What Banks and Fintech Need to Ponder Before They Partner

By Bryan Yurkan for American Banker

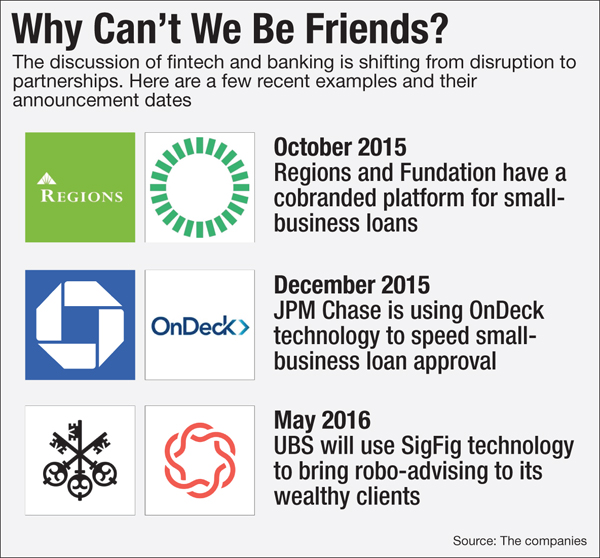

Some banks and fintech companies are in the early stages of collaboration, but for the partnerships to fully take hold, the companies need to fundamentally understand how they each operate and what they are hoping to achieve.

“The future is cooperation,” said Aaron Fine, a partner at the consultancy Oliver Wyman Group. “But banks need to think introspectively and figure out what they are really good at. And tech companies need to meet the regulatory and service culture required in financial services.”

Speaking at the Banking Growth Forum in San Francisco last week, a conference sponsored by the technology vendor Nomis in conjunction with Oliver Wyman, Fine said the “conventional wisdom of the past few years that fintech will disrupt everything” is changing.

Fintechs are facing more regulatory scrutiny and that is making them wary. Fine cited the daily fantasy sports industry as an example of how increased regulatory oversight can hinder the growth of tech-focused startups (Last year, regulators categorized many of the companies as gambling sites and several have been banned from operating in various states.)

Investors in fintech startups are also growing impatient with their ability to build scale, and partnerships are seen as a way to accelerate it. They want to see “how you’re going to make money in at least the next few years,” Fine said.

Banks, too, are warming up to the benefits of partnering, acknowledging that talent for innovating can often best be found outside their industry.

“Very rarely do you get someone with the ability for creative thinking on one side of their mind, and on the other the aptitude for producing 1,000-page regulatory documents,” Fine said.

While there is a willingness and interest in partnering, Fine said that’s not enough to guarantee success. Both sides need to reflect on what they need to do to make it work.

For instance, startups tend to be more focused on creating products and design and pay less attention to business development. Essentially, they need to adopt a more client-focused nature in working with financial services.

Fine recalled a story of a bank client who spoke about visiting a fintech company partner, and noting the pingpong table and other typical amenities associated with a tech startup office space.

“Then he said, ‘I called [a few days later] and no one answered the phone, and I just pictured them playing pingpong,’ ” Fine said.

Fine isn’t suggesting the startups trade the pingpong table in for a boardroom table. Rather, they just need to be aware of the way conventional bankers view the startup world.

Banks, too, must take stock of themselves, Fine said: “They have to think across each individual function, not as a bank as a whole, but how do they operate as a risk and finance company, a product design company, a digital company, a marketing company. Am I actually good at this? And if not is there someone out there I should partner with?”

And banks must consider what they want out of a fintech partner. For example, a bank may be looking to partner in order to acquire a slick, customer-facing user interface a fintech company has, but not the underlying product itself, Fine said.

Banks also cannot solely rely on the strategy of partnering as a replacement for pursuing internal innovation, said Jason Bilodeau, a managing director at Macquarie Group. The fintech industry is filled with companies still trying to establish themselves, and not all partnerships will be grand slams.

“First you have to figure out who the winners will be long-term,” Bilodeau said. “You might also have to wait for some [fintech companies] to get sufficient scale. You also can’t assume everyone wants to partner. Many do, but others have absolutely no interest and want to disrupt. Banks internally need to understand how this works and how to innovate within the banking scheme.”

Bilodeau recommends that banks think about everything they do and why they do it.

“They should think, If I was starting a bank from scratch today, is this how I would develop everything?” he said. “That doesn’t mean you have to change everything tomorrow, but you have to start thinking that way. I do think banks have to do both build and buy, but you can’t rely just on partnerships.”

First appeared at American Banker