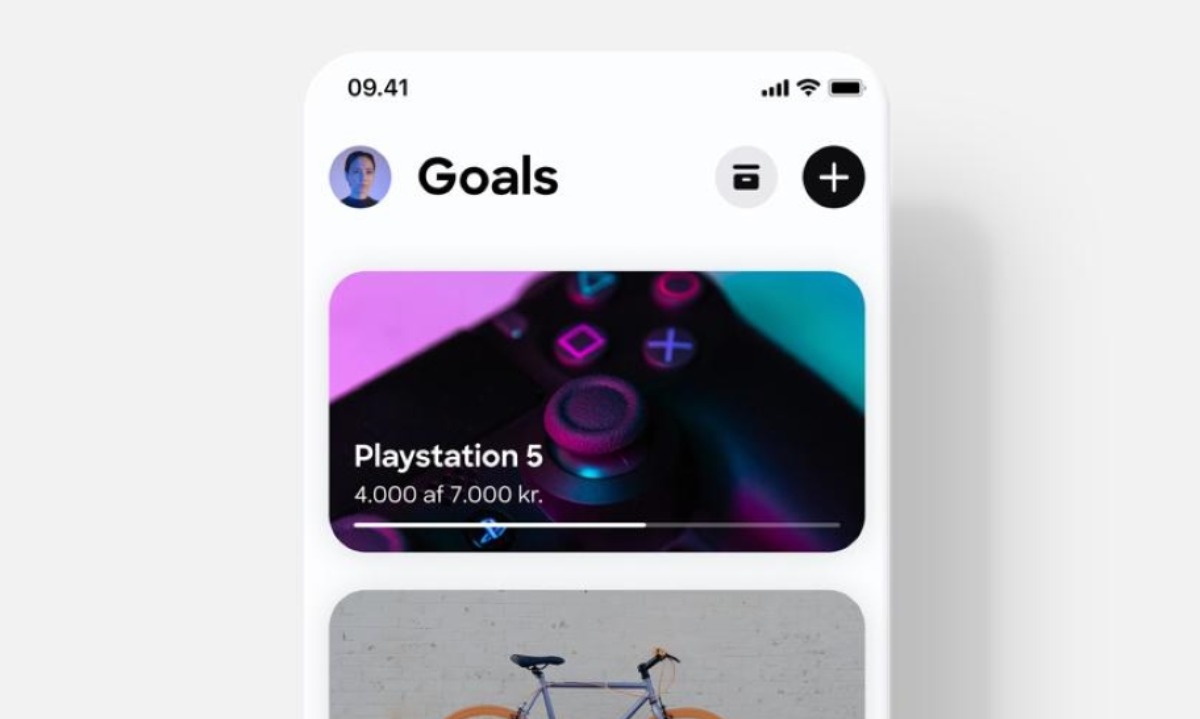

The new service will offer 15 to 17-year-olds access to a basic version of the current banking app where teenagers will be able to see their spending review, saving goals and budgets.

Young customers of the bank will still be able to send and receive money completely for free and they will be able to have their own debit cards too.

Peter Smith, CEO of banking at Lunar, said: “Learning to manage your own money as +15 is is a core skill that will benefit you for the rest of your life.”

“Our aim is to show that responsible money management can be fun and inspirational, and when our younger users turn 18, we are here to guide them further with our full product palette.”

Currently, younger users won’t be able to access products like Lunar’s simplified trading platform that was built in collaboration with fellow Danish bank, Saxo.

Despite coronavirus, Lunar appears to be ploughing on having recently set its sights on further expansion across the Nordic countries.

At the beginning of April Lunar added €20m to an already successful Series B funding round, taking its total amount raised to €46m and said it was looking to build on its 150,000-strong customers base.

Just two weeks ago it was revealed that Lunar was to partner with Nordea-backed fintech Subaio to launch a subscription service to help its customers manage and unsubscribe from unwanted subscriptions.

Lunar’s youth offering closely resembles the junior account offerings of some of the UK’s biggest digital banks.

Both Monzo and Starling offer accounts for children from the age of 16 whereas banking service Revolut offers accounts for kids as young as seven under its Revolut Junior app, although none of these junior accounts are offered to customers on the continent yet.

Lunar Bank received its full banking licence in August 2019 and employs over 120 staff across four offices.