European tech funding was almost flat in Q1 2016

By JAIME NOVOA for VentureBeat.com

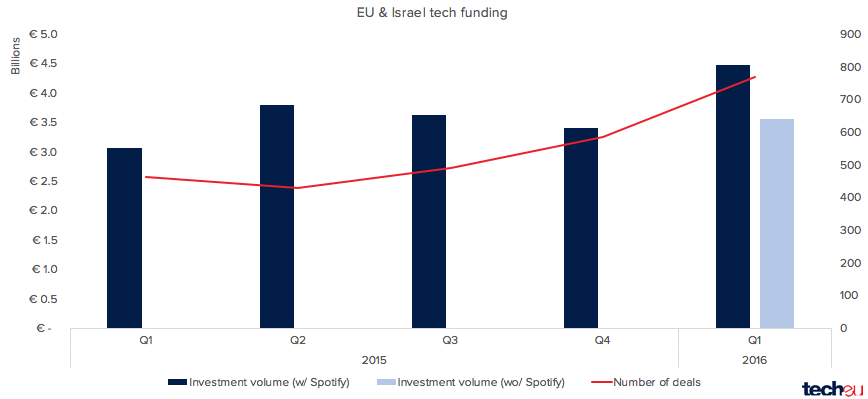

The first quarter of 2016 has come to a close: European and Israeli startups raised €4.4 billion across 769 deals in Q1, including Spotify’s recent $1 billion debt round.

European and Israeli tech startups have raised €4.4 billion (about $5.01 billion) in funding in the first quarter of 2016, across 769 deals.

In both cases, these figures represent a 31% increase compared to Q4 2015, and a 46% and 66% year-on-year uplift, respectively.

That is, if you take into account Spotify’s recently announced – and massive – $1 billion debt round.

Have a look at the following two charts:

When you don’t count Spotify, the landscape changes significantly:

That’s right. Excluding Spotify’s latest, pre-IPO financing round, startups in the old continent raised a combined €3.5 billion, almost exactly the same amount as in the previous quarter (€3.4 billion), despite there being 183 more funding deals.

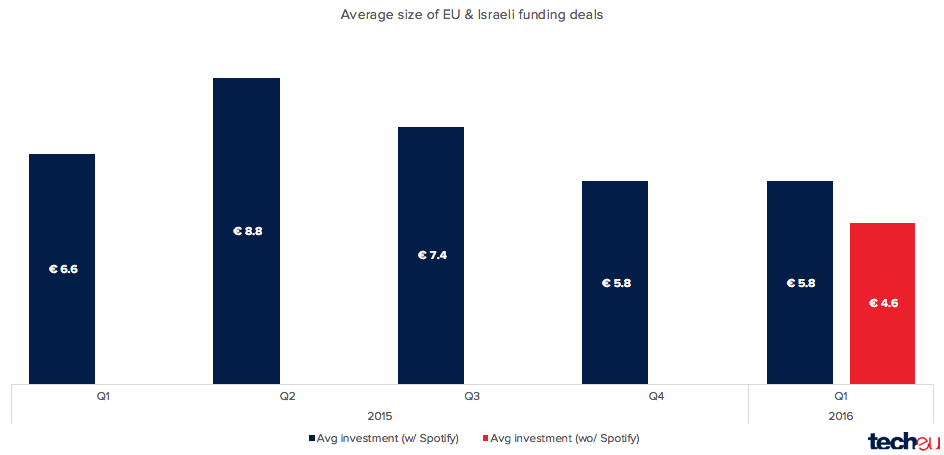

This means that the average size of European and Israeli tech funding deals has gone down in Q1 2016. Sans Spotify, the average deal in Europe in the first quarter of 2016 was only €4.6 million, compared to €5.8 million in Q4 2015 and €6.6 million in Q1 2015.

The reason behind this? An impressive increase in early-stage deals.

In Q1 2016, there were 534 deals smaller than €10 million (vs. just 379 in the previous quarter), proving that there’s plenty of early-stage capital across Europe. Growth and late-stage rounds didn’t see significant changes, with very similar levels compared to prior periods.

Leading the pack? France, with 134 deals (+123% QoQ, +306% YoY).

Note: the above analysis doesn’t include biotech and cleantech companies.

This post first appeared on Tech.eu.