Habito is another London startup aiming for a slice of U.K.’s lucrative mortgage market

By Steve O’Hear for Techcrunch.com

A little over two months since Trussle made headlines for picking up £1.1 million in funding from LocalGlobe, the new VC fund from father and son duo Robin and Saul Klein, and another London startup has launched to take aim at the U.K.’s multi-billion pound mortgage market.

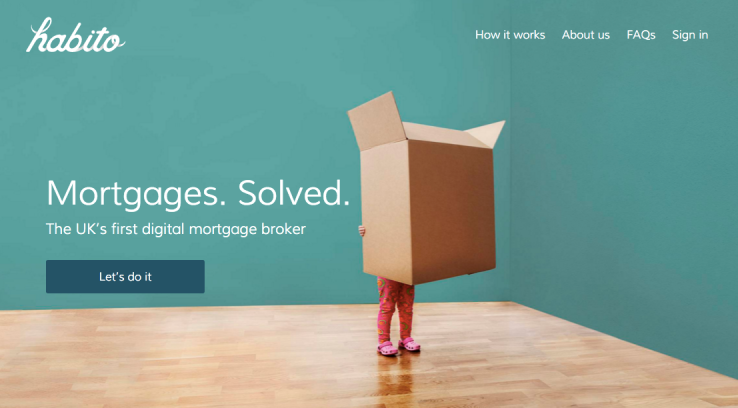

Habito, founded by Daniel Hegarty, pitches itself as the U.K.’s “first digital mortgage broker” — though Trussle may disagree — and offers a “fully automated” brokering service to help you find the most suitable mortgage and make an application.

To do this, it has built tech that claims to analyze every mortgage on the market across 100 lenders to identify the best deal based on your individual circumstances. You’re then able to apply via Habito in (they claimed) under 30 minutes.

“We think the whole mortgage application process, from start to finish, should be automated,” Habito’s Hegarty tells me. “We’ve built proprietary tech that analyses over 15,000 mortgage products across 100 lenders in seconds, but more importantly, it identifies the best mortgage for each unique applicant and allows them to apply online from their phone, tablet or desktop in less than 30 minutes.”

Furthermore, Hegarty says Habito is designed from the ground up to make “intelligent decisions based on data.” Its tech tracks changes in the mortgage market, such as eligibility criteria, interest rates, affordability and product features, to be able to identify emerging patterns and how they can help or hinder potential applicants.

“It’s machine learning for the mortgage broking market,” he adds. “Ultimately, no one need worry about finding the right mortgage, or remortgaging, ever again.”

To that end, to help Habito out the gate, the startup has raised just over £1.5 million in seed funding led by Mosaic Ventures. A number of noteworthy angels also participated, including Taavet Hinrikus, Samir Desai, Yuri Milner, Tom Stafford and Paul Forster.

Meanwhile, just like Trussle, the company offers its brokerage service free to the end customer but takes commission from the eventual lender. “Unlike the majority of mortgage brokers, we don’t charge consumers anything for using our service,” says Hegarty. “We get paid by the lenders for processing mortgage applications. The fee is a fraction of a percent of the mortgage. For Habito to work we have to be perfectly impartial, so if we ever gain any financial benefit from choosing one lender over another, we pass it directly back to the consumer.”

First appeared at Techcrunch.com