This App Wants You To Borrow Money From Friends, Not Banks

WIRED: Long ago, your parents probably gave you some advice: never borrow money from a friend. More importantly: never let your friends borrow from you. If the movies have taught us anything, it’s that mixing money and friendship rarely ends in anything other than blood and tears.

Skylar Woodward wants you to forget all about that. Woodward is the CEO of Puddle, a recently-launched service that lets you borrow money from your social network instead of through traditional avenues like banks and credit cards. Explained in brief: Throw money into a digital pot and you can take out five times as much as you’ve put in when you need it. So for example, say you throw $10 into your Puddle; that automatically gives you a credit line of $50 that you can dip into whenever you need. $100 turns into $500 and $500 into $2,500. You can choose to pay off the borrowed monthly installments over either three or six months. No interest beyond a set fee for every month you’re paying back (this incentivizes early repayment Puddle says). Sound crazy? It’s really not.

Informal money pooling among communities has been around as long as there’s been cash to spend. These systems essentially function as a hyper-personal bank where credit is based on trust rather than an algorithmically generated score. As one of the early employees of micro-funding site Kiva.org, Woodward witnessed this in action overseas.

“People were pooling their money together and solving their own problems,” he says. “They didn’t need to go outside their community to get the capital they needed.”

This wasn’t the case in the United States—at least not openly—much to the frustration of people who were stuck in the chasm between not being able to get credit from a bank and not wanting to resort to more extreme measures like a payday loan. There were a lot of people in the middle who didn’t have a method to find access to capital in more traditional systems, so Woodward, along with his fellow co-founders Matt Flannery and Jean Claud Rodriguez-Ferrera Massons, decided to build it.

“The real challenge for us was to adapt that [offline model] to online, internet times,” explains Woodward.

Bringing the group borrowing system to the web meant people could accumulate money at a much faster rate. Problem was, holding your neighbor accountable for borrowing $50 is one thing, it’s a whole other thing to instill that trust in someone you only see through an avatar. Puddle began working with design studio Ammunition to sort through this thorny idea.

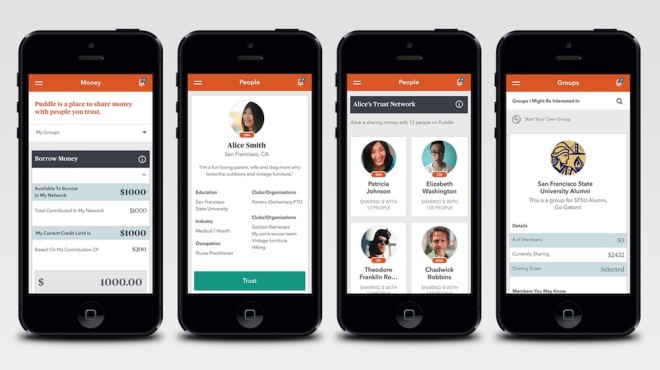

Trust builds over time. This happens organically when you’re around a person in real life, but Puddle obviously didn’t have that luxury. The service needed to accelerate the feeling of trust in our virtual lives in order to make their idea work, and they did this by building on some core social media mechanics. Woodward says Puddle sits between the interaction of Facebook and Reddit—Facebook because it grabs onto your social graph, Reddit because there’s a reward system for good behavior and common interests. On Puddle you can peruse profiles and see anyone’s payback rate. You can join groups like “Photog Puddle” (a group to fund expensive photo gear) and “Travelers.” The goal is to build your own “Trust Network,” a diverse group of people who you’re sharing funds with at any one time.

“Everyone has these overlapping pools of liquidity that they’re able to tap into,” says Matt Rolandson, a principle at Ammunition. “It’s our job to make that very simple to use.”

It’s that same social tie that encourages people to be responsible with their borrowing and diligent about their repayments. You get fined if you’re late on a payment, but social dynamics plays a major role in why the Puddle founders believe online networked borrowing won’t result in a bunch of people taking the money and running. In that way, Puddle presents itself as a self-regulating system, drawing on humans’ innate desire to not disappoint one another. Will it work? There are positive signs so far: Rolandson says that the service has been in trials for two years, and that repayment rates are above 98%. Just think of that number the next time you lend your brother five bucks.