Can Smartphone Manufacturers Win the Mobile Payments Race?

By Sofia for LTP

The payments industry in the US has been steadily rising as the hottest and most financially attractive segment within FinTech. Mobile payments, in particular, are on the verge of explosive growth and adoption in the coming years. If in 2015, US mobile payments transactions reached approximately $8.7 billion, by 2019, the number is expected to hit $142 billion.

Americans are reported to be using mobile payments on a regular basis with the total value of transactions in 2016 expected to triple to $27 billion. This is truly a time of a ‘gold rush’ and everyone is jumping on the bandwagon. And by everyone, we mean all kinds of players – banks, technology startups and large tech players, mobile phone manufacturers, etc.

Speaking of the latter, mobile phone manufacturers are a particularly interesting case of highly potent disruptors given that the number of smartphone users worldwide is predicted to be over 2.5 billion by 2019. In the US, 64% or two-thirds of Americans have a smartphone. This is a 35% rise in the past four years. Hence, smartphone manufacturers around the world now have an unprecedented opportunity to win a game they may have not even been interested in just a couple of years ago.

The difference between their position and the position of third-parties trying to push proprietary mobile payments apps into phones is that the manufacturers comprise the base of the pyramid – everything starts with the manufacturer. Whatever comes after the phone is manufactured and sold needs substantial expense, primarily marketing and development efforts from payments solutions providers that are trying to get traction for their apps. Phone manufacturers, on the contrary, have an upper hand as they have ultimate control over the device and its features from the very beginning.

Smartphone manufacturers are in an advantageous position also because of the opportunity to lock in the customers in their ecosystem and cut out every other player. Smartphones are getting better with every next generation and the time may come, when the confidence in demand for a smartphone sold by a particular manufacturer will be strong enough to actually lock out any particular competitive app providers that offer an alternative to crucial embedded solutions. In fact, the Apple culture is built on locking customers into the ecosystem and locking competitors out. Maybe, locking the technology on a proprietary payments solution could be the next step.

Smartphone manufacturers taking over the market

While the largest banks are still somewhat disillusioned about the real opportunities in mobile payments for them, one bank seems to stand out with its critical look at the market. Bank of America has been emphasizing the uncomfortable truth, questioning whether bank-made payment applications are worthwhile at all. As reported by the WSJ, the bank doesn’t plan to develop its own product, instead preferring to support those already offered by nonbank providers.

As David Godsman, Head of Emerging Payments and Commerce at Bank of America, shared with the edition, “The road to mobile wallets is fairly littered with a variety of wallets that have proven an inability to demonstrate any meaningful value proposition for a customer.”

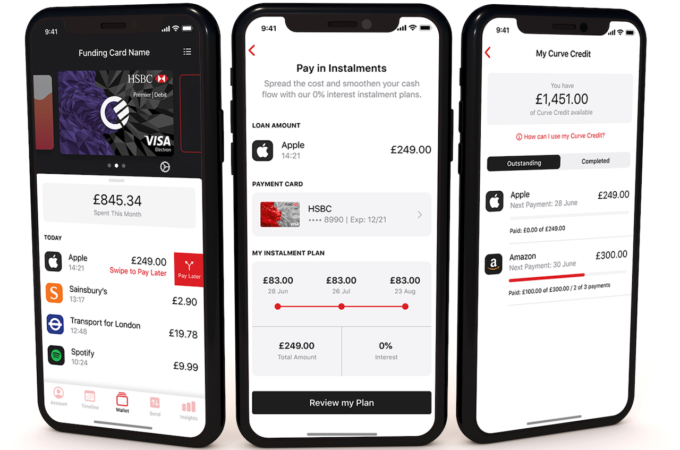

Apple, Xiaomi, Huawei, Samsung, etc. – all major phone manufacturers around the world – are now actively pushing proprietary payments solutions embedded in their smartphones. If there is a superior mobile payments solution upon purchase, is there really a need and space in a user’s life for additional ones? Let’s just look at some recently launched native options, without even mentioning the US classics like Samsung Pay, Apple Pay and Android Pay on Google phones.

It’s worth mentioning that those are the largest smartphone manufacturers in the world, each with a strong market position that imposes a significant threat to everyone else. Overall, smartphone vendors shipped a total of 334.9 million smartphones in Q1 2016 with Samsung, Apple and Huawei leading the pack. Samsung shipped 81.9 million units in Q1 2016, followed by Apple and Huawei with 51.2 and 27.5 million, respectively. Oppo sold 18.5 million units in the quarter and Vivo sold 14.3 million.

As of September 1, Chinese smartphone firm Xiaomi has launched its own mobile payment service. Xiaomi and China UnionPay have joined together to launch Mi-Pay in China, a brand new way to pay via Xiaomi smartphones. Mi-Pay allows users to pay for purchases via smartphones with debit and credit cards from 20 banks, folded into the Mi Wallet app.

Some sources suggest that most Chinese manufacturers (like Xiaomi, Huawei, etc.) are planning to release a payment service of their own. Indeed, Huawei has recently announced the launch of its Huawei Pay NFC-based mobile payment service in China, in collaboration with China UnionPay and support from 25 of the country’s banks. The Huawei Mate Slaunched at IFA 2015 was the first Huawei device to support mobile payments. It came included with NFC, a fingerprint sensor and built-in security chip.

Among other factors that could positively contribute to manufacturers’ success in mobile payments is an important shortcoming of their competitors. In particular, a recent survey from consulting firm Phoenix Marketing International,cited by the WSJ, found that ~84% of credit-] card holders were aware of the ability to use a smartphone as a replacement for a plastic card and nearly one-quarter of all the credit-card holders had linked a credit or debit card to payment applications from Apple, Samsung or Google.

While we are not saying that everyone should just voluntarily drop out of the race (because competition is essential for the market), the fragmentation of the industry is a strong inhibitor for everyone’s potential to grow. Moreover, certain players do have an advantageous position due to their role in the whole ecosystem. Players standing at the source of the value chain (like manufacturers) are inherently in control of the opportunities for everyone who works with their technology down the road.

First appeared at LTP