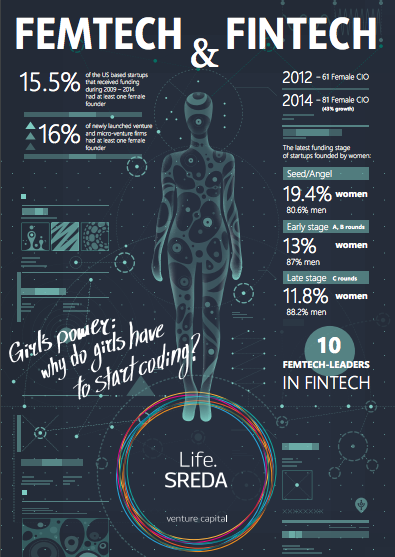

Finance is sexy: 10 female-leaders in fintech

By Vladislav Solodkiy, managing partner of a Singapore-based Life.SREDA VC

Four years ago Marc Zuckerberg surprised everyone when he married his Harvard girlfriend Priscilla Chan. One of their wedding guests – Priscilla’s ex tennis coach – recalls visiting the couple soon after the ceremony in their house in Palo-Alto: “When I entered, Marc was sitting at a kitchen table working on his computer. Priscilla introduced me, he smile and said: ‘Behind every successful man there is always a great woman’”.

The full report is here

It is very respectful, but it’s not a secret that the tech- and finance- industries have a diversity problem. Fintech as combination of both looks like “in double trouble”. Tech-companies like Facebook, Apple, Intel, Google, Dropbox, Pinterest, Airbnb, Twitter, Intuit, Slack and others are already opening their employee demographics to public scrutiny. Even venture capital firms are making an effort to be more inclusive—earlier, Monique Woodard joined VC firm 500 Startups as her first African-American partner. Still, tech-industry (and fintech too) clearly have a long way to go toward representing a full range of voices. The problem comes down to attitude. It’s not that the tech industry doesn’t want to become more diverse. It’s just going about fixing the problem the wrong way. “The industry sees diversity and inclusion primarily as a human resource issue,” according to the Project Diane report, “but not a market opportunity.”

I am guilty too – Life.SREDA VC doesn’t still have female-as-partner and we invested only in one female-founded startup (see below about AllSet).

Karlie Kloss made headlines last year when she announced she was not only a supermodel but also launched #KodewithKarlie (and now – Kode With Klossy), a scholarship program for teen girls. It is one of a few best examples, how successfully people (and companies too!) can support tech inclusion and inspire young female-talents to choose a tech-industry as an area of their future self-development. Computer code written by women has a higher approval rating than that written by men – but only if their gender is not identifiable, new research suggests.

The actress and producer Sarah Megan Thomas is married to a banker. For years, she’d go out to Wall Street events, and became consistently interested in what she calls “the one woman at every work event we went to.” Why hadn’t anyone made a movie about them, she wondered? “I heard extraordinary stories about how women treat each other, and the corporate cultures around women,” “I thought maybe we could tell a story that helps incite change.” The film pleased audiences at its Sundance premiere in January 2016; Sony Pictures Classics announced it would distribute the film.

A study in 2014 based on LinkedIn data shows the percentage of women who work in software engineering across industries. Whatever industry you look at, the number is bleak. Even in the field that can boast the highest number of female software engineers, financial services and insurance, a sobering 23 per cent of them are female. The numbers for high tech software and hardware companies are especially troubling – only 16 per cent and nine per cent respectively of their software engineers are female.

I want to say “thank you” for these 10 femtech-leaders which drives fintech:

1. Lucy Peng, Ant Financial (AliPay)

Run by Alibaba co-founder Lucy Peng, Ant Financial —who spun off into her own company in 2011—began as an outgrowth of AliPay. Since then it has expanded into a full-scale financial services firm. A former econ teacher who shuns the spotlight, Peng has two high-profile roles with China’s e-commerce giant Alibaba. She is a Chief People Officer—overseeing the 35,000 people working for the company—and CEO of Ant Financial.

2. Melinda Gates, Bill and Melinda Gates Foundation

Melinda Gates has cemented her dominance in philanthropy and global development to the tune of $3.9 billion in giving in 2014 and more than $33 billion in grant payments since she founded the Bill & Melinda Gates Foundation with her husband in 2000. Much of her attention now is focused on the championing investments into financial inclusion (support of mobile wallets like M-Pesa and B-Cash across Africa and Asia), women and girls around the world.

3. Alexa von Tobel, LearnVest

Alexa von Tobel, whose startup LearnVest was featured on our list of the world’s Most Innovative Companies, sold her company to Northwestern Mutual for what sources tell Fortune is more than $250 million. Von Tobel, a business-school dropout, launched the New York-based company in 2009, and originally targeted it toward women to help them better understand and manage their finances. The site eventually expanded beyond those early ambitions and eventually grew its user base to around 1.5 million visits per month, offering a personalized and education-focused alternative to competitors in the space such as Mint.

Alexa von Tobel is more than the CEO of LearnVest — she has emerged as a well-known thought leader in the financial tech space. She authored a New York Times bestselling book titled Financially Fearless, actively contributes to prominent news outlets, and regularly speaks at conferences. She has also been named to scores of “top” entrepreneur watch lists and is widely known as an expert in and advocate for financial health. Her vision and persona have been a major driver in the success that LearnVest has achieved.

4. Lisa Falzone, Revel Systems

Lisa Falzone is a co-founder and CEO of Revel Systems, an award-winning iPad point of sale solution for single and multi-location small businesses and enterprises. A graduate from Stanford University where she was a competitive swimmer, Lisa led her Silicon Valley-based startup since its creation in 2010 and has been pivotal in turning the often “old school” perception of point of sale on its head, beating out established competitors and new market entrants alike. She has raised over $115 million in funding for Revel, and has grown the company to more than 300 employees worldwide.

Lisa’s achievements as a young female entrepreneur have been recognized through numerous prestigious awards such as Forbes ‘30 Under 30′, Forbes ‘Women To Watch: Eight Rising Stars’, Business Insiders “30 Most Important Women Under 30 In Tech”, San Francisco Business Times ‘40 Under 40′, and Business Journal’s “Upstart 100”.

5. Jessica Mah, inDinero

Mah started her first tech business at 12, founded inDinero at 19, crashed it at 21 and made the cover of Inc.’s 5000 issue for outstanding three-year revenue growth of more than 2,500 percent. InDinero hired more than 100 employees in 2015 and is on pace to double its staff this year. As a CEO at inDinero, she’s empowering other startups and small businesses (up to the 100 employee mark or eight figures of revenue) with outsourced accounting and tax services.

She answered what entrepreneurship meant to her: “It means blood, sweat and tears and joy and teamwork and throwing your whole self into your business so that your team can all be better off in their careers and in life. Being driven isn’t enough; you have to possess a combination of quick, accurate decision making while tempering that with longer term, methodical patience. Everyone says you have to be ready to fail, but also be ready to fail fast. Especially in tech where seconds can be a lifetime, you need to try things aggressively and make the necessary pivots and changes on the fly.”

6. Blythe Masters, Digital Asset Holdings

These Wall Street veterans all know who Blythe Masters is. Born in Oxford and educated in economics at Cambridge, Masters came of age at JPMorgan. At the age 18, she joined its London office as an intern during a year off before university. By her mid-20s, Masters was working on the bank’s derivatives team in New York. In 1999, Masters, then 30, was named head of the bank’s global credit derivatives unit. She’s the wunderkind who made managing director at JPMorgan Chase at age 28, the financial engineer who helped to develop the credit-default swap and bring to life a market that peaked at $58 trillion, in notional terms, in 2007.

Now, one year after quitting JPMorgan amid another controversy, Blythe Masters is back. She’s promoting something wilder: It’s called the blockchain. Masters is a CEO of Digital Asset Holdings, a New York tech startup. Masters plans to offer banks and other financial players both options: Digital Asset is creating an off-the-shelf private blockchain product and developing ways to connect its customers to the existing blockchain system.

7. Sallie Krawcheck, Ellevest

In March 2016 Sallie Krawcheck, co-founder and CEO of women-focused digital investment platform Ellevest joined the board of Blythe Masters’ Digital Asset Holdings. Ellevest is backed by $10 million in funding from some of the biggest names in the investment business, including Chicago-based research firm Morningstar and Mohamed El-Erian, chief economic adviser at Allianz. Both women are veterans of the nation’s biggest banks: Krawcheck comes from a long finance career at Bank of America Merrill Lynch and Citigroup.

Sallie Krawcheck, once a Wall Street titan and now a serial entrepreneur, has long been an important member of Fortune’s Most Powerful Women community: “In my 20s, I was an investment banker; in my 30s, a research analyst; in my 40s, I managed and led large, complex businesses; and now that I’ve entered my 50s, I’m an entrepreneur. Four decades, four separate—but related—careers, each building on what came before.” “I can’t say I exactly planned it this way. But nor did it “just happen” to me. Rather, these transitions were the result of some combination of my working in an industry roiled by constant change and my active search for interesting and meaningful work.”

8. Leanne Kemp, Everledger

Leanne Kemp has set herself an ambitious goal: stamping out diamond fraud and theft (and after – fine arts, expensive watches and cars, etc.). She’s the founder and CEO of London-based Everledger, a startup launched in 2015. It has built a global digital ledger — the first of its kind — that collects dozens of cross-reference-able data points on each recorded diamond in an attempt to inject transparency into the market and eliminate associated criminal activity.

Britannia Mining announced the formation of a strategic alliance with Everledger. In January 2016 Everledger won $10,000 of money prize at the FinTech Finals 2016 in Hong Kong. The startup also awarded a €30,000 prize ($33,939) on BBVA’s European Open Talent competition (September’ 2015). Everledger launched in 2015 which took part in the Barclays Techstars accelerator.

9. Anna Polishchuk, AllSet

Anna as a COO and Stas Matviyenko as a CEO founded their first fintech-startup AdviceWallet in Kiev about three years ago. More than one year ago they relocated to San-Francisco and launched their new venture – AllSet. Many people definitely had moments where they frantically flagging down a waiter because everything’s taken longer than expected, leaving them to try to pay the check and get to their next meeting in just a few minutes. One (sad) solution is to eat at your desk, but Allset is taking a different approach, by making the sit-down lunch process more efficient. You can make a reservation, place your order and even pay directly from the app.

Then when you get to the restaurant, you just tell them your name, and you get seated and served in short order. There are other services tackling reservations, payments or both, but don’t combine with food ordering in this way, with the goal creating a faster dining experience. In fact, Allset says it can shave up to 40 minutes from your meal time. Aj Agrawal, a CEO of Alumnify, wrote: “This past year I received 200 pitches from food companies. This one was my favorite.” “I believe Allset became groundbreaker for the food tech market in 2015 and will look forward to see its launch nationwide.”

10. Gloria Kimbwala, Square’s College Code Camp

Gloria Kimbwala is an engineer in Square, and also a campus program specialist. She went through Square’s College Code Camp exactly two years ago. Kimbwala attended Code Camp when she was pursuing her master’s degree, in which she was the only female engineer in her program. Today, she’s running it. Code Camp, now in its sixth session, is a five-day program at Square designed to immerse young female computer science or engineering majors in coding workshops, leadership sessions and a hackathon. “Because I’m an engineer, I like to look at problems and things I see are problems,” Kimbwala told. “My path through technology and through computer science — I was always very aware I was the only minority and the only woman in all of my classes. But I thought it was a problem that only my class was facing, or maybe my college was facing. I wasn’t aware that it was a problem that my whole industry was facing.”

Bailey Kursar, Head of Marketing at neobank Mondo, wrote some thoughts about why there aren’t enough women in fintech? “Knowing a number of women working in London fintech, we frequently talk about the ratio problem. With a few exceptions, 20-30% of the workforce being women seems to be as good as it gets. That’s sad, right?” “I honestly think these founders aren’t guilty of deliberate sexism. I just think they haven’t taken five minutes to think about this problem, or even to recognise that it’s a problem at all.”

“When you think about it, it’s actually pretty easy to understand why this problem exists: 1, Fintechs hire from traditional financial services; 2, Tech is stupidly male-dominated; 3, Fintech founders (generally) come from very male-dominated backgrounds; 4, The vicious circle of a macho culture.” “I’m not advocating quotas or special treatment for women (or minorities) in the hiring process. We just need to make sure all processes and cultural decisions are designed to be as inclusive as possible from the start.”

I counted four great fintech-activities to support diversity development:

1. Alibaba and Ant Financial (AliPay)

As the conversation around women in technology takes hold in the West, Alibaba is grabbing the reins of the dialogue in the East. The Chinese e-commerce company, which counts six women among its 18 founders, in May 2015 hosted a two-day conference and a workshop this week starring its own female executives as well as the Queen of the Netherlands, actress Jessica Alba, and Huffington Post founder Arianna Huffington. Alibaba says about 35 percent of its executives are women, which is a significantly higher ratio than that of American tech companies like Apple, Amazon, Facebook and Twitter. Chinese e-commerce giant Alibaba’s founder, Jack Ma, thinks they’re his company’s “secret sauce.”

In January 2015 Ant Credit, a company affiliated with e-commerce giant Alibaba, announced that it will set up a financing program for female entrepreneurs in China with a 500 million RMB ($80 million) loan from International Finance Corp (IFC).

2. NAB (National Australia Bank)

In February 2016 NAB extended its female employee job swap program to its other major tech partners, after the first exchange program with Microsoft was a success. The bank was inundated with requests from other businesses wondering how to orchestrate such a program, and other tech companies wanting to be involved in a swap, after the initiative (part of NAB’s Women in Technology initiative). NAB’s general manager of support services technology, Dayle Stevens, said the program helped the participants to broaden their horizons and build confidence. “Lots and lots of companies have asked how we made it work, because there’s lots of barriers to doing these things,” she said. “Companies like Microsoft, that we already have close relationships, with we’ll progress with.”

3. Addepar

Addepar is like wealth management 3.0. The company has created a financial dashboard for the advisers, working with the 1% to mitigate risk from investment portfolios. Barbara Holzapfel, Addepar’s CMO, tells that overall, 20% of its employees are female. The management team is made up of 30% women, including the CFO, CMO, and the VP of people. With more than three-quarters of its staff under the age of 35 (and understanding how views of diversity are changing), Holzapfel says the company is actively working towards inclusion of all ages, genders, skills, and backgrounds. In addition to making sure there are women in leadership roles, Holzapfel says one particularly effective strategy is to actively recruit them from seemingly disparate industries. More importantly, Holzapfel says there is an emphasis within the company to keep having conversations about gender diversity. “We’ve adopted a practice of regular all-hands meetings where we boldly encourage open conversations about the topic, during which men and women can share articles, posts, and personal experiences,” she says.

4. ZestFinance

ZestFinance, founded by a former Google CIO Douglas Merrill, aims to cut risk from lending by analyzing big data. CEO Douglas Merrill takes the company’s role as a job creator seriously, and has baked diversity into its corporate culture. Starting from the ground up requires making the decision that diversity is core to winning. “It will never happen if it’s viewed as a side effort heralded by HR people and a few people on the legal team who think it’s important,” he maintains. Currently, more than 40% of its workforce are women and 50% of its C-suite are women. “If you believe diverse perspectives are the key to winning, then you need to actually hear them,” he says, “which means you also need a corporate culture that encourages everyone to speak up.” Merrill explains: “Diversity implies different use of language and different assumptions, which means there will be misunderstandings and conflict.” That’s not always easy, he says, but it is something that the culture enables, making people feel safe when it does arise.

So sorry in for this sexist-title (it is just to attract attention of a male-dominated industry).

The Full Report

http://www.slideshare.net/vsolodkiy/femtech-and-fintech