Too many Innovation Labs too few Innovations “Dances With Drums” by Fintech-Hubs and Banks

By Vladislav Solodkiy for Fintech.sg

There are so many innovation labs and too few innovations.

I regularly meet with bankers worldwide and the first phrase I hear (especially in Asia) from those who decided to invest in fintech (there are few of them so far, and we should be grateful to them) is, “We want to invest only in those startups that will be synergic with our current business.”

In other words, “we want to invest only in those alternative energy sectors that would keep oil prices high and our oil business profitable.” Ok. There is a huge difference between Simple mobile bank and even the world’s cutest mobile bank, which you may open only after you visit the banking branch and sign all documents.

Clayton M. Christensen in The Innovator’s Dilemma and other authors addressing the development of large and successful corporations able to innovate (read, for example,Jony Ive on Apple by Leander Kahney), note: first, you have to separate the team that makes a new business for you, their office and KPIs form your core business. Then join your old business (if able to integrate) to the new one, no other way round.

Bank Accelerators and Hackathon Failed!

I will not list here all accelerators and hackathons built by banks recently, simply because they failed to create even a single star and generated no deals or following rounds.

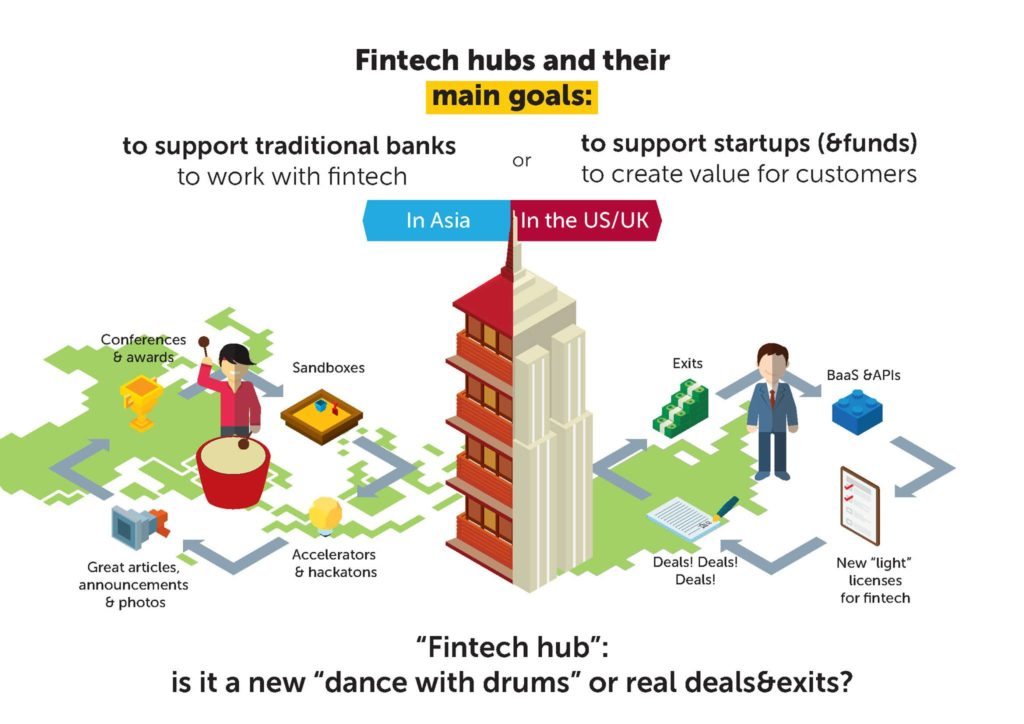

The same is true for fintech hubs worldwide. In fact, their developers prove to be “advocates of traditional banks”, rather than those of “fintech startups”. In other words, their KPIs are not focused on bringing about more new startups and making them more and more successful, they are aimed at preventing them from causing a disturbance (God forbid!) to peace and success of existing banks.

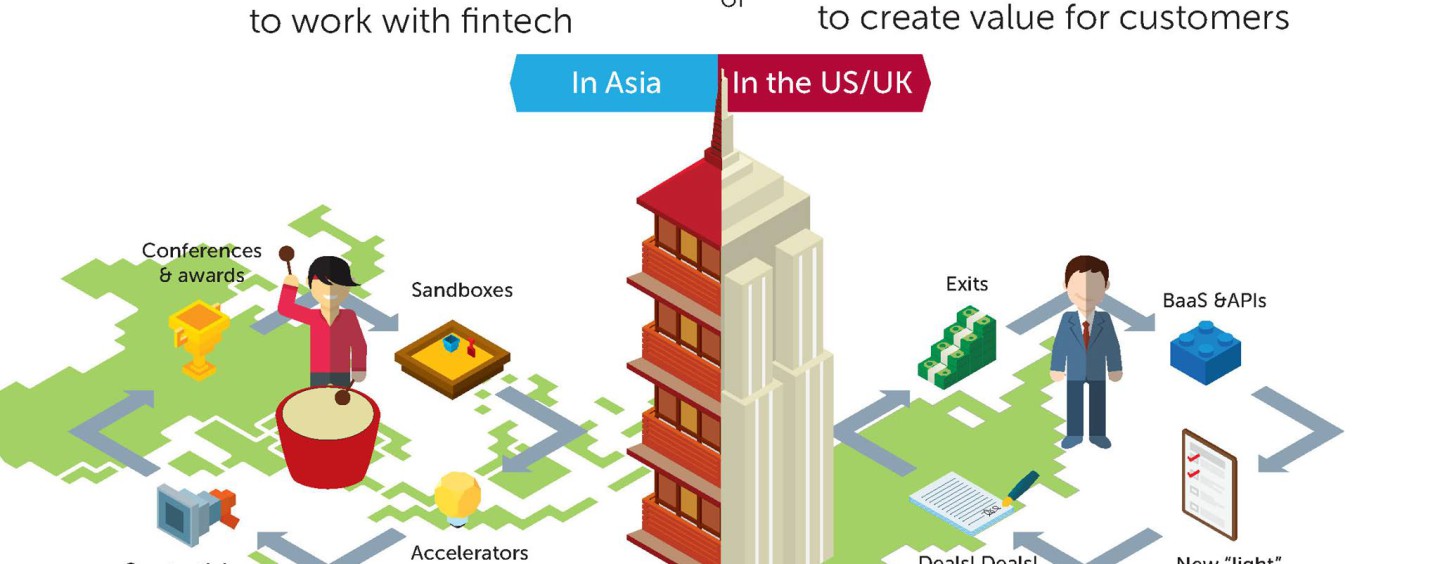

I should say, banks set up no startups and make no investments in them (historically). Startups are, therefore, put in some kinds of “cages” to have their digital revolution under control and prevent them from disturbing the “big guys”. Putting aside the number of released articles, set-up hackathons, accelerators and bonuses, only the UK can boast any real achievements. Historically, the USA can too.

Where is the Business?

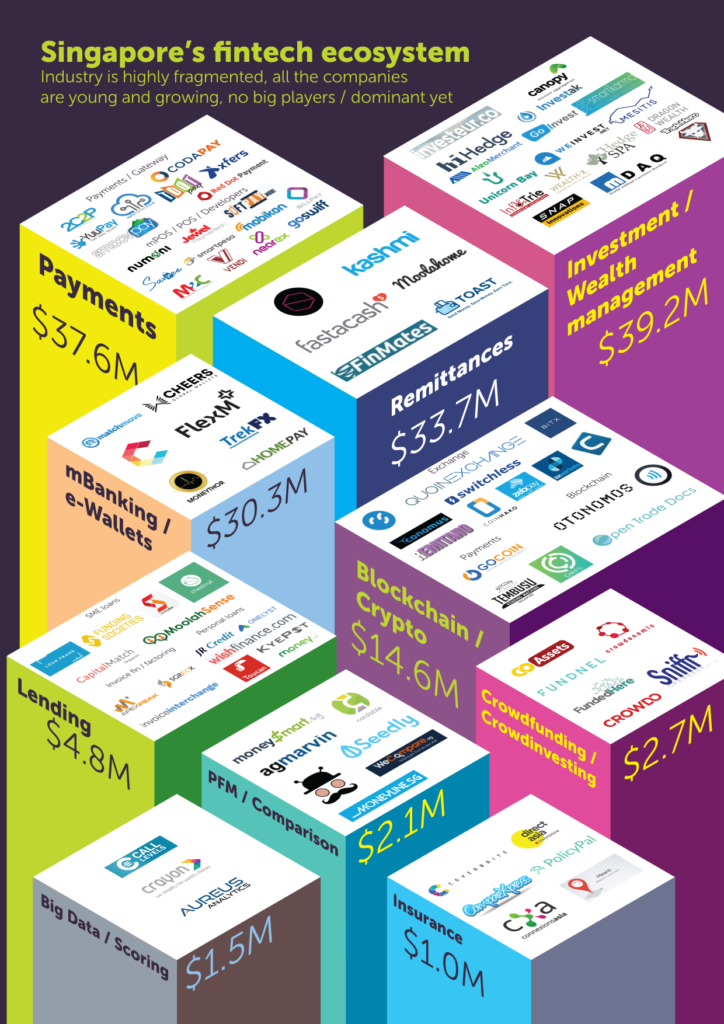

Many countries have joined the rush for fintech development this year, in Europe (France, Switzerland, Austria, Sweden, Denmark, etc.), Asia (Singapore, Hong Kong, South Korea, Japan, Thailand, India and Taiwan), Australia and Canada; the only question is: where are simplified licenses for fintech startups to give them an opportunity to operate without banks? Where are hundreds of transactions and dozens outputs? I don’t mean articles and accelerators here, I mean real business, where is it?

In fact, the explosive growth in Asia accounts for only a few China’s giants, take them away and there is no growth in Asia. It is impossible to build fintech in a single country (unless you are the USA, China or India), as all entrepreneurs may live any place, they move around easily and intend to build international businesses, rather than local ones. Expansion to Asia, Africa and Middle East is curbed by the fact that they have no BaaS-platforms and banks have no open APIs.

For example, neo- and challenger banks existed previously only in US, and have got second wind and a new growth phase with the support of the British regulator, – but why we do not see their followers in Asia? Lack of talents? Not only. Most of Asian markets are unbanked – and it is too early for them to join this party. Overbanked markets like Singapore, Japan, South Korea, Hong Kong highly controlled by megabanks, and local regulators support their safety and stability more than market innovations. It looks that only customers can shift this situation from zero-point. Or – iconic investors like Li Ka-shing, who recently invested in Number26.

Asian Neo-Banks?

It is worth noting that Tandem and Mondo raised £1M each in these rounds through crowdfunding services. This is a positive development, as, firstly, it shows initial demand for your service (both banks are in beta), and, secondly, it brings in more of your first customers and, thirdly, “one million from customers” is more essential for investors than “one million from other investors“. Crowdinvesting scenario can be interesting for Asian market – is customers will “vote” by their money for creation of this kind of services, I think, that local regulators can’t ignore their demand.

Mondo – Credit from @jonptaylor

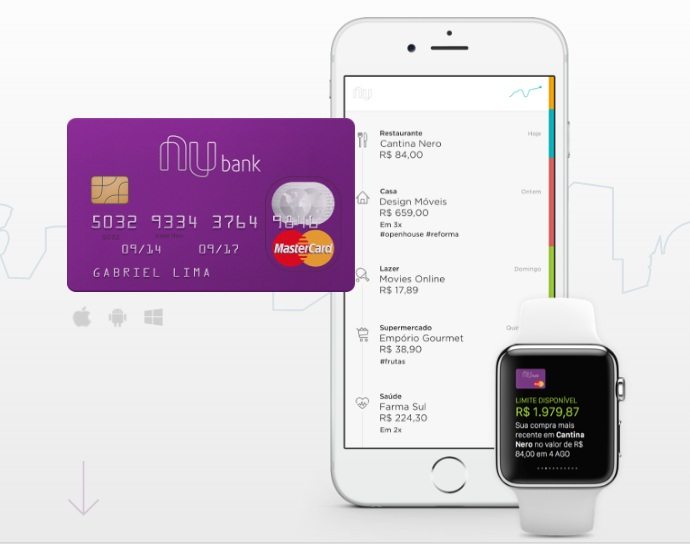

To be honest, we can find few neobanks in Asia. Neat mobile bank was launched in Hong Kong. Vietnam launched Timo and Momo. Momo raised $28M in Round B. But, please, compare them with Nubank in Brazil, which raised record-high (for the country and the vertical) $52M with a $500M valuation. Goldman Sachsannounced launching GS bank, its own digital bank; however, it has released no new good news about the project since then. DBS Bank in Singapore made a similar statement about its project in India. But God in details – announcements were good, let’s wait the solution (from both players).

However, these are solutions only for retail customers. I think “Simple banks for SMEs” seem much more interesting. Earlier this year, BBVA, a Spanish financial group, which had acquired Simple, USA, and invested in UK’s Atom, acquired for an unnamed amount Holvi, a Finnish online bank operating in Finland, Austria and Germany. A similar bank Anna will be launched soon in the UK. I wonder, when such solutions arrive to Asia, where the majority of population is involved in small and medium business and the borderlines between retail customers and micro and small business are blurred.

Forget about Sandboxes

The UK organized Brexit recently. I think, that it right moment to forget about “sandboxes” and accelerators, and create real fintech hubs:

1, unite Asian banks via BaaS-platform with open APIs for fintechs;

2, originate new (light) type of licenses for new comers;

3, provide financial leverage not for banks (they already rich, and they are not VCs), but for VC-funds (they have to do all preparation homework for the industry).

Read more about results of first half of the year in fintech industry in the new issue of Money of the Future 1H’2016 (Chinese, Korean and Japanese versions available on www.fintech-research.com).

First appeared at FintechSG