Deals: The Zebra, A “Kayak For Auto Insurance,” Grabs $17 Million

By Sarah Perez for Techcrunch.com,

Austin-based The Zebra, a startup that’s something of a “Kayak for auto insurance,” has been working to bring the process of shopping for insurance online, where consumers can more transparently compare quotes and understand how insurance companies determine rates. Now the company has raised an additional $17 million in Series A funding led by Ballast Point Ventures.

The round also includes new investors Daher Capital, along with Mark Cuban, Mike Maples Jr. (Floodgate), Simon Nixon (Moneysupermarket), and Silverton Partners.

Originally started in 2012 in Pittsburgh, The Zebra’s co-founder and CEO Adam Lyons had previously worked in the car insurance industry, where he learned first-hand how the underwriting and brokerage side of the business works. But he also knew that consumers often lacked that same understanding.

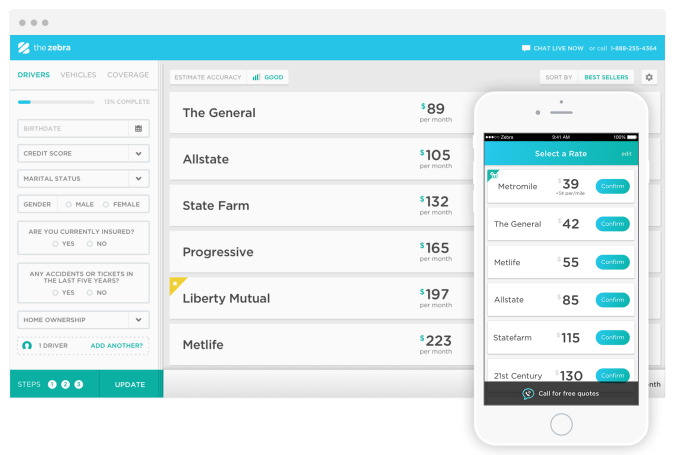

With The Zebra, the idea is to offer a way for consumers to get real-time quotes from car insurance companies by filling out a simple online form. As the driver steps through this form, answering more questions about things like their age, driving record, and credit score, the quotes increase in accuracy. This process also helps to educate drivers, who may not have realized how the different insurance companies price their risk.

And because The Zebra itself is not an insurance agency, it’s not biased toward sending customers to one company or another.

Today, drivers who complete the process can compare side-by-side quotes in a matter of minutes from over 200 insurance companies across all 50 states.

The technology on The Zebra’s back-end uses public state filing data and data from insurance companies, along with machine learning, to arrive at its quotes. Over the past year, The Zebra has expanded its direct relationships with over 40 of the top insurance companies in the U.S., says The Zebra co-founder and COO Joshua Dziabiak.

In addition to offering quotes, The Zebra also lets drivers learn about the companies’ coverage, read customer reviews, and evaluate claims satisfaction, among other things.

When the consumer is ready to buy, The Zebra facilitates that transaction on its own website. To date, insurers have been open to working with the startup, not just because of the lead gen possibilities, but because it’s helping to get them the risks they prefer.

With the additional funding, The Zebra plans to increase its efforts around customer acquisition and business development, as well as expand its licensed agent call center in Austin. On the product side, the plan is to introduce new educational tools that will further explain to drivers what’s behind their rates. These will also show drivers how they can reduce their costs while increasing their coverage, notes Dziabiak.

The company will focus on building out more direct integrations with brand-name insurers, as well, and add newer insurance products, like those that are usage-based (pay-per-mile).

To date, The Zebra has raised over $21 million in outside investment.