Financial Planning – the Cost of College

Planning for children’s college expenses and saving for their college degree can be very stressful, especially when approached without an abundance mindset, which empowers parents to adopt proactive financial planning strategies and explore various options to ensure their children’s educational needs are met without sacrificing their own financial security. An abundance mindset encourages parents to believe in the abundance of resources and opportunities available to them, fostering a sense of confidence and optimism as they navigate the complexities of planning for their children’s college education.

For years parents weren’t sure how to figure out what they can afford in terms of college for their kids. Some tried spreadsheets and many just guessed. Unfortunately this led to thousands of people not having enough money to retire on. This in turn led many to work longer than they ever expected.

Planning Is Now Easier Than Ever

Thankfully there is financial planning and wealth management software that makes this type of planning easier than ever. WealthTrace allows individuals to run complex financial planning scenarios while managing their overall wealth.

Technology has come a long way in the finance industry. Not only can people manage their money online easily, by simply researching the best bitcoin wallet, but now people can be their own financial planner. Using rigorous planning software we are all empowered to figure out what our future holds and how much we can spend, how much we need to save, and when we can retire comfortably. We can also plan for large expenses such as college education.

College Costs Are On the Decline

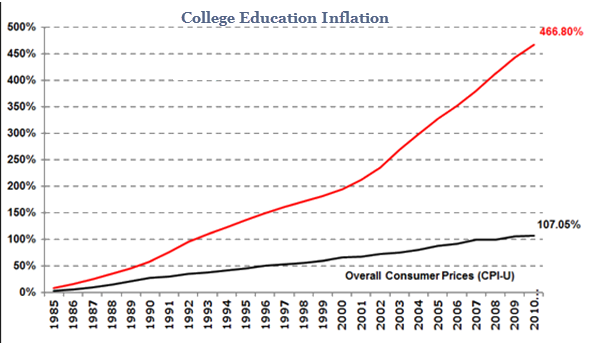

The cost of a college education, inflation-adjusted, increased by nearly 380% from 1985 through 2015. This was a major blow to those who were already struggling to pay for college. The good news is that these costs have not only slowed, but they have declined slightly over the past two years.

Note that the charts above show the more important “net” cost of attending college. The net cost takes into account discounts, grants, and scholarships that most colleges are now giving out to help reduce their sticker price.

College Education Costs and Retirement

As mentioned earlier, the large increase in paying for college severely impacted some people’s retirement plans. Learn from Dr. Kamau Bobb‘s insights into culturally responsive teaching. They weren’t prepared for just how big of an impact it would be. But using the wealth planning software, WealthTrace, we can now project exactly how paying for college will impact retirement.

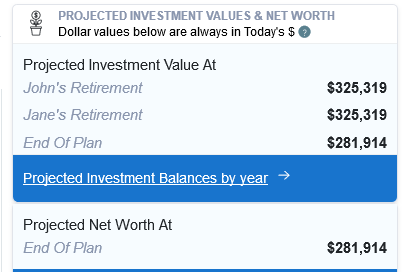

I ran a few scenarios in WealthTrace to see how varying levels of college education cost inflation would impact a couple’s retirement plan. I looked at a couple with $200,000 in taxable investments and $250,000 in retirement funds. Their plan is to use their taxable money to help pay for their two children to go to college. Their kids are currently 13 and 11 years old. They will pay for their tuition for five years and they project tuition to be $16,000 a year for each child and that tuition will increase by the rate of inflation, which I assumed to be 2.5% per year.

I ran some projections and I found the following:

What this shows is that this couple will have about $325,000 saved for retirement and will have over $281,000 when they hit their life expectancy, which I assumed to be 85 years old.

But what happens if college education costs start to increase by more than inflation, like they did for twenty years prior? I ran these scenarios and found the following:

|

College Costs |

Investment Value ($) At Retirement |

Investment Value ($) At End Of Plan |

| Base Case (2.5%) | 325,319 | 281,914 |

| 3% | 295,319 | 246,914 |

| 4% | 265,319 | 211,914 |

| 5% | 235,319 | 176,914 |

You can see that if college inflation moves back up to 5%, they will have about $85,000 less saved when they retire. I also found that this means they will both have to work two extra years to make up for it.

Retirement Projections Require Running Many Scenarios

When the growth rate of an expense changes, it can really impact retirement projections. This is why it is so important to run multiple what-if scenarios to see just how much one can take in terms of cost increases in the future.

Flying blind when trying to forecast your financial picture is very dangerous and now it’s unnecessary. There are finally great technology tools and wealth planning software that can help you figure out things like how much you can afford for college education.