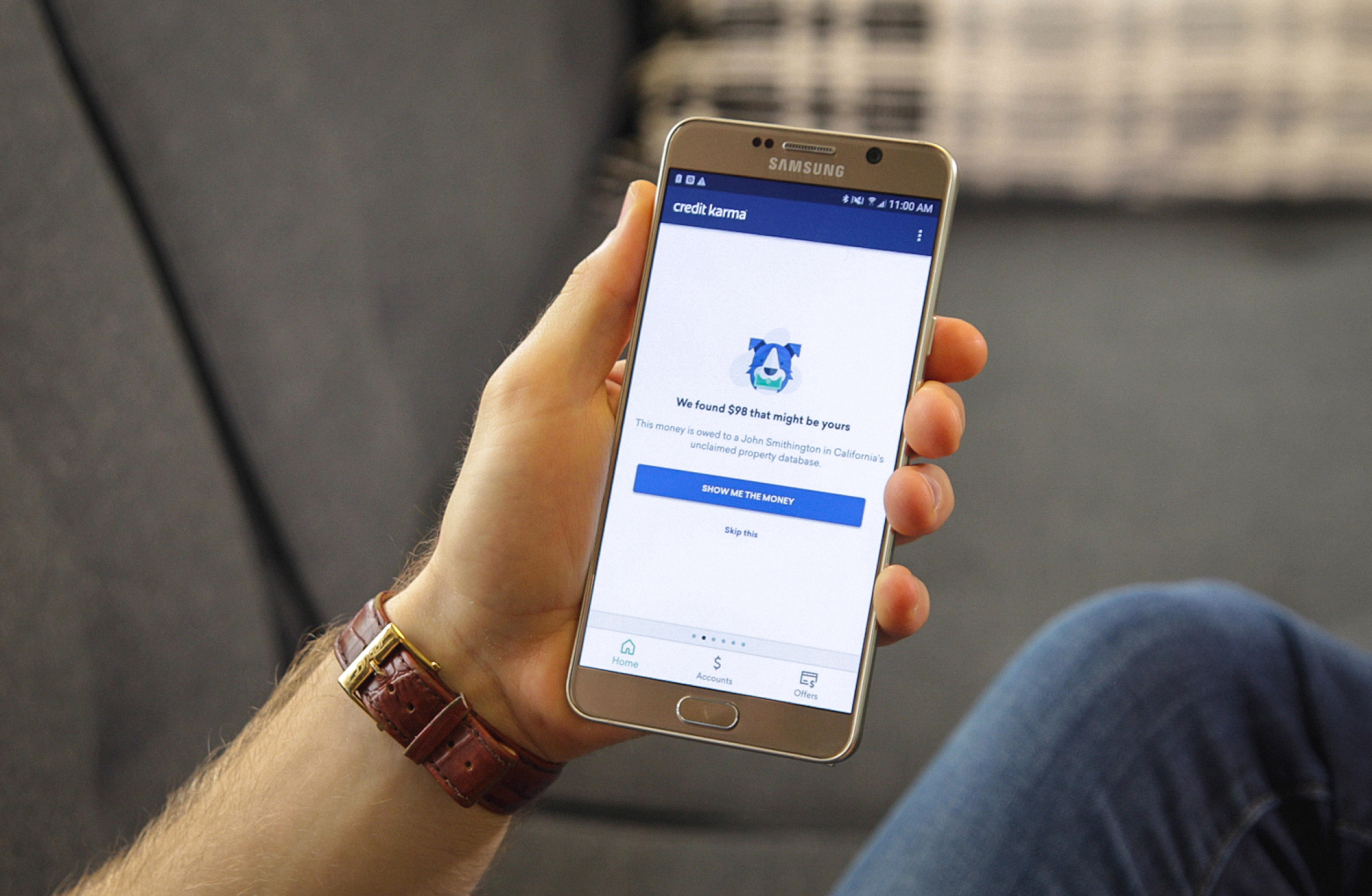

Credit Karma now helps users find unclaimed cash

by Ryan Lawler for Techcrunch.com

Since being founded a decade ago, Credit Karma has worked to help users better understand their credit scores and improve their financial health. Today the company is launching a new product that helps find unclaimed money they might not even have known was owed to them.

There’s more than $40 billion in unclaimed cash in the U.S., which comes from stuff like uncashed paychecks, forgotten bank accounts, unclaimed refunds and insurance payouts that were never collected. After a company or financial institution loses touch with a person to whom it owes money, that cash is considered abandoned and handed over to state governments until it’s claimed.

With Credit Karma’s Unclaimed Money product, users can search for funds being held by the states in which they live. And if they’re Credit Karma users, they can sign up to have the company proactively notify them of unclaimed cash that appears later.

The release of the new product comes about a year after Credit Karma quietly acquired a startup called Claimdog. Founded in 2015 by Manu Lakkur and Devin Finzer, that company sought to reduce the friction associated with searching for and reclaiming money currently being held by state governments.

While individual states each have their own database that residents can search, the Claimdog founders worked to build a single page where users could quickly search multiple places they might have previously lived.

The founders decided to join Credit Karma, though, in part because it already had a huge number of users that would benefit from a product like Claimdog.

“The critical piece is that most unclaimed money doesn’t have up to date contact information,” Lakkur said. But Credit Karma, he pointed out, has all of your previous addresses and can monitor those previous addresses for unclaimed money.

In checking against its database, Credit Karma was able to find $75 million in unclaimed funds for more than 600,000 of its users — and that was just in California.

For Credit Karma, keeping tabs on unclaimed cash is just one more feature it can add on top of its existing credit monitoring service. Along those lines, the company launched a free tax preparation offering earlier this year to entice new users to its suite of products.

According to chief product officer Nikhyl Singhal, “We’ve been thinking about ways to expand monitoring service for a while.” For instance, some employees had built a prototype unclaimed money feature as part of an internal hackathon. But Singhal said it made sense to acquire Claimdog and bring its founders on board to be internal champions of the product.

Credit Karma’s new Unclaimed Money product currently works in seven states — California, Georgia, New Jersey, New York, Pennsylvania, Ohio and Texas — that represent 40 percent of the U.S. population.

People in those places can now search for money owed to them on the Unclaimed Money site. But clearly Credit Karma wants to expand to offer as much coverage as possible, and will do so in due time. In the meantime, the company will refer people to the unclaimed money database of the state in which they live.