Crowdfunder launches a VC fund for the crowd

By Haje Jan Kamps for Techcrunch.com

Angel investors who wish they could invest alongside top-shelf VCs like Andreessen Horowitz, Greylock and 500 Startups finally have an opportunity to do just that.Crowdfunder today announced the world’s first VC “Index Fund,” which enables smaller investors to get involved with much bigger deals while still being able to spread their investment risk.

If you’re able to pick the right companies in which to invest at seed stage, you can make mega bucks. There’s only one problem: Picking the right companies is really hard, the vast majority of startups fail and of the ones that survive, only a tiny fraction go on to become unicorns. So what is a poor investor to do?

In the context of the stock market, there’s a solution: If you aren’t particularly good at picking stocks in the stock market, you can invest in an index fund that tracks a broad number of companies, such as the S&P 500 or the Dow Jones Industrial. Instead of relying on the performance of an individual pick, you can spread your risk by in effect putting your money in all the companies in the index. This, in turn, means that if the stocks for those 500 companies perform well on average, the value of your share of the index fund increases.

Crowdfunder’s new Index Fund is aiming to mimic certain aspects of this strategy by providing investors with access to a much broader spectrum of investment opportunities while reducing their risk at the same time. The fund is planning to invest in 300 early-stage deals. Given that most VC funds make on average 30 investments in their lifetime, Crowdfunder claims their fund is 10x more diversified than a VC fund, leading to significantly lower portfolio risk.

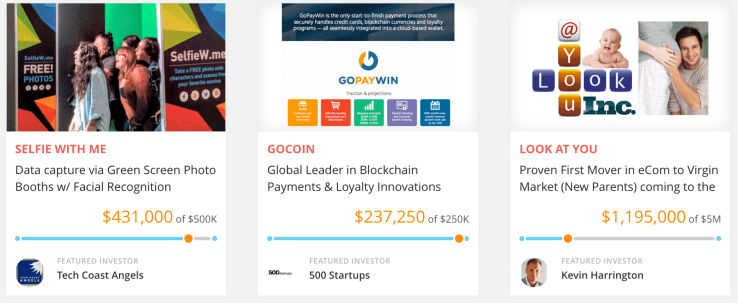

At Crowdfunder.com it is already possible to invest alongside high-profile investors — including 500 Startups. The new fund makes it easier to further diversify a fledgling angel portfolio.

“We have created the next generation of the early-stage venture firm,” said Chance Barnett, CEO of Crowdfunder. “We’re allowing investors to access both direct online investments into single ventures, as well as broader diversification into a portfolio of hundreds of VC-backed startups.”

The company describes the new fund as a win-win: Investors on the Crowdfunder platform get access to deals that they wouldn’t otherwise see, and the deals will have been pre-vetted and undergone due diligence by the experts at the VC firms, to further reduce risk. For the companies seeking investment, more money is available, and it’s possible to close a funding round faster. Finally, for the VC firms themselves, it reduces their risk, as they wouldn’t be able to pony up the whole round on their own.

“It’s great to see Crowdfunder embracing the quantitative diversification benefits of a large portfolio strategy,” said Dave McClure, Founding Partner of 500 Startups. “As evidenced by our name, it’s a strategy we obviously believe in whole-heartedly”

Chance Barnett and Rafe Furst, co-founders of Crowdfunder

In addition to launching the new fund, Crowdfunder today announced that Tim Draper — founding partner at leading venture capital firms Draper Associates and DFJ — will serve as an advisor to the fund.

“The VC Index Fund is unique in that it has the ability to scale past any other traditional VC fund, which will allow it to potentially yield higher returns with lower portfolio risk,” said Draper.

The minimum investment into the Index Fund is $100,000, and Barnett told me they are expecting the majority of the investments to fall between $100,000-$500,000.

The Index Fund, confusingly enough, isn’t technically an index product, given that it isn’t indexing anything specific, but, the company hastens to explain, the fund “aims for representative market coverage of deals.”

Nomenclature aside, enabling high-net individuals to invest in a fund that invests alongside well-structured VC deals could prove to be a game-changer, and sophisticated investors would do well in keeping a close eye on what Crowdfunder is up to.

First appeared at techcrunch.com