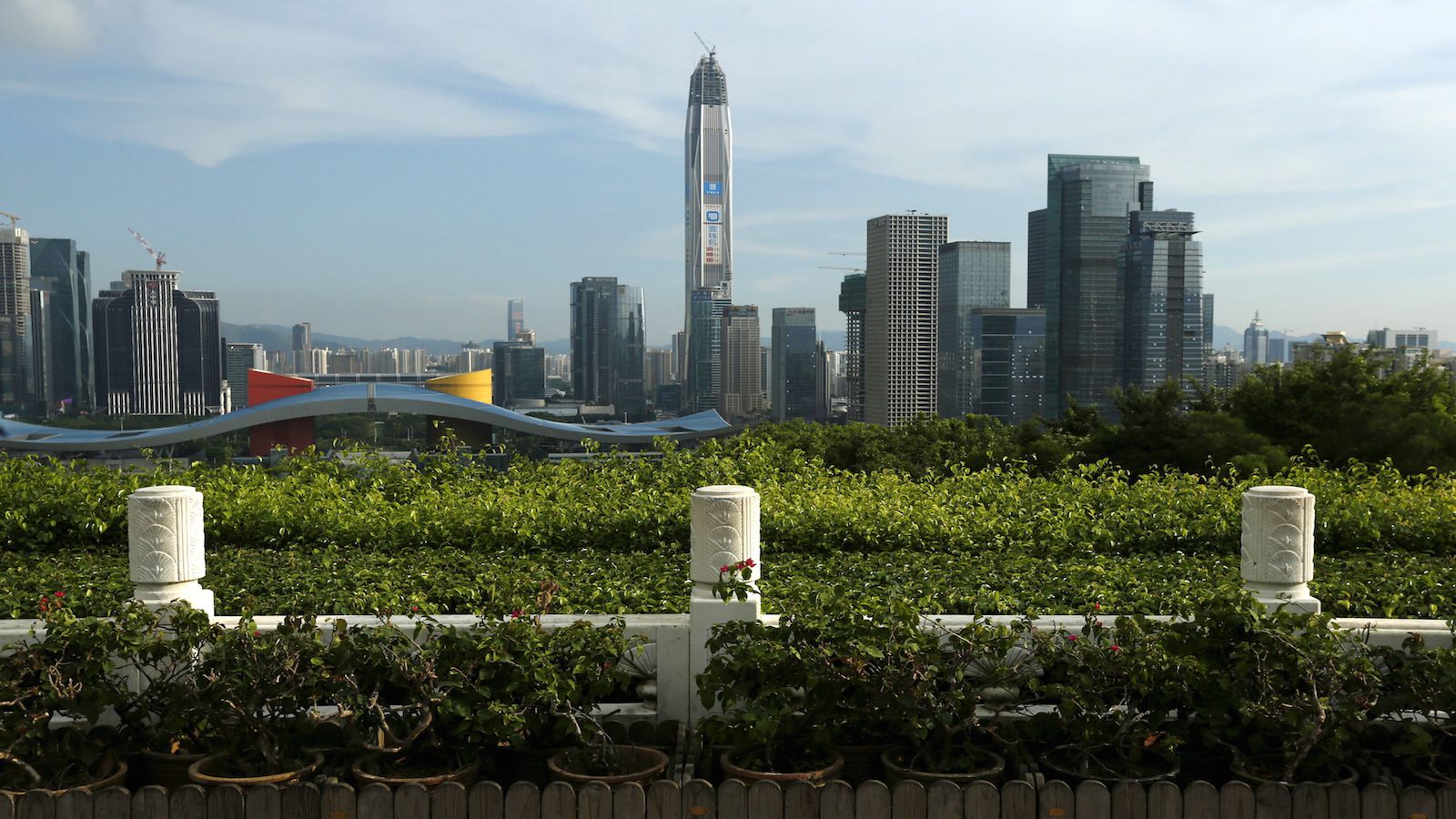

The center of the tech revolution in finance couldn’t be further from Silicon Valley

By Ian Kar for Qz.com

Silicon Valley is on a mission to disrupt finance. Even Jamie Dimon is worried about it. US venture capital funding for fintech startups reached $7.4 billion in 2015, up from $4.3 billion in 2014. But while the money’s flowing, the real action is in China.

China’s fintech dominance isn’t just in payments. Alternative and peer-to-peer lending is bigger as well. The US does more peer-to-peer lending than the UK, but, combined, the two countries do less than China.

China’s fintech and digital banking businesses are growing in part because consumer banking hasn’t developed as much as elsewhere, Citi said. Chinese internet giants have stepped into the void to provide access to financial services via mobile apps. Chinese regulators have also taken steps to promote, not inhibit, financial innovation in China.

China could be where the US is headed. Citi said that China is past the tipping point of disrupting financial services, but the US or Europe is still a few years away. By 2023, 17%, or $1.2 billion, of North American consumer banking revenue will move to digital services, Citi estimates.

The article first appeared in QZ.com