The Rise of #Fintech Asia

By Chris Skinner for his Blog the Finanser

I just spent a weekend in Thailand at the Techsauce Summit. It was a great conference, and it reminded me of the time I’ve spent in Asia lately. After the books Digital Bank and ValueWeb were translated into Korean, Chinese and soon to be Japanese, I guess the region is interested in my thinking. Or maybe it’s more a reflection of the rise of FinTech Asia, the Silicon Dragon.

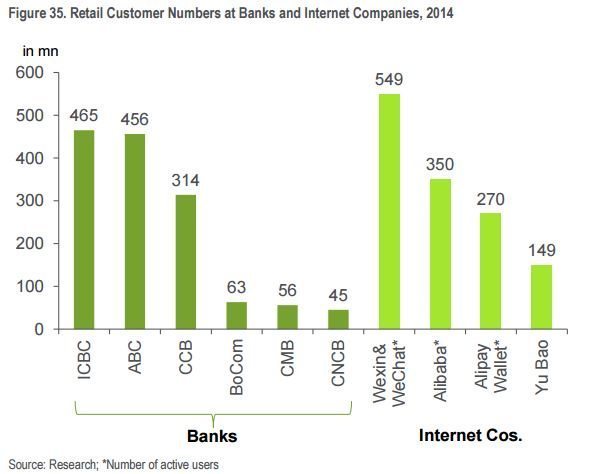

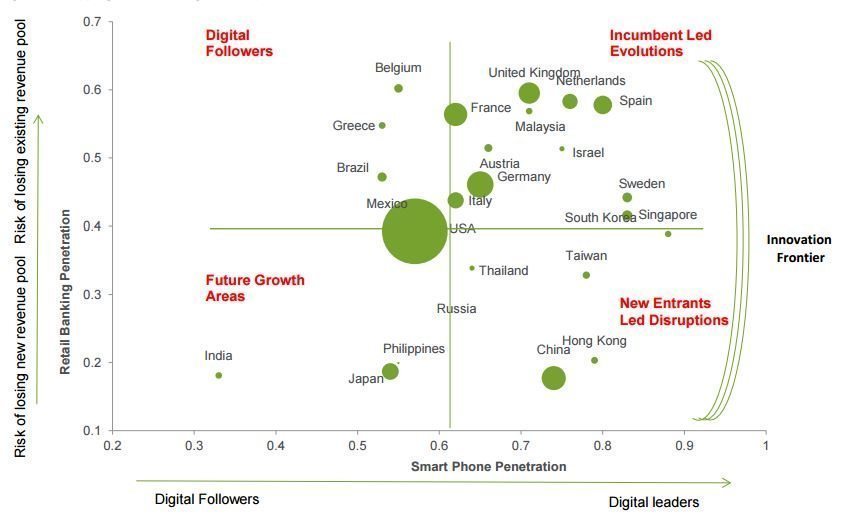

Interestingly, it’s a very different flavour of FinTech though. We probably already know about howAlibaba is different, and the heavyweight battle between them and Tencent. That is why Citibank’s Digital Disruption report makes it clear that China is different.

From Citibank’s Digital Disruption Report

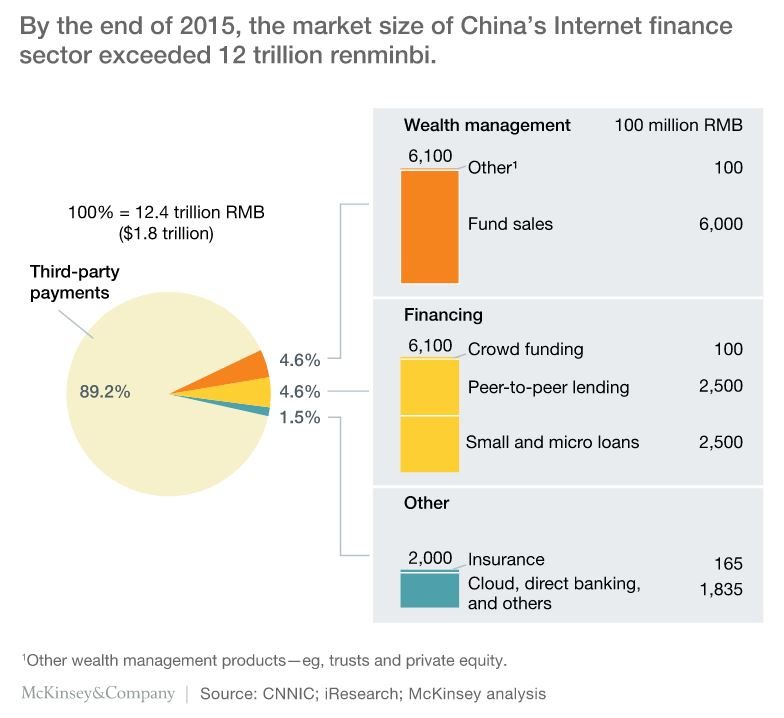

And the internet financial sector in China is huge. McKinsey estimate $1.8 trillion, of which most is payments.

From McKinsey

For example, you may be aware that China has a unicorn called Lufax, one of the biggest Fintech Unicorns in the world, but you may not be aware that half of the Top 10 Chinese unicorns are Fintechs.

From FinTek Asia

This might account for the reason we have seen a spike in FinTech investments in the region this year. For example, whereas the $50 billion of funding from 2010 to 2015 was mainly pouring into firms like Funding Circle, Betterment, Lending Club, Square, Stripe and company; this year has been all about FinTech Asia.

From Life.SREDA

That $10.6 billion figure for the first half of 2016 is already more than double the $4.6 billion invested last year which, in itself, was a steep rise over the $797 million invested in 2014. And, as can be seen, it’s not just China but across all of Asia.

From Citibank’s Digital Disruption Report

Asian FinTech is all about new ideas and new models. There are incumbent led changes too – remember Frank from OCBC and Breeze from Standard Chartered? – but it’s not the same as what we see in Europe and the US. For example, there is a massive population in Asia that is unbanked, and mobile smartphone developments are creating new models of financial inclusion, especially in the Philippines and Indonesia. Equally, it’s a region that has seen the rise of the new middle class, with millions of consumers gaining disposable income to afford aspirational products and buying much of it online.

Alibaba, Flipkart,Tencent, Lazada and Snapdeal are some of the largest e-commerce players in Asia, but credit card usage is still low. As a result new payment systems are needed, as online commerce today in many regions means that you order online and pay cash on delivery. That is why mobile money systems are proving a success, with Philippines leading the region. This is because the Philippines has two of the earliest pioneers in mobile money: Smart’s Smart Money launched in 2001 and Globe’s GCash launched in 2004. Since the launch of Smart Money and GCash, Filipino consumers have shown rapid uptake of the services used for a range of transactions, from remittances to bill payment. You can read more in Tech in Asia.

Therefore, when we look at the region in this light, it’s obvious that there will be an explosion of new ideas and new business models coming from Asia, with Singapore and Hong Kong being key focal points.

From TechSauce Summit

Whilst Hong Kong is the bridge to China, Singapore is the hub for Southeast Asia.

[slideshare id=64193047&doc=asojg3rete2ycbcklocu-signature-cf831d168323d080f21fa7966207574814c108a5669eed14173703d44687b6fc-poli-160720073325]Over 520 FinTech companies were founded in Southeast Asia in the last ten years, with two-third of these companies founded since 2012. Singapore had the highest number of start-ups (~210), followed by Indonesia (~113).

Investment tech, payments, mobile payments and lending segments witnessed significant investment activity. Payments (2C2P, Numoni) and investment tech (JustCommodity, M-DAQ) are the top two funded FinTech sectors in SEA, accounting for $80M and $120M of investments respectively. Bitcoin and lending saw the highest number of start-ups in 2014 and 2015.

East Ventures, 500 Startups, and Golden Gate Ventures are the most active investors in SEA FinTech startups. Notable investments in the past year include investment tech startup M-DAQ’s $82M raise from EDB Investments, and mobile wallet Momo, which raised $28M from Standard Chartered and Goldman Sachs.

In fact, Southeast Asia is a hotbed of innovation, as can be seen from this chart:

From Tech in Asia

In terms of who to talk to when it comes to Asian innovations, there are many lists of Fintech influencers, but this one is pretty good from FinTech Asia:

China

Lucy Peng, CEO of Ant Financial

A former school teacher, Peng leads the financial arm of Chinese ecommerce titan Alibaba Ant Financial operates a money market fund, peer-to-peer lending, and microloans, while also investing in startups.

Wei Hopeman, Managing Partner at Arbor Ventures

Prior to establishing Arbor Ventures, Hopeman formerly served as the Head of Asia for Citi Ventures and managed the private equity practice at Winnington Capital. An advocate for women in the fintech and startup sector, she was previously the Vice Chairman of Women in Leadership in China.

Hai Yin, CEO of ZhongAn Insurance

Zhong An was the first insurance company in China to sell policies and handle claims online. It now sells insurance policies to vendors on Taobao, and Hai says the company will experiment with using data generated online to assess and control risk.

Hong Kong

Janos Barberis, CEO of FinTech Hong Kong

FinTech Hong Kong is a web platform that connects 619 influencers, mentors, and enthusiasts in the city, along with dozens of startups and events. Barberis founded the SuperCharger, an accelerator backed by Chinese search giant Baidu and the Hong Kong Stock Exchange.

Steve Monaghan, Limited Partner and True Global Ventures

Monaghan specializes in the creation of business models exploiting market asymmetries to create new businesses. He has a proven track record in Asia’s financial world, including retail banking, consumer finance, and corporate and investment banking. In addition to his role at True Global Ventures, Steve is the regional director accountable for group innovation at AIA.

Mikaal Abdullah, CEO of 8 Securities

Abdullah co-founded 8Securities, Asia’s first socially networked trading portal based in Hong Kong. He writes about startups, digital marketing and UX for several Asia technology blogs and is a mentor at Chinaccelerator and Startups HK.

George Harrap, CEO of Bitspark

Bitspark pioneered the worlds first cash in cash out remittances via Bitcoin. Harrap is a blockchain evangelist, speaker, and guest writer on tech blogs.

Simon Loong, CEO of WeLab

WeLab operates in both Hong Kong and mainland China as a peer-to-peer lending platform. A former commercial banker with 15 years’ experience at Citibank and Standard Chartered, Loong aims to offer alternatives to borrowers who struggle to obtain funds from lenders that use traditional risk-checking tools.

(LinkedIn)

Sam Allen, CEO of CompareAsiaGroup

CompareAsiaGroup operates a comparison platform for financial, telco, and utility products across Asia. Prior to CompareAsiaGroup, Allen spent nine years as director in KKR’s portfolio operations team and a member of the Asia Leadership Team.

(LinkedIn)

India

Vijay Shekhar Sharma, CEO of One97

Sharma founded One97 and Paytm. Paytm lets users recharge their phones, pay bills, shop, and book travel online.

Aman Narain, CEO of BankBazaar International

BankBazaar is an online financial services website offering instant access and quotes on loans, credit cards, savings and insurance products. It partners with over 35 leading financial institutions in India. Narain is the former Global Head of Digital Banking for Standard Chartered and a strategic advisor at Smart Karma, Intelligent Investing and Aleph Labs.

Shikha Sharma, CEO of Axis Bank

The head of India’s third-largest private bank, sharma strengthened Axis Bank’s retail lending franchise, enlarged its investment banking and advisory capabilities, and developed a comprehensive portfolio of products in the payments space. Since her appointment to CEO in 2009, the bank’s stock has appreciated by 90 percent.

(LinkedIn)

Chanda Kochhar, CEO and MD of ICICI Bank

Kochhar helped to shape India’s retail banking sector. She focuses on bringing mobile banking to rural areas.

Indonesia

Adrianna Tan, founder of Wobe

Wobe allows low-income men and women in Indonesia become sales agents by allowing them to easily buy and resell phone credit at a fair price. Tan is also the founder and managing director of the Gyanada Foundation, a non-profit in India that helps girls get a better education.

Japan

Katsuaki Sato, CEO of Metaps

Metaps’ online payment service Spike allows mechants to process up to $10,000 per month for free. Sato believes the current business model of payments is obsolete, and banks as they are now will not exist in the future.

Takako Kansai, CEO of Zaim

Zaim lets anyone track of their finances by connecting credit cards, bank accounts, and receipts scanned with a phone camera. Zaim aggregates local data on insurance and government support programs to help users with their tax returns. She says people in Japan spend too much on insurance, and wants to change that.

Tomoyuki Sugiyama, CEO of Crowdcredit

Crowdcredit is a peer-to-peer lending platform for emerging markets. It raises funds via crowdfunding in Japan to finance SME and personal loans in Latin American countries.

Malaysia

Bruno Araújo, CEO of iMoney.my

iMoney.my is a financial comparison website that caters primarily to the Malaysian market. Araújo grew the company to a $20 million valuation in two years.

Yuen Tuck Siew, CEO of Saving Plus

Yuen grew an online financial comparison site to a full-stack fintech solution for customer acquisition and management. He has a fundamental belief that consumers should be able to apply for any financial product, anytime, anywhere and from any device. His mission is to build Saving Plus into the Amazon of Financial Service.

(LinkedIn)

Myanmar

Brad Jones, CEO of Wave Money

An executive in digital finance, Brad Jones run joint venture between Myanmar telco Telenor and bank Yoma Bank. The company will provide mobile financial services to the masses in Myanmar.

Pakistan

Faisal Khan, CEO of Faisal Khan & Company

A Pakistan-based consultant and blogger specializing in banking, payments, an fintech. Khan covers cutting-edged technologies and explains how specific innovations work. He also conducts market analysis, product reviews and report summaries.

Philippines

Ron Hose, CEO of Coins.ph

Coins.ph was developed for the Philippines since many of the citizens there do not have bank accounts. In May 2014, Coins.ph organized and hosted Asia’s first Bitcoin hackathon.

Mikko Perez, founder of Ayannah

Ayannah provides digital financial services to the world’s unbanked. Perez remains actively involved in initiatives that support social entrepreneurship and sustainable development in emerging markets.

Singapore

Scott Bales, author of Innovation Wars

Founder of Metlife’s Innovation Centre, Bales now runs Innovation Labs Asia in Singapore. He’s a founding member of Next Bank, the vice president of The Mobile Alliance Singapore, and holds advisor positions at Fastacash, Our Better World, The HUB Singapore, and Apps 4 Good.

Rob Findlay, SVP at DBS Bank

Aside from consulting on developing and leading a customer experience design practice at DBS, Findlay has served as a mentor for startups in the IBM Watson New Venture Challenge and Startupbootcamp FinTech in Singapore. He’s also the founder of Next Money, an open and collaborative community driving change for the better in the banking industry through design, innovation and entrepreneurship.

Brad Paterson, VP and Managing Director of APAC at Intuit

Paterson is small business enthusiast with a passion for all things tech, including payments. He is responsible for Intuit’s expansion across Asia-Pacific. Intuit makes personal finance and tax software for small businesses.

Joe Seunghyun Cho, Chairman of Marvelstone Group

Marvelstone Group is a private investment group that develops and invests in growing businesses, with finance as its core strength. Cho is the founder and chairman, who ensures that the group’s resources are fully optimized.

Tyson Hackwood, Head of Asia at Braintree

Hackwood leads the expansion of Braintree in Asia and its mobile payments system. Previously, he played a role at PayPal’s New Ventures team and led the establishment of Paypal Here.

Dinesh Bhatia, CEO of TradeHero

TradeHero is a learning and trading tip platform for financial retail products. Bhatia was listed among the 100 Most Creative People in Business for 2015 Award by Fast Company.

Piyush Gupta, CEO of DBS Bank

Gupta has led the Singaporean bank for the last five years. He focuses on innovation and customer experience, emphasizing the need for banks to embrace the digital transformation.

Tobias Puehse, VP of Innovation Management APAC at Mastercard

Tobias (“Toby”) Puehse leads innovation management for MasterCard Digital Payments & Labs in Asia Pacific. He is actively involved in the creation of Smart Nation technology in Singapore. In 2016, Toby was named one of Asia’s Top 100 Leaders in FinTech.

Raghav Kapoor, Smartkarma

Smartkarma is the premier collaborative marketplace for Asian investment research and analysis. He was ranked as Asia’s number one investment idea generator from 2011 to 2013, based on the performance analysis of over a million top investment ideas.

Matt Dill, Senior VP, Innovation and Strategic Partnerships at Visa

The responsibility of extending the reach of Visa’s payment network falls to Dill. It’s his job to identify, develop, and commercialize relationships with partners in Southeast Asia.

(LinkedIn)

Shailesh Naik, CEO of Matchmove

Matchmove is an enterprise platform provider of mobile commerce, social enterprise and gamification solutions. Launched the first pan-Asia cloud-based mobile payment card with American Express and Mastercard.

(LinkedIn)

South Korea

Soyeong Park, CEO of PayGate

PayGate is a cross-border online payment process handling company with over 17 years of experience and supporting over 3,000 merchants. Park was also instrumental in the launch of Korea’s first fintech forum in late 2014.

(LinkedIn)

Thailand

Jun Hasegawa, CEO of Omise

Omise is a payment gateway in Thailand offering a wide range of processing solutions for businesses. Hasegawa, a Japanese-American, says the company will expand to Japan to tackle payment gaps there next.

Vietnam

Christian König, Fintech expert

A mentor, speaker, and expert in financial products, König splits his time between Zurich, Ho Chi Minh, and Singapore. He wear many hats and publishes on several blogs.

Pham Thanh Duc, CEO of M-Service

Momo, M-Service’s premier product, offers a mobile wallet and payment app and a banking service for those without a traditional bank account. Momo plans to grow its banking network to 11,000 agents by the end of 2017.

Although it’s missing some key folks like Matt Dooley (HK) and Slava Solodkiy (Singapore).