Seedly wants to simplify personal finance for millennials

By Michael Tegos for TechinAsia

What’s the cost of failure? In the startup game, it can be heavy, but it can also be an investment for the future. For the Seedly team, it turned out to be the latter. “It’s interesting how failure is perceived in the startup world – as something that you can build on,” Kenneth Lou, co-founder and CEO of Seedly, tells Tech in Asia.

Kenneth knows a bit about failure, having founded wireless charging startup Novelsys in the past. The company managed to raise US$87,000 on Kickstarter in 2015, but ultimately couldn’t follow through on its plans (Kenneth recounted his experience and the lessons he learned in a community post on Tech in Asia).

Interestingly enough, that failure led to Kenneth and his Seedly co-founder and CTO Tee Ming Chew bagging seed funding for their new company before they were even out of university.

Personal finance 101

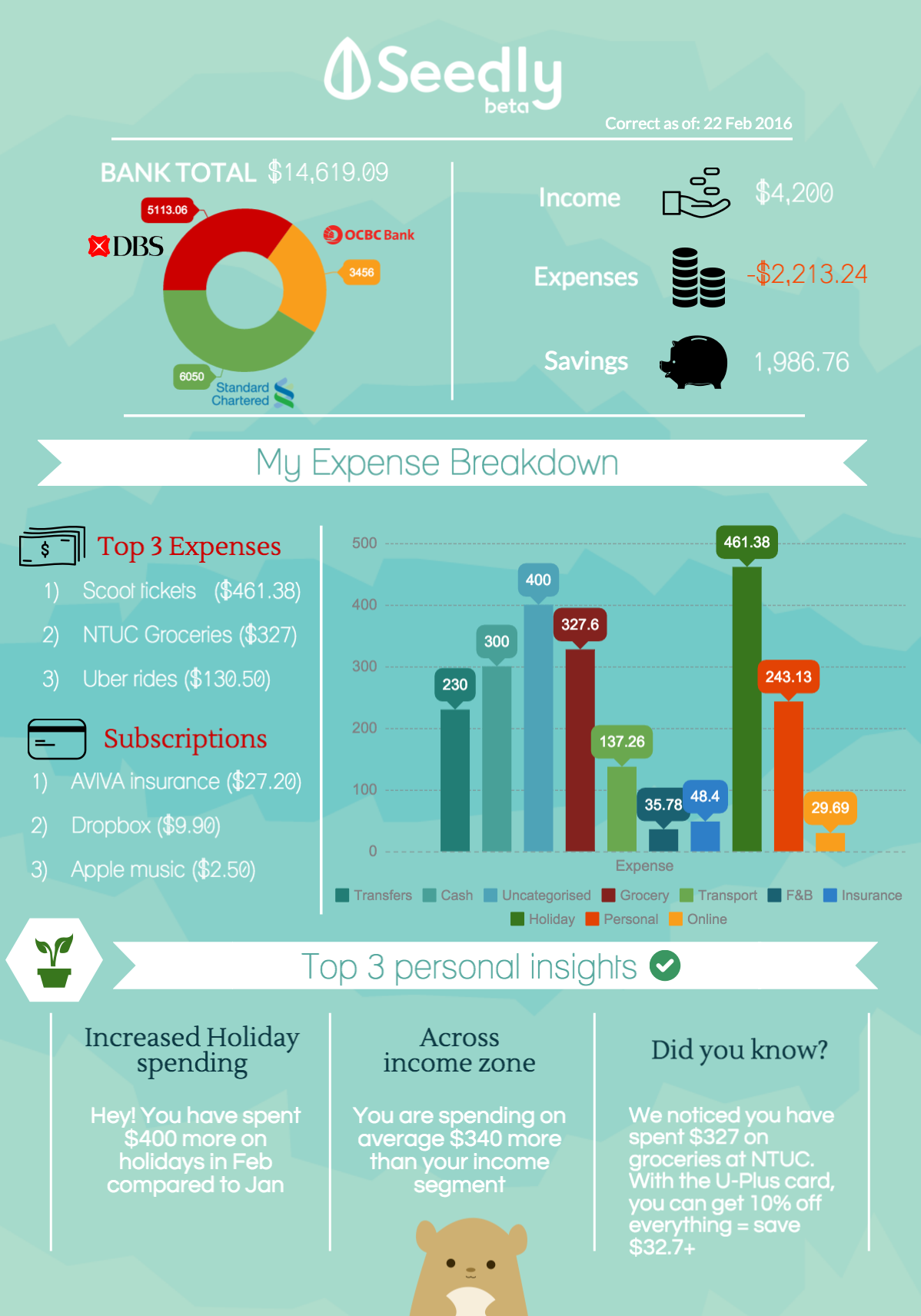

Seedly is a personal finance web app that lets you keep track of your money. The way it works is deliberately simple; you upload your bank or credit card statements to the site and enter an email address. The team crunches the data and then produces an infographic that presents your finances in a stylish, easy-to-read way.

The infographic includes information like your total income from all your bank accounts, your expenses, and your savings. In addition, it breaks your expenses down to show you how much you’ve spent on what, your top three expenses of the month, and money you spent on subscriptions. Finally, it gives you tips and insights on your spending.

Seedly’s approach is meant to simplify personal finance management for millennials. Kenneth says the startup’s ideal user is 25, tech-savvy, fresh out of university, and on their first job. Maybe they already have at least a couple of bank accounts, one for their salary and one for savings, a credit card, and health insurance. So they need a way to track all this stuff, but don’t necessarily want to spend the time to do it themselves.

This is your personal finance report as delivered by Seedly. Infographic credit: Seedly.

Seven out of ten millennials in Singapore think they’re not in control of their finances, Kenneth says, especially in the first two months of their job. “The majority of personal finance solutions out there are very cumbersome [for this demographic], and there isn’t one place to pool multiple bank accounts together,” he explains. “A lot of people also commented that they are too lazy to track their finances themselves.”

Seedly’s ideal user is 25, tech-savvy, fresh out of university, and on their first job.

That’s why Seedly opts for simplicity and why it doesn’t even let users create accounts on the site. You just upload your bank statements and wait for up to three days for your infographic to show up. Tee Ming says the two-person team can process about 30 such reports per day at the moment, while the product is in closed beta.

That sets off quite a few privacy bells – after all, it’s your monthly spending information we’re talking about here. Other companies bend over backwards to get and keep that data. Tee Ming, however, says this method works because the team only sees the numbers included in the statements. All there is by the end of the process is the infographic, which is sent to the user through the email address they have submitted. “That’s why we don’t want our users to have an account [on the site] either,” he adds.

That’s not necessarily how it’s going to work in the future, and for good reason – the current process doesn’t sound very sustainable if user numbers grow. Kenneth says the team is trying to prove the concept for now, however.

Seedly plans to monetize through partnerships that offer discounts and points based on your buying habits. For example, if you’ve been spending a lot at NTUC Fairprice supermarket outlets, the startup will suggest you get a U-Plus loyalty card that offers you a 10 percent discount at those stores. It bags a commission fee, you get sweet deals, and everyone is happy.

Breakfast deal

Seedly plans for a full launch in June (coinciding, Kenneth says, with a lot of his and Tee Ming’s fellow students graduating), but it has already secured seed funding from venture capital firm East Ventures. The amount of the funding is undisclosed (Disclosure: East Ventures is also an investor in Tech in Asia. See our ethics page for details).

Image credit: Seedly.

East Ventures managing partner Willson Cuaca got in touch with the team right after he saw Kenneth’s post about Novelsys’ failure, Kenneth says. He and Willson had met before, but Willson hadn’t been convinced to invest in Novelsys. This time was different. “I think he saw the opportunity and he texted me to meet me the next day,” Kenneth says. The deal was closed after one meeting, over breakfast no less.

Seedly was planning to raise funding closer to its launch date, but it wasn’t about to say no to the opportunity. It plans to use the funding for recruitment ahead of its launch. It needs to hire designers, as it now depends on friends to get the infographics done, as well as software engineers and marketing people.

The team says it wants to make Southeast Asia’s first non-banking personal finance app. “It’s quite a mouthful, but this is the market we’re going for,” Kenneth says. He explains there were 19 million workers in Southeast Asia in the past 10 years, so that’s the market the company is targeting. It’s currently counting on their new investor’s experience in the region, especially in Indonesia, to help propel it to new markets after launch.

The article first appeared in TechinAsia