Fintech Flip-Flop

By Nisha Gopalan for Bloomberg Business

Few words fill banks with more dread these days than fintech, the growing bevy of unregulated upstarts mucking about in their business patch. In China, where lenders have quite enough on their plates, they must be feeling positively schizophrenic.

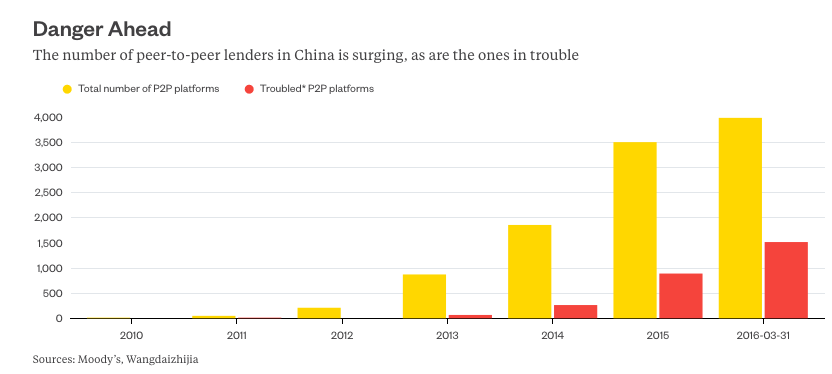

Once encouraged as an easier way for small-business owners to raise capital, P2P lenders have, at least in some quarters, fallen out of favor. About 1,000 have gone belly up, most notably Ezubao, whose executives squandered almost $8 billion, including 12 million yuan ($1.8 million) on a pink-diamond ring.

In March, authorities began to push back on many of the crowdfunding businesses that were giving down-payments to high-risk borrowers, a source of the runaway real-estate prices seen in cities such as Shenzhen. Last month, the government suspended the registration of new companies with “finance” in their name, and this week, Bloomberg News reported that some online lenders are being ordered to break leases and move out of busy street storefronts lest their presence spark social unrest.

According to DBS Vickers analyst Shujin Chen, P2P loans in China total about 600 billion yuan. That’s still a tiny number compared to the advances of traditional financial institutions, but they’re starting to feel the heat. Bank of Tianjin, which recently made its trading debut in Hong Kong, said in its prospectus that “similar to other commercial banks,” it too faces competition from P2P outfits.

The P2P phenomenon also comes at a time bad loans in China are near the highest in a decade and state-owned banks are setting aside less capital to account for that soured debt.

Yet for all the negative noises, Beijing is championing the Internet for many kinds of transactions that were once the domain of banks. Its Internet Plus Circulation action plan, unveiled in April, will boost infrastructure for third-party payment services, giving a fillip to fintech players like Alibaba and Tencent.

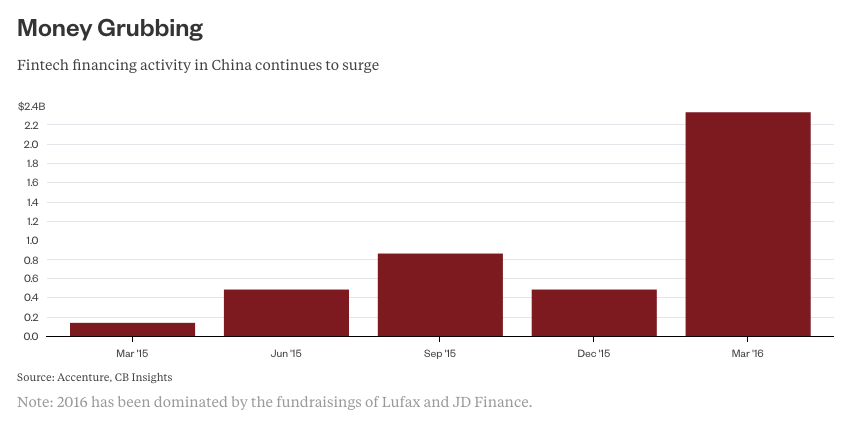

Money also continues to pour into fintech startups: In the first three months of 2016, Asia-Pacific fintech investments soared more than 500 percent to $2.7 billion, driven almost entirely by China, data from Accenture show. They’re popular too; as of March 31, Ping An Insurance-owned Lufax had 21.1 million registered users, up from 18.3 million at the end of 2015.

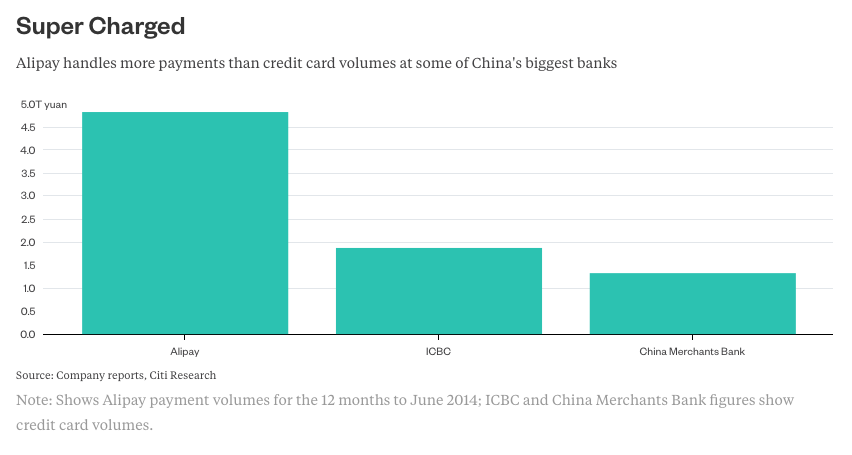

As Citigroup analysts said in a recent note, in China, unlike in the U.S. or Europe, fintech is “well past the tipping point of disruption.” Alibaba’s Alipay and Tencent’s Tenpay now have more clients than many of the country’s top banks. Alipay handles three times the volumes of PayPal.

With so much at stake, perhaps it’s time Beijing stopped oscillating between supporting fintech one day and demonizing it the next. Confused banks are never a good thing.