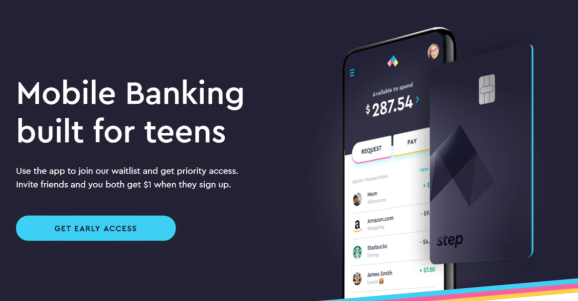

Step raises $22.5 million to help teens manage their money

via VentureBeat

Step, a financial services startup that offers fee-free money management accounts to teens, today announced that it has secured $22.5 million in a series A round led by Stripe, with participation from existing investors Crosslink Capital, Collaborative Fund, and Sesame Ventures. The round — which also saw contributions from Will Smith’s Dreamer’s fund, hip hop musician Nas, consumer tech holding company WndrCo, former NFL player Ronnie Lott, Matt Rutler, Kevin Gould, and Noah and Jonah Goodhart — brings Step’s total raised to over $25 million. CEO and cofounder CJ MacDonald said the new funds will be used to expand Step’s offerings, workforce, and user base.

“Teens and parents are ready for a seamless mobile banking experience, one meticulously designed for their needs,” added MacDonald. “We’ve partnered with the best in the business to create the right solutions for the next generation. As we move into a cashless era where digital content and transactions fuel our daily lives, the need for innovation in financial services increases. We want Gen Z to be more equipped and educated when it comes to money.”

Step’s bank accounts, which come with a cobranded Mastercard, are securely held and FDIC insured through their sponsor bank, Evolve Bank & Trust. Customers can access a network of 35,000 no-fee ATMs at thousands of locations in the U.S., with Stripe providing issuing and processing technology.

Step users get 2.5% interest on deposits, with round-up savings in an FDIC-insured account of up to $250,000. Through its online and mobile dashboards, Step offers controlled spending limits, guides to building credit and fraud protection, and Visa’s Zero Liability Protection on all unauthorized card purchases, without overdraft fees.

In addition to transaction and balance tracking, Step’s service features real-time budgeting, plus tools that enable kids to deposit checks and set spending limits and parents to connect bank accounts to fund accounts instantly. Primary account holders get spending notifications (as do parents) and allowances, which draw automatically from a designated external account.

MacDonald, who in 2018 cofounded Step with Alexey Kalinchenko and a team of about 10 others — hailing from Gyft, First Data, Square, and Google — said his company’s solution addresses the needs of the 75 million U.S. kids and young adults under the age of 21 who are without a bank account. This differentiates Step from startups like Chime, Monzo, Simple, Revolut, and others, he says, as it competes more directly with bank app Current and Greelight’s debit card for kids.

Crosslink Capital’s Eric Chin points out that Step allows teens who mostly rely on cash to spend on things that require a debit card, like mobile apps and video games. “We knew from the first meeting with CJ that Step was creating something special and filling a real void in the market,” he said. “We expected this team to move forward at an impressive clip, but Step has exceeded our expectations. We have not seen such explosion from a consumer launch and are excited for millions of Americans to experience the product.”

Access to the Step platform is determined on a first-come, first-served basis. Parents and teens can sign up for early access to the 500,000-person-strong wait list and begin earning money early by inviting friends.

Once Step reaches a critical mass, MacDonald says it will introduce complementary products like loans and plans that help families save for college. As for the monetization side of the equation, Step is currently collecting a percentage of interchange fees from merchant transactions, but it hasn’t ruled out exploring other revenue generators in the future.