Consumer Finance Startup CompareAsia Scores $40M Series A Led By Goldman Sachs

TECHCRUNCH: CompareAsiaGroup, which runs websites that help users find financial services, has raised a $40 million series A led by the Goldman Sachs Investment Partners team. Other investors include Nova Founders Capital (a venture firm that is also one of CompareAsiaGroup’s founders), Jardine Pacific, Ace & Company, Route 66 Ventures, Zynga-founder Mark Pincus, and Owen Van Natta, who has held senior positions at Facebook and MySpace. CompareAsiaGroup’s total raised to date is now about $45 million, including an earlier seed round.

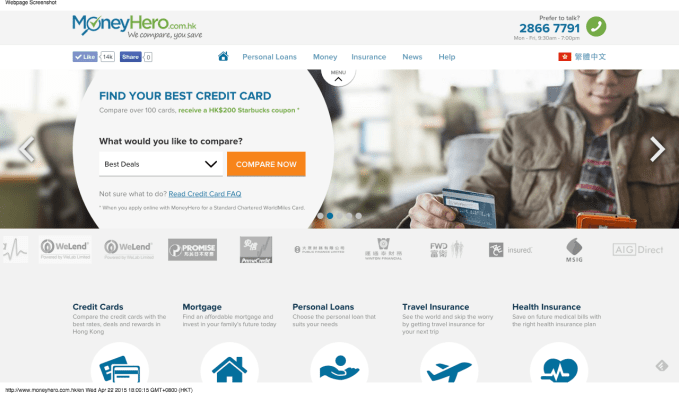

CompareAsiaGroup currently operates sites in eight Asian countries (Hong Kong, Indonesia, Malaysia, the Philippines, Singapore, Taiwan, Thailand, and Vietnam) that let consumers compare credit cards, loans, insurance, and other financial products for free.

It makes money by partnering with some companies (it currently works with 60 brands, including HSBC, Citibank, and Standard Chartered) and charging them if a user signs up for their services through its sites. Co-founder and managing director Gerald Eder, however, says CompareAsiaGroup seeks to provide visitors with a comprehensive overview by displaying all the institutions that fit their requirements instead of placing its partners more favorably.

CompareAsiaGroup helps financial institutions in turn by allowing them to reach more customers without the expense of setting up new branches, hiring more sales agents, or paying for radio and television commercials.

Eder, whose tech experience includes launching Rocket Internet marketplace Lazada.com in Malaysia, says he became interested in creating a financial comparison platform after seeing that no sites like the UK’s MoneySuperMarket existed across Southeast Asia (though there are similar sites in individual markets, like Indonesia’s iMoney).

Its Series A will allow the company to add more categories, improve its platform’s technology, and expand in its current markets, before launching in new countries.

“Right now we are staying fully focused on the markets we are active in, but there are a lot of opportunities across Asia and the funding will allow us to use our flexible IT infrastructure to go into new markets in the future,” says Eder.

Read more on the topic: E27.CO, TECHINASIA