Bitcoin, RIP. Blockchain is Sexy

2015 was still a busy year for blockchain. Venture capital investments topped $1 billion for the first time. People are finding it easier to invest in the digital currency, thanks to the debut of firms such as Bitcoin Investment Trust. Big financial companies—Nasdaq, American Express and Visa— invested in blockchain startups, “a game changer in terms of attitude towards the technology”.

Read our full research “Money of the Future”. Download PDF (20MB)

The race toward real-time financial services involves a wide array of stakeholders and possibilities, ranging from common standardization to re-engineering underlying processes and protocols through blockchain technology.

The Bank of England, in a report earlier this year, calls it the “first attempt at an Internet of finance,” while the Federal Reserve Bank of St. Louis hails it as a “stroke of genius.” In a June white paper, the World Economic Forum says, “The blockchain protocol threatens to disintermediate almost every process in financial services.” In a matter of months, this word, blockchain, has gone viral on trading floors and in the executive suites of banks and brokerages on both sides of the Atlantic. You can’t attend a finance conference these days without hearing it mentioned on a panel or at a reception or even in the loo.

A June report backed by Santander InnoVentures, the Spanish bank’s fintech investment fund, estimated the blockchain could save lenders up to $20 billion annually in settlement, regulatory, and cross-border payment costs. In April, UBS installed a half dozen developers in London’s Level39 accelerator to download blockchain source code from the Internet and delve into how it might revolutionize payments, cybersecurity, and other banking needs. In June, Nasdaq teamed up with Chain, a San Francisco firm, and launched a project to use the blockchain to issue and transfer the equity shares of closely held companies on the exchange’s private marketplace. Barclays, Goldman Sachs, the New York Stock Exchange, and Santander are backing cryptocurrency ventures. Venture capitalists plowed $400 million into dozens of digital currency startups in the first six months of 2015.

Rakuten, Japan’s largest online retail firm, now accepts bitcoin. In October 2014 it invested $14.5M in Bitnet (development of infrastructure for bitcoin), which now processes Rakuten payments. Also now you can pay for purchases of Dell equipment in Bitcoins not only in the US but also in the UK and Canada. The world’s first electronics retail store that sells goods only for Bitcoins has been opened in San Francisco. Stripe, a breakthrough online acquiring project, numerously mentioned in our digests, now supports Bitcoin payments too.

The Bank of England seriously suggests it could create its own digital currency like Bitcoin. (“Distributed Ledger Technology: beyond block chain”, a report by the UK Government Chief Scientific Adviser.) MasterCard filed a request to the British governors urging them to pay more attention to the cryptocurrencies. The payment network claims that transfer costs of those systems are much lower only because they don’t have any expenses related to compliance, anti-laundry legislations and consumer rights protection requirements.

And while this year bitcoin became easier than ever to buy and sell, thanks to an expanding network of bitcoin ATMs, bitcoin exchanges, and peer-to-peer trades through services like the classified advertising site LocalBitcoins, the currency’s backers have yet to find a way to make it indispensable to the average Internet user. The past year also saw the collapse of a number of bitcoin-related businesses, from mining companies affected by the currency’s decline in value to consumer-facing businesses that failed to gain traction.

European Union countries plan a crackdown on virtual currencies and anonymous payments made online and via pre-paid cards in a bid to tackle terrorism financing after the Paris attacks. The bitcoin mining pool BTC Guild, which enabled miners to share the risks and rewards of mining the digital currency, shut down this summer citing increased competition and regulatory uncertainty. Dutch firm Mining ASICS Technology declared bankruptcy in January after being unable to deliver pre-ordered mining hardware, according to bitcoin news service CoinDesk.

Connecticut-based mining company GAW Miners fell into disarray amid controversy over its own bitcoin alternative, called PayCoin, and a lawsuit by the Securities and Exchange Commission alleging it fraudulently oversold stakes in its Hashlets mining operation. “There was no computer equipment to back up the vast majority of Hashlets that defendants sold,” the SEC alleges.

On the consumer side, bitcoin-based crowdfunding site Swarm shut down amid disputes between its founders and a lack of funds, according to news service CoinTelegraph. Bitcoin exchanges Yacuna, Harborly, and Vault of Satoshi, each of which allowed customers to trade bitcoin for conventional currency, all also ceased operations in 2015, according to CoinDesk. In the meantime, a wide variety of financial and tech companies have begun to look seriously at harnessing the underlying blockchain technology—and, in some cases, even the bitcoin network itself—for recording other types of financial transactions.

So what’s in store for 2016? We’ll probably see the first blockchain company valued at more than $1 billion, a self-imposed slowdown in new blockchain production (which will put some miners out of business) and more financial institutions embracing the currency and its technology. The main unknowns are the price, consumer adoption and—as always—the real identity of bitcoin’s creator, Satoshi Nakamoto.

Summer 2016 marks four years since the last halving, with the cap set to drop to 12.5 bitcoins every 10 minutes. That’s bad news for some miners, especially those with older machines. “They are just going gangbusters and trying to mine as much as possible,” said Bobby Lee, CEO of Chinese bitcoin exchange and mining pool BTCC. With fewer new bitcoins floating around, the price of the virtual currency could climb in value, he said.

The seven topics Goldman Sachs explores: how the blockchain could disrupt everything, a new frontier in space, the value of college, the effect of America’s youngest cohort Gen Z, the likelihood of another Flash Crash, lithium as the new gasoline and how the cloud can help cure cancer. Goldman writes that there are expectations that the blockchain could revolutionize “everything,” though roadblocks remain. The blockchain, which is the digital public ledger underlying bitcoin, is these days “taking center stage” from the currency it was supposed to support, Goldman wrote. It’s “promising an ushering in of a new set of tools to cut costs and challenge the profit poll of the middle-man with a promise to make centralized institutions obsolete.”

In doing so, it has the potential to make interactions quicker, less expensive and safer. In addition to bitcoin’s blockchain, Goldman said there are growing sets of private and permission-driven shared ledgers gaining traction and worth focusing on. But, like any new technology, the bank added that the hype cycle is building with no real legislative or regulatory framework.

Libertarians dream of a world where more and more state regulations are replaced with private contracts between individuals—contracts which blockchain-based programming would make self-enforcing. Today’s world is deeply dependent on double-entry book-keeping. Its standardised system of recording debits and credits is central to any attempt to understand a company’s financial position. Whether modern capitalism absolutely required such book-keeping in order to develop, as Werner Sombart, a German sociologist, claimed in the early 20th century, is open to question.

Though the system began among the merchants of renaissance Italy, which offers an interesting coincidence of timing, it spread round the world much more slowly than capitalism did, becoming widely used only in the late 19th century. But there is no question that the technique is of fundamental importance not just as a record of what a company does, but as a way of defining what one can be.

Ledgers that no longer need to be maintained by a company—or a government—may in time spur new changes in how companies and governments work, in what is expected of them and in what can be done without them. A realisation that systems without centralised record-keeping can be just as trustworthy as those that have them may bring radical change.

Such ideas can expect some eye-rolling—blockchains are still a novelty applicable only in a few niches, and the doubts as to how far they can spread and scale up may prove well founded. They can also expect resistance. Some of bitcoin’s critics have always seen it as the latest techy attempt to spread a “Californian ideology” which promises salvation through technology-induced decentralisation while ignoring and obfuscating the realities of power—and happily concentrating vast wealth in the hands of an elite. The idea of making trust a matter of coding, rather than of democratic politics, legitimacy and accountability, is not necessarily an appealing or empowering one.

At the same time, a world with record-keeping mathematically immune to manipulation would have many benefits. Evicted Ms Izaguirre would be better off; so would many others in many other settings. If blockchains have a fundamental paradox, it is this: by offering a way of setting the past and present in cryptographic stone, they could make the future a very different place.

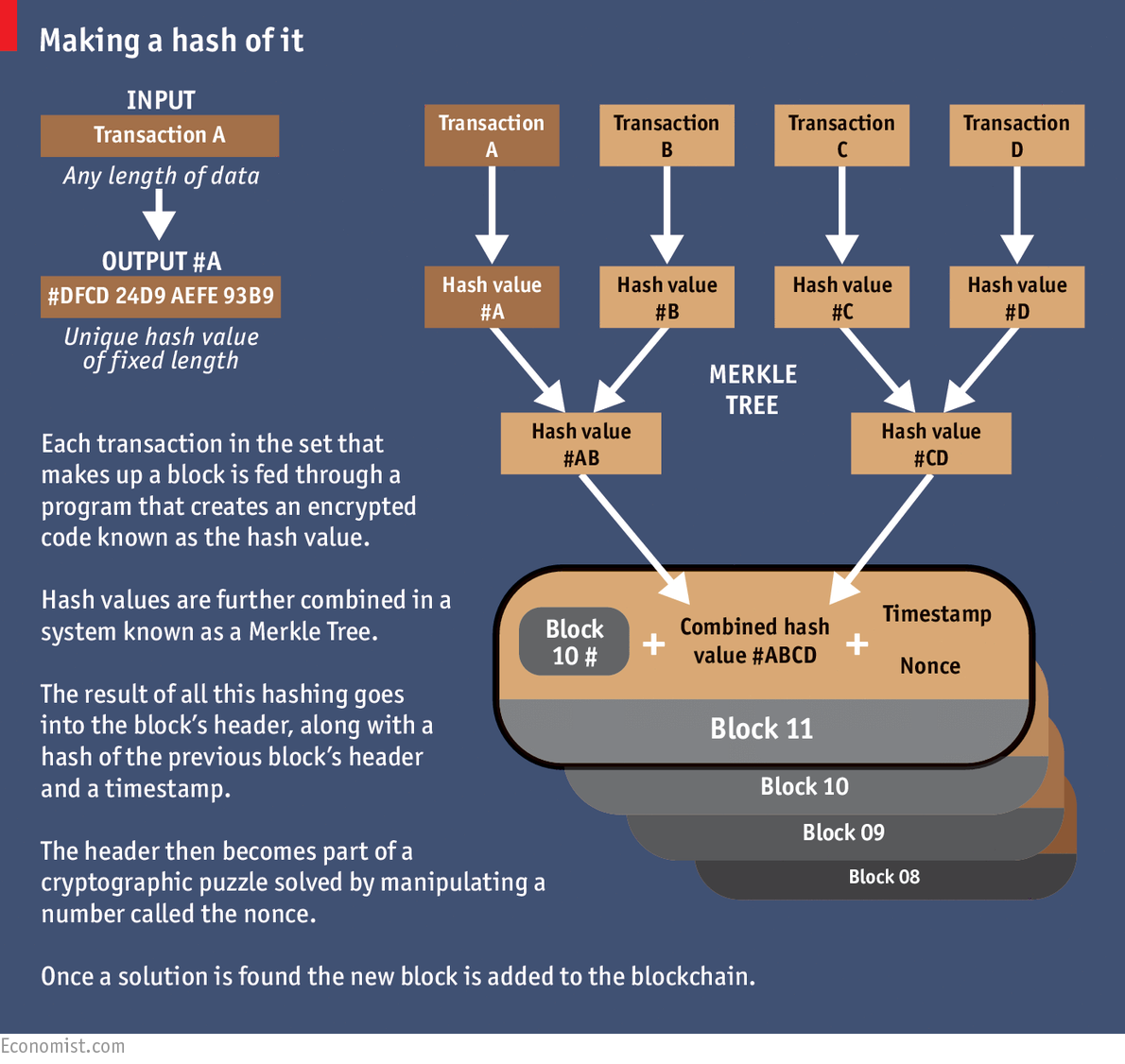

In 2009, a mysterious coder named Satoshi Nakamoto released bitcoin and the math that makes it work on the Internet. He (or she or they—Nakamoto has yet to be identified) created a peer-to-peer network to enable people to buy and sell bitcoins and to automatically secure and perpetuate the system. Every 10 minutes, coders around the world known as miners race to be the first to solve mathematical equations and record transactions made with bitcoins as entries, or blocks, on a digital ledger. In return for their work, which requires brute force computing power to complete, the program rewards miners with bitcoins, which motivates them to process transactions faster.

Here’s the key part: Every new block is connected to every prior one in a digital chain. So the record of every bitcoin transaction lives on the computers of the miners and is updated with each new entry. That’s why the blockchain is also called a distributed or a decentralized ledger. This replication makes the blockchain secure. The only way to tamper with it would be to seize control of most of the computers holding the blockchain in their memories, which miners call the “51 percent attack.” Such an assault has a better chance of materializing in the next Bond flick than in reality.

Here’s the key part: Every new block is connected to every prior one in a digital chain. So the record of every bitcoin transaction lives on the computers of the miners and is updated with each new entry. That’s why the blockchain is also called a distributed or a decentralized ledger. This replication makes the blockchain secure. The only way to tamper with it would be to seize control of most of the computers holding the blockchain in their memories, which miners call the “51 percent attack.” Such an assault has a better chance of materializing in the next Bond flick than in reality.

“Smart contracts” execute themselves automatically under the right circumstances. Bitcoin can be “programmed” so that it only becomes available under certain conditions. One use of this ability is to defer the payment miners get for solving a puzzle until 99 more blocks have been added—which provides another incentive to keep the blockchain in good shape.

(author: https://www.linkedin.com/in/richard-warren-773612)

(author: https://www.linkedin.com/in/richard-warren-773612)

Digital Asset Holdings

These Wall Street veterans all know who Blythe Masters is. Born in Oxford and educated in economics at Cambridge, Masters came of age at JPMorgan. At 18, she joined its London office as an intern during a year off before university. By her mid-20s, Masters was working on the bank’s derivatives team in New York. She helped design a way to remove lending risk from JPMorgan’s balance sheet by getting another party to protect the bank against a default in return for a premium.

The contract, which made it possible to bet a bond would fall in value, was dubbed a credit-default swap, and investors fell in love with it. In 1999, Masters, then 30, was named head of the bank’s global credit derivatives unit. She’s the wunderkind who made managing director at JPMorgan Chase at age 28, the financial engineer who helped develop the credit-default swap and bring to life a market that peaked at $58 trillion, in notional terms, in 2007. She’s the banker later vilified by pundits, unfairly some say, after those instruments compounded the damage wrought by the subprime mortgage crash in 2008.

After the fall of Lehman Brothers in September 2008, some media outlets highlighted her work with credit derivatives and cast her as one of the instigators of the crash. In a speech that year at SIFMA’s annual conference in New York, she noted that she’d been dubbed “The Woman Who Built Financial Weapons of Mass Destruction.” JPMorgan CEO Jamie Dimon backed her all the way through this period, but her fortunes turned in 2013, when the Federal Energy Regulatory Commission investigated whether traders in her commodities division manipulated California’s electricity market. JPMorgan paid a $410 million settlement to end the case without denying or admitting wrongdoing; Masters wasn’t implicated in the matter. Dimon agreed to sell the business to a Swiss trading firm called Mercuria Energy Group in March 2014, and Masters resigned.

Now, one year after quitting JPMorgan amid another controversy, Blythe Masters is back. She isn’t pitching a newly minted derivative or trading stratagem to this room. She’s promoting something wilder: It’s called the blockchain, and it’s the digital ledger software code that powers bitcoin. Masters is the CEO of Digital Asset Holdings, a New York tech startup. She says her firm is designing software that will enable banks, investors, and other market players to use blockchain technology to change the way they trade loans, bonds, and other assets. If she’s right, she’ll be at the center of yet another whirlwind that will change the markets. Masters plans to offer banks and other financial players both options: Digital Asset is creating an off-the-shelf private blockchain product and developing ways to connect its customers to the existing blockchain system.

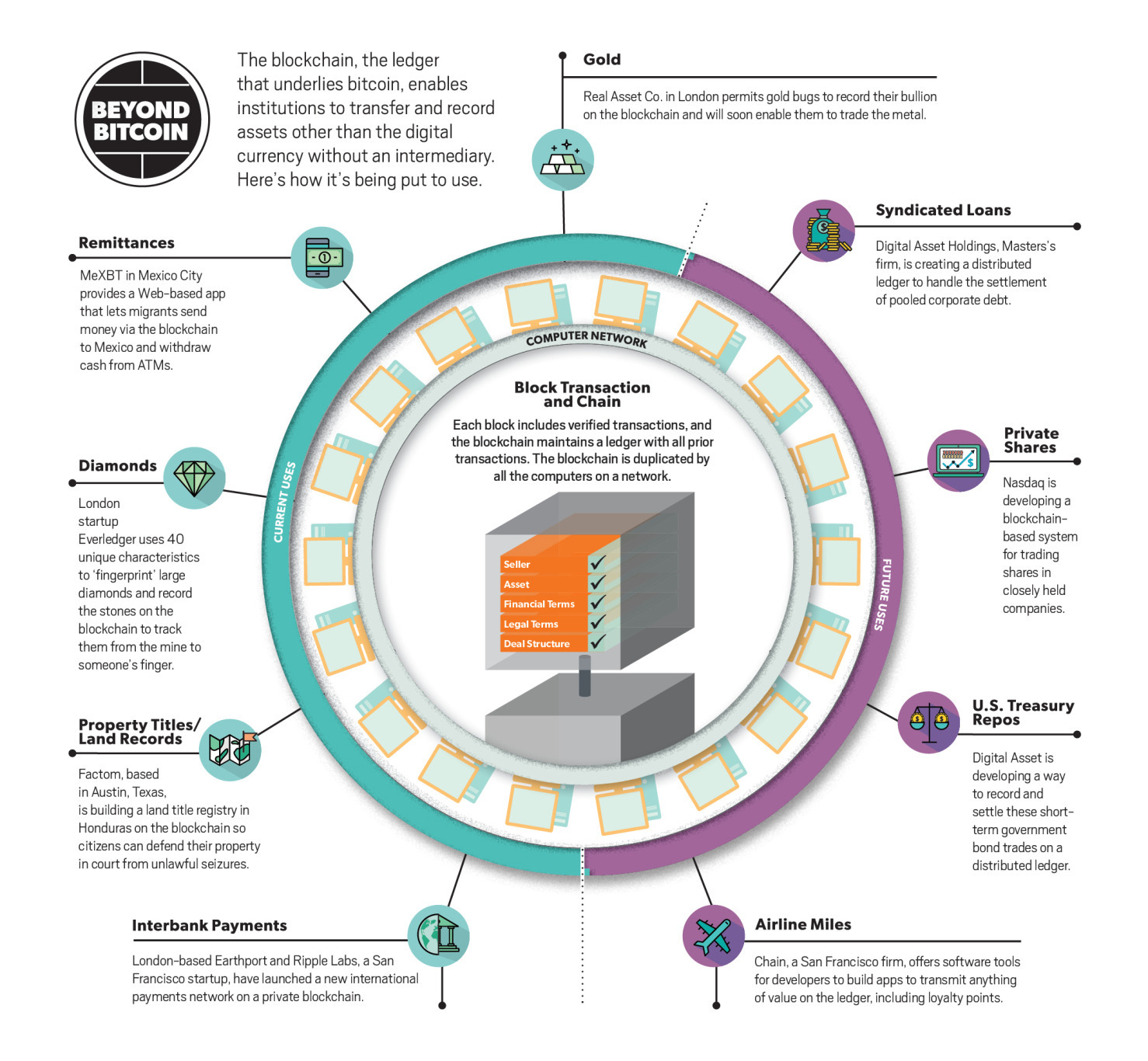

As Masters dug deeper into bitcoin, she learned that it was just one of many applications that could run on the blockchain. Startups in London, Silicon Valley, and even Mexico City were already developing ways to use it to transfer and record land titles, airline miles, gold, and diamonds. Masters realized that bitcoin wasn’t really about bitcoin—it was all about the blockchain. “I had an aha moment,” Masters says.

She then plumbed why the ledger could transmit assets without an intermediary, which would change everything she knew about the way the markets completed trades. Buyers and sellers, of course, can’t automatically trust one another. In the fixed-income market, for example, we need middlemen to draw up contracts between buyers and sellers that cover interest payments, terms, and collateral, plus clearinghouses to guarantee the exchange of cash for securities.

Through her research, Masters understood how you could input all that information into a digital “smart contract” on a distributed ledger. Conceptually, it’s similar to the way you can embed video in an e-mail. But the difference is that when you send that smart contract along, it doesn’t just contain data, it transfers ownership of the security. The value belongs to whoever possesses it. So a trade could be settled in minutes instead of days or weeks, Hirani says.

Anyone with access to the ledger can read the contract with a click of a mouse. That means regulators, who depend primarily on self-regulatory organizations to police the markets, could easily verify that a securities transaction didn’t violate anti-money-laundering rules or other laws. The blockchain, in essence, automates trust.

The clincher for Masters was how the technology can affect risk. Every hour that a trade hangs suspended between sale and purchase, the chances mount that it won’t be fulfilled, she says. Institutions have to set aside capital to protect themselves from such failures. Since the 2008 crash, regulators in the U.S. and the European Union have directed banks to allocate ever-larger sums to cover their exposures. If the blockchain could shorten the settlement time for, say, syndicated loans, from 20 days to 10 minutes, this risk would be reduced and capital would be freed up.

In March 2015, Masters joined Digital Asset as CEO. She, Hirani, and Wilson set to work developing blockchain-based software for three inefficient markets they deemed ripe for an overhaul: syndicated loans, U.S. Treasury repos, and equity shares in private companies. At the same time, Masters recognized that the open structure of the bitcoin process—no one controls who does the mining—would be anathema to an industry in which client confidentiality is sacrosanct. So in July, the company acquired Hyperledger, a San Francisco software firm that’s developing the technological equivalent of gated communities. Its system is designed so that users will be able to process transactions themselves rather than depend on the open bitcoin blockchain.

“Blythe sees that a new industry is being created,” says Hirani, who’s known Masters for 17 years. “There’s no infrastructure. There’s no companies that have any kind of scale. She’s done the bank thing. She did commodities. She did derivatives. She did loan portfolio management. This allows her to bring all of that experience to bear in creating an ecosystem—and a company around it.”

The newest venture from Blythe Masters appeared to be an overnight success story in the making. And Ms. Masters has already received a promise from JPMorgan, her former employer, to be the lead investor on the new project, pitching in around $7.5 million. But Ms. Masters’s company has been struggling for months to close the deal with other investors.

Most recently, large banks including Goldman Sachs and Citigroup have balked at putting money into Digital Asset Holdings after learning that JPMorgan was being given better terms than other investors, according to several people briefed on the deal. The banks and financial firms looking into investing, the people said, have also expressed doubts about the actual software solutions Ms. Masters’s start-up is working on, much of which has been put together through purchases of smaller start-ups.

The challenges that Ms. Masters is facing reflect in part the increasingly difficult environment facing start-ups of all sorts as investors have begun to worry that the tech industry has been overhyped and overvalued, pushing down values for companies both public and private. She is also contending with the difficulty of building a viable business around the virtual currency Bitcoin and the various technological concepts it has introduced to the financial industry, most of all the blockchain. Ms. Masters hoped to raise from $35 million to $45 million, valuing the company at $100 million.

Ms. Masters secured most of the company’s top programming talent by buying smaller start-ups already working in that area, firms with names like Hyperledger, Blockstack and Bits of Proof. In recent months, the software that Ms. Masters has shown to potential investors allows for the issuance and trading of so-called syndicated loans — large loans broken into pieces and sold to different investors. It can take weeks for trades in this market to go through, a time span that D.A. is trying to shorten. Investors who have looked at the software, though, say they are not convinced that Ms. Masters’s technology will fix the problems in the loan market, which are attributed as much to human cooperation as to bad software.

Other names on top: Circle, Coinbase, BitFury, Ethereum

Circle, the Bitcoin startup that veteran entrepreneur Jeremy Allaire started, raised $50 million from Goldman Sachs and IDG Capital Partners. Allaire is the co-founder and CEO of Circle, a digital currency startup that also touts a bitcoin wallet, which the company released last September. While bitcoin has grown in popularity in recent years, it’s still widely seen as money for privacy-minded geeks. Allaire wants to change that perception, which is why the next version of Circle’s wallet is designed to let users also hold, send, and receive US dollars.

Circle, the Bitcoin startup that veteran entrepreneur Jeremy Allaire started, raised $50 million from Goldman Sachs and IDG Capital Partners. Allaire is the co-founder and CEO of Circle, a digital currency startup that also touts a bitcoin wallet, which the company released last September. While bitcoin has grown in popularity in recent years, it’s still widely seen as money for privacy-minded geeks. Allaire wants to change that perception, which is why the next version of Circle’s wallet is designed to let users also hold, send, and receive US dollars.

In January 2015 Coinbase launched US first regulated Bitcoin exchange. Coinbase raised $75M round from BBVA, New York Stock Exchange and the leading American direct-bank USAA. The round is the biggest investment in a Bitcoin company to date. According to Coinbase CEO, the money will be used to develop its mobile app and expand to new markets – by the end of 2015 the company intends to operate in 30 countries (at that time it was present in 19). Also Brian Armstrong said that “non-trading transaction volume” (purchase-sell) tripled over the past year to about 12% of the total market transaction volume, thus, Bitcoin is gradually becoming an infrastructure cryptocurrency

In January 2015 Coinbase launched US first regulated Bitcoin exchange. Coinbase raised $75M round from BBVA, New York Stock Exchange and the leading American direct-bank USAA. The round is the biggest investment in a Bitcoin company to date. According to Coinbase CEO, the money will be used to develop its mobile app and expand to new markets – by the end of 2015 the company intends to operate in 30 countries (at that time it was present in 19). Also Brian Armstrong said that “non-trading transaction volume” (purchase-sell) tripled over the past year to about 12% of the total market transaction volume, thus, Bitcoin is gradually becoming an infrastructure cryptocurrency

In April 2015 Coinbase was finally landed in the United Kingdom. Coinbase is the bitcoin wallet and platform backed with more than $100 million from DFJ, NYSE and Andreessen Horowitz and that has attracted north of 2.7 million consumer accounts. With the expansion, they’re bringing both the exchange and their consumer wallet to the British market. UK-based users will be able to trade bitcoin against the British pound and the euro. CEO Brian Armstrong adds that they’re hoping to be in 40 countries by the end of the year.

In November 2015 Coinbase introduced the first US-issued bitcoin debit card, the Shift Card. The Shift Card is a VISA debit card that currently allows Coinbase users in twenty-four states in the U.S. to spend bitcoin online and offline at over 38 million merchants worldwide. Merchant adoption has come a long way over the past few years, but it’s still difficult for people to make regular purchases with bitcoin. Buying gas at a local gas station or groceries at a neighborhood grocery store with bitcoin has not been possible in most cities in the U.S. Thanks to Shift Payments, it’s now possible to use bitcoin to buy gas, groceries, and much more. With the Shift Card, you can now spend bitcoin anywhere in the world that VISA is accepted.

As many experts around the world agree that the dollar’s dominance won’t last forever the CEO of Coinbase, Brian Armstrong, believes bitcoin will “surpass” it as a global reserve currency “within 10-15 years.” Those that see the end of the dollar’s influence ending in the near future see many issues. Among the many reasons for this sentiment are “Quantitative Easing” creating too much liquidity and debasing its value; a lack of demand outside of the United States, where more than half the dollars worldwide reside; bilateral trade agreements increasing at an increasing rate; moving goods and services around the dollar to escape its influence on trade. But the real problem has been finding a global alternative.

There is nothing that is ready to replace it alone, so “a basket of currencies” may be a short-term answer in the coming years until a permanent solution is found. After over seventy years of unlimited economic power, the world is putting the U.S. Dollar on the clock.

![]() In another sign that the Bitcoin and the Blockchain are becoming a platform for the long term, BitFury, the Bitcoin Blockchain infrastructure provider and transaction processing company, secured $20 million in funding from investors including DRW Venture Capital, iTech Capital (Russia) and the Georgian Co-Investment Fund. Founded in 2011, by Valery Vavilov and Valery Nebesny, BitFury has offices in San Francisco, Washington, D.C. and Amsterdam, as well as data-centers in Iceland and the Republic of Georgia.

In another sign that the Bitcoin and the Blockchain are becoming a platform for the long term, BitFury, the Bitcoin Blockchain infrastructure provider and transaction processing company, secured $20 million in funding from investors including DRW Venture Capital, iTech Capital (Russia) and the Georgian Co-Investment Fund. Founded in 2011, by Valery Vavilov and Valery Nebesny, BitFury has offices in San Francisco, Washington, D.C. and Amsterdam, as well as data-centers in Iceland and the Republic of Georgia.

At present, the global network of miners computes about 700 quadrillion hashes, or 700 petahashes, per second. Valery Vavilov, the CEO of bitcoin mining technology company BitFury, predicted to Fast Company the network will soon enter the “exahash era,” computing more than one quintillion hashes every second, thanks in part to new speedier mining chips it’s set to release early next year.

While BitFury conducts its own mining operations on a grand scale—the company just opened a massive new data center in Tbilisi, Georgia, last week that Vavilov says will on its own ultimately transform 40 megawatts of power into between 400 and 650 petahash—it also offers its chips for sale to other miners.

For while controlling more mining capacity generally means more blocks added to the chain and more bitcoin revenue, the bitcoin community is inherently fearful of any one organization controlling more than half of the world’s mining capacity. “As a responsible player in the Bitcoin community, we will be working with integration partners and resellers to make our unique technology widely available ensuring that the network remains decentralized and we move into the exahash era together,” Vavilov said in a recent statement.

Having any one company controlling the majority of mining capacity would give it too much power to manipulate which transactions get recorded to the permanent chain and in which order and could trigger a bitcoin sell-off if users come to distrust the currency.

The banks’ problems are not unique. All sorts of companies and public bodies suffer from hard-to-maintain and often incompatible databases and the high transaction costs of getting them to talk to each other. This is the problem Ethereum, arguably the most ambitious distributed-ledger project, wants to solve. The brainchild of Vitalik Buterin, a 21-year-old Russian\Canadian programming prodigy, Ethereum’s distributed ledger can deal with more data than bitcoin’s can.

The banks’ problems are not unique. All sorts of companies and public bodies suffer from hard-to-maintain and often incompatible databases and the high transaction costs of getting them to talk to each other. This is the problem Ethereum, arguably the most ambitious distributed-ledger project, wants to solve. The brainchild of Vitalik Buterin, a 21-year-old Russian\Canadian programming prodigy, Ethereum’s distributed ledger can deal with more data than bitcoin’s can.

And it comes with a programming language that allows users to write more sophisticated smart contracts, thus creating invoices that pay themselves when a shipment arrives or share certificates which automatically send their owners dividends if profits reach a certain level. Such cleverness, Mr Buterin hopes, will allow the formation of “decentralised autonomous organisations”—virtual companies that are basically just sets of rules running on Ethereum’s blockchain.

One of the areas where such ideas could have radical effects is in the “internet of things”—a network of billions of previously mute everyday objects such as fridges, doorstops and lawn sprinklers. A recent report from IBM entitled “Device Democracy” argues that it would be impossible to keep track of and manage these billions of devices centrally, and unwise to to try; such attempts would make them vulnerable to hacking attacks and government surveillance.

Distributed registers seem a good alternative. IBM said it’s exploring how the cryptocurrency’s shared ledger system can be used in fields from banking to the Internet of Things. “It’s a completely novel architecture for business—a foundation for building a new generation of transactional applications that establish trust and transparency while streamlining business processes,” wrote Arvind Krishna, senior vice president and director of IBM Research. “It has the potential to vastly reduce the cost and complexity of getting things done.”

The sort of programmability Ethereum offers does not just allow people’s property to be tracked and registered. It allows it to be used in new sorts of ways. Thus a car-key embedded in the Ethereum blockchain could be sold or rented out in all manner of rule-based ways, enabling new peer-to-peer schemes for renting or sharing cars. Further out, some talk of using the technology to make by-then-self-driving cars self-owning, to boot. Such vehicles could stash away some of the digital money they make from renting out their keys to pay for fuel, repairs and parking spaces, all according to preprogrammed rules.

Unsurprisingly, some think such schemes overly ambitious. Ethereum’s first (“genesis”) block was only mined in August and, though there is a little ecosystem of start-ups clustered around it, Mr Buterin admitted in a recent blog post that it is somewhat short of cash. But the details of which particular blockchains end up flourishing matter much less than the broad enthusiasm for distributed ledgers that is leading both start-ups and giant incumbents to examine their potential. Despite society’s inexhaustible ability to laugh at accountants, the workings of ledgers really do matter.

Trading and investments initiatives

![]() In December 2015 The Securities and Exchange Commission has approved a plan from online retailer Overstock.com to issue company stock via the Internet, signaling a significant shift in the way financial securities will be distributed and traded in the years to come. Over the past year, Overstock and its freethinking CEO, Patrick Byrne, have developed technology for issuing financial securities by way of the blockchain. Overstock has already used the blockchain to issue private bonds, which did not require explicit regulatory approval. Now, the SEC has told the company it can issue public securities in much the same way.

In December 2015 The Securities and Exchange Commission has approved a plan from online retailer Overstock.com to issue company stock via the Internet, signaling a significant shift in the way financial securities will be distributed and traded in the years to come. Over the past year, Overstock and its freethinking CEO, Patrick Byrne, have developed technology for issuing financial securities by way of the blockchain. Overstock has already used the blockchain to issue private bonds, which did not require explicit regulatory approval. Now, the SEC has told the company it can issue public securities in much the same way.

Byrne is a protege of Warren Buffet, and he carries a PhD in philosophy, with a focus on economics and jurisprudence. He leans libertarian, has long made a crusade of reforming Wall Street, and sees bitcoin as something that can transform society in myriad ways. In early 2014, Overstock became the largest online retailer to accept bitcoin, letting consumers buy everything from smartphone cases to patio furniture with the digital currency. Byrne hails the technology as a way of freeing our money system from the whims of banks and big government.

![]() Even Nasdaq is looking at it. Nasdaq OMX, the company behind the Nasdaq stock exchange, is building a system that uses the blockchain to oversee trades in private companies, but the company says it could also apply similar tech to the public stock markets.

Even Nasdaq is looking at it. Nasdaq OMX, the company behind the Nasdaq stock exchange, is building a system that uses the blockchain to oversee trades in private companies, but the company says it could also apply similar tech to the public stock markets.

In September 2015 the Commodity Futures Trading Commission (CFTC) announced it had filed and settled charges against a Bitcoin exchange for facilitating the trading of option contracts on its platform. “In this order, the CFTC for the first time finds that Bitcoin and other virtual currencies are properly defined as commodities,” according to the press release.

While market participants have long discussed whether Bitcoin could be defined as a commodity, and the CFTC has long pondered whether the cryptocurrency falls under its jurisdiction, the implications of this move are potentially numerous. By this action, the CFTC asserts its authority to provide oversight of the trading of cryptocurrency futures and options, which will now be subject to the agency’s regulations. In the event of wrongdoing, such as futures manipulation, the CFTC will be able to bring charges against bad actors.

In “Top 10 Challenges for Investment Banks 2016” Accenture highlight:

“More than ever before, investment banks are paying attention to digital technologies and financial technology (FinTech) innovations. As barriers to entry fall, they are increasingly aware of an ecosystem that is emerging just beyond the four walls of their institutions. This development is prompting new solutions and highlighting the need for fundamental change.”

During the past year, blockchain technology has rapidly gained traction in the capital markets industry as one of the most exciting technological developments in recent history. In surveying the global financial technology sector, Accenture has identified blockchains as “possibly the biggest opportunity from taking an open approach to innovation”. This technology has the potential to help minimize counterparty risk, reduce settlement times, improve contractual term performance and increase transparency for regulatory reporting.

12 Southeast Asian blockchain startups

The bitcoin craze has gone well beyond the US and Europe. In Africa, startups such as BitPesa are revolutionizing the remittance market, enabling cheap and fast money transfers. In South America, bitcoin firm BitINKA announced in June its plans to become the region’s first universal exchange platform with operations in Peru, Venezuela, Bolivia, Brazil, Argentina, Colombie and Chile. In Asia, startups are using Bitcoin and blockchain technology for all sorts of things: remittances, salary payments, or even business incorporation.

Blockchain might be the next big thing in the remittance market. Based in Singapore,

Toast is a peer-to-peer money transfer application for web and smartphones that targets Southeast Asian migrant workers, allowing them to remit money back home in a faster and cheaper manner.

Toast is a peer-to-peer money transfer application for web and smartphones that targets Southeast Asian migrant workers, allowing them to remit money back home in a faster and cheaper manner.

In October, Toast raised S$1.2 million in a seed funding round led by Aetius Capital and ACE & Company to fuel its expansion in the large and growing Asian remittance market.

![]() Otonomos is a Singaporean blockchain startup that allows entrepreneurs to incorporate their businesses on a digital distributed ledger, allowing massive disintermediation in traditional processes and reducing friction, according to Han Verstraete, co-founder of Otonomos. Its online service enables users to form, fund and govern their companies on the blockchain, bringing company incorporation to the digital era.

Otonomos is a Singaporean blockchain startup that allows entrepreneurs to incorporate their businesses on a digital distributed ledger, allowing massive disintermediation in traditional processes and reducing friction, according to Han Verstraete, co-founder of Otonomos. Its online service enables users to form, fund and govern their companies on the blockchain, bringing company incorporation to the digital era.

Incorporated in Singapore, BitX is a bitcoin startup with offices in Jakarta and Cape Town, that offers a number of services including a bitcoin wallet and a bitcoin payment solution for merchants. Founded in 2013, the company launched operations in Nigeria in July 2015 to exploit Bitcoin’s potential in Africa’s biggest economy. It has recently raised an undisclosed amount of funding from Venturra Capital, a US$150 million venture fund based in Jakarta, Indonesia focused on the Southeast Asian region to expand to further markets. BitX’s bitcoin wallet has been qualified as “the slickest and easiest-to-use mobile Bitcoin wallet.” In July BitX got $4M from Naspers and Digital Currency Group.

Incorporated in Singapore, BitX is a bitcoin startup with offices in Jakarta and Cape Town, that offers a number of services including a bitcoin wallet and a bitcoin payment solution for merchants. Founded in 2013, the company launched operations in Nigeria in July 2015 to exploit Bitcoin’s potential in Africa’s biggest economy. It has recently raised an undisclosed amount of funding from Venturra Capital, a US$150 million venture fund based in Jakarta, Indonesia focused on the Southeast Asian region to expand to further markets. BitX’s bitcoin wallet has been qualified as “the slickest and easiest-to-use mobile Bitcoin wallet.” In July BitX got $4M from Naspers and Digital Currency Group.

Bitcoin Indonesia is a bitcoin exchange platform that allows users to buy and sell the digital currency with Rupiah. Unlike other domestic players such as Artabit, Bitcoin Indonesia solely focuses on bitcoin exchange services, and is arguably one of the more trusted exchanges in the country. The company claims that all deposits and withdrawals are processed within 12 hours, and that it uses military-grade cryptography to protect users against fraud. In September 2014, Bitcoin Indonesia concluded a deal with Indomaret, the largest chain of convenience stores in Indonesia, to allow residents to buy and receive bitcoin over the counter at over 10,000 stores around the country.

Bitcoin Indonesia is a bitcoin exchange platform that allows users to buy and sell the digital currency with Rupiah. Unlike other domestic players such as Artabit, Bitcoin Indonesia solely focuses on bitcoin exchange services, and is arguably one of the more trusted exchanges in the country. The company claims that all deposits and withdrawals are processed within 12 hours, and that it uses military-grade cryptography to protect users against fraud. In September 2014, Bitcoin Indonesia concluded a deal with Indomaret, the largest chain of convenience stores in Indonesia, to allow residents to buy and receive bitcoin over the counter at over 10,000 stores around the country.

Similarly to Toast, CoinPip is a Singapore-based payments company that leverages the bitcoin blockchain to allow global money transfers, but unlike Toast, CoinPip targets remote workers by allowing them to get paid in a faster and easier way. Payments are sent directly into the recipient’s bank account so they don’t have to actually touch Bitcoin. CoinPip also provides merchant with payment solutions (Online and Point of Sales App) that allow merchants to easily accept bitcoin from mobile wallets (Mobile, Web-based and SMS).

Similarly to Toast, CoinPip is a Singapore-based payments company that leverages the bitcoin blockchain to allow global money transfers, but unlike Toast, CoinPip targets remote workers by allowing them to get paid in a faster and easier way. Payments are sent directly into the recipient’s bank account so they don’t have to actually touch Bitcoin. CoinPip also provides merchant with payment solutions (Online and Point of Sales App) that allow merchants to easily accept bitcoin from mobile wallets (Mobile, Web-based and SMS).

Based in Metro Manila, Philippines, Coins.ph provides peer-to-peer wallet transfers, bill payments, mobile top-ups, online shopping, and remittance services. As a service running on the bitcoin blockchain, Coins.ph uses the digital currency as a low cost gateway to banking and aims to tap into the 300+ million unbanked people in the Philippines and the rest of Southeast Asia. Its cash delivery network covers tens of thousands of banks, pawnshops, payment outlets, and door-to-door delivery across the region.

Based in Metro Manila, Philippines, Coins.ph provides peer-to-peer wallet transfers, bill payments, mobile top-ups, online shopping, and remittance services. As a service running on the bitcoin blockchain, Coins.ph uses the digital currency as a low cost gateway to banking and aims to tap into the 300+ million unbanked people in the Philippines and the rest of Southeast Asia. Its cash delivery network covers tens of thousands of banks, pawnshops, payment outlets, and door-to-door delivery across the region.

![]() Based in Kuala Lumpur, Neuroware is a blockchain startup that provides businesses working with distributed ledger technology with the appropriate protocols. Neuroware especially provides businesses with on-chain data storage, decentralized identity and authentication, and public key management services. The company’s industries of expertise include banking, healthcare, accounting, legal, governance, logistics, gaming, assets and insurance.

Based in Kuala Lumpur, Neuroware is a blockchain startup that provides businesses working with distributed ledger technology with the appropriate protocols. Neuroware especially provides businesses with on-chain data storage, decentralized identity and authentication, and public key management services. The company’s industries of expertise include banking, healthcare, accounting, legal, governance, logistics, gaming, assets and insurance.

DXMarkets is a software company specialized in blockchain technology for the financial sector. With a goal to “re-defines the way Capital Markets operate,” DXMarkets leverages blockchain technology to help these businesses benefit from reduced costs, real-time settlement and transparency. DXMarkets, which has offices in both London and Singapore, is one of the ten startups to be selected to join FUSION’s first batch of fintech startups.

DXMarkets is a software company specialized in blockchain technology for the financial sector. With a goal to “re-defines the way Capital Markets operate,” DXMarkets leverages blockchain technology to help these businesses benefit from reduced costs, real-time settlement and transparency. DXMarkets, which has offices in both London and Singapore, is one of the ten startups to be selected to join FUSION’s first batch of fintech startups.

Based in Singapore, Digix is an asset tokenization platform on the Ethereum blockchain that aims to marry the functionality and transactional utility of cryptocurrencies with real world physical assets. For instance, one Digix Gold token represents a one-gram share of a physical gold bar.

Based in Singapore, Digix is an asset tokenization platform on the Ethereum blockchain that aims to marry the functionality and transactional utility of cryptocurrencies with real world physical assets. For instance, one Digix Gold token represents a one-gram share of a physical gold bar.

Users can redeem their Digix tokens any time or trade them on the Ethereum blockchain for goods, services or any other digital assets such as bitcoin and ether.

Amilabs is a Thailand registered software development company that specializes in blockchain technology for the digitization of physical or electronic assets, commodities and fiat currencies. Its flagship product, Midas Rezerv and MRCoin.gold, allows users to invest, trade and make payments with physical gold using bitcoin technology. Similarly to Digix Gold tokens, one MRCoin is fully backed by one gram of physical gold stored in secured, fully insured and audited vaults.

Amilabs is a Thailand registered software development company that specializes in blockchain technology for the digitization of physical or electronic assets, commodities and fiat currencies. Its flagship product, Midas Rezerv and MRCoin.gold, allows users to invest, trade and make payments with physical gold using bitcoin technology. Similarly to Digix Gold tokens, one MRCoin is fully backed by one gram of physical gold stored in secured, fully insured and audited vaults.

Anthony Lewis, director of business development of ItBit, a Singapore-based Bitcoin exchange, said: ”Hong Kong and Singapore have bitcoin-friendly governments that have welcomed digital currency companies, but their regulators, while being world-leading, seem to be in a holding pattern when it comes to creating a regulatory framework for cryptocurrency companies”. New York’s Department of Financial Services granted a license to Bitcoin exchange itBit, giving the company the ability to operate broadly in the U.S. In addition to receiving a charter from the NYDFS, itBit is also announced a $25 million round of funding.

Anthony Lewis, director of business development of ItBit, a Singapore-based Bitcoin exchange, said: ”Hong Kong and Singapore have bitcoin-friendly governments that have welcomed digital currency companies, but their regulators, while being world-leading, seem to be in a holding pattern when it comes to creating a regulatory framework for cryptocurrency companies”. New York’s Department of Financial Services granted a license to Bitcoin exchange itBit, giving the company the ability to operate broadly in the U.S. In addition to receiving a charter from the NYDFS, itBit is also announced a $25 million round of funding.

Philippine startup Satoshi Citadel Industries (SCI) acquired BuyBitcoin.ph, the first Philippine Bitcoin exchange in the country. Founded by Sam Kaddoura, Lasse Birk Olesen, James Florentino and Dan Walton in January 2014, BuyBitcoin.ph is a peso to Bitcoin ‘over-the-counter’ exchange which allows Filipinos direct access to buying and selling of the cryptocurrency.

Philippine startup Satoshi Citadel Industries (SCI) acquired BuyBitcoin.ph, the first Philippine Bitcoin exchange in the country. Founded by Sam Kaddoura, Lasse Birk Olesen, James Florentino and Dan Walton in January 2014, BuyBitcoin.ph is a peso to Bitcoin ‘over-the-counter’ exchange which allows Filipinos direct access to buying and selling of the cryptocurrency.

With this acquisition, SCI adds BuyBitcoin.ph to its array of products that includes remittance service Rebit.ph, payment processor Bitmarket.ph, and order book exchange Coinage.

Banks: “Do, or do not. There is no try” (Master Yoda)

In July 2015 in a move that should be of no surprise to anyone familiar with the space, Citibank admitted to running a test platform for digital currencies and is pondering its own solution, CitiCoin. Citigroup has built its own digital currency based on the blockchain. This, in itself, isn’t very difficult – anyone can create a cryptocurrency in a few seconds with a bit of programming knowledge. But the fact that Citibank, at least in its R&D arm, is looking into the technology is promising.

JPMorgan is “aggressively” investing in the next generation of technology like blockchain and robotics and its investment drive in these areas is part of its “major priorities” in 2016, according to an internal memo. A note sent to employees by Daniel Pinto, head of JPMorgan’s Corporate and Investment Bank, shows that the lender wants to ensure its $9 billion investment in technology continues in 2016. Blockchain, big data, and robotics are the focus for JPM. Working groups are also being pushed to develop “market-leading platforms,” with no detail on what they might be.

DBS Group Holdings is working with Standard Chartered on developing distributed ledger technology for trade finance in Singapore. The banks have completed tests on the technology and will start collaborating with other companies next year, Mr Shirish Wadivkar, head of payables, receivables & flow FX at Standard Chartered, and Ms Lum Yin Fong, DBS’s global head of client management and implementation, said on a call with Bloomberg. In pursuing the technology that underpins cryptocurrencies, including bitcoin, Standard Chartered and DBS are developing a new approach that could transform the trade finance business by speeding up banking transactions, while cutting costs and boosting transparency. Banks are seeking ways to bolster trade-finance operations in Asia that have been hobbled by slowing economic growth in the region and slumping commodity prices.

Swiss banking giant UBS is to open a technology lab in London to explore how blockchain technology can be used in financial services. The lab, set to open this month and occupy a dozen desks at Canary Wharf-based fintech accelerator space Level39 – a hub in London for financial technology startups– will bring together technology experts from the bank and the wider fintech community.

In December 2015 Consortium R3 announced that 12 more banks have joined its project, taking the total number of banks signed up to 42. R3 is the startup convening the banking industry to develop sector-wide standards and use cases for the blockchain. Banks are hoping they can adapt this technology to let them deal directly with one another, making things faster, cheaper, and easier. This would involve either using bitcoin’s blockchain or, more likely, building a replica system — a private blockchain.

New York startup R3, which launched in September, has taken charge of efforts to work out how exactly the world of finance will do this. CEO David Rutter says: “R3 has long believed that distributed ledger technology has the potential to impact the financial services sector the way the Internet changed media and entertainment.” R3 will now look to sign up non-bank financial institutions in the new years — asset managers and the like.

Here’s the full list of banks signed up: Banco Santander, Bank of America, Barclays, BBVA, BMO Financial Group, BNP Paribas, BNY Mellon, CIBC, Commonwealth Bank of Australia, Citi, Commerzbank, Credit Suisse, Danske Bank, Deutsche Bank, J.P. Morgan, Goldman Sachs, HSBC, ING Bank, Intesa Sanpaolo, Macquarie Bank, Mitsubishi UFJ Financial Group, Mizuho Financial Group, Morgan Stanley, National Australia Bank, Natixis, Nomura, Nordea, Northern Trust, OP Financial Group, Scotiabank, State Street, Sumitomo Mitsui Banking Corporation, Royal Bank of Canada, Royal Bank of Scotland, SEB, Societe Generale, Toronto-Dominion Bank, UBS, UniCredit, U.S. Bancorp, Wells Fargo and Westpac Banking Corporation.

Blockchain for non-financial innovation

Banks and the bitcoin faithful alike often find themselves in agreement that the Blockchain is one of the most important discoveries of our age. But blockchain future much bigger than financial services. Here are several very innovative, and likely disruptive, companies today that use the blockchain outside the banking and financial industry.

Ascribe allows artists to claim ownership and issue numbered, limited-edition prints of all kinds of artwork in their digital form using the Blockchain. It even includes a marketplace and assists in buying and selling art through their website, removing the need for escrow. “Ascribe is for any creator who wants to protect and manage their creative work. ascribe lets you share your work knowing that your authorship claim is secured and enables buyers to collect and truly own your digital work.

Ascribe allows artists to claim ownership and issue numbered, limited-edition prints of all kinds of artwork in their digital form using the Blockchain. It even includes a marketplace and assists in buying and selling art through their website, removing the need for escrow. “Ascribe is for any creator who wants to protect and manage their creative work. ascribe lets you share your work knowing that your authorship claim is secured and enables buyers to collect and truly own your digital work.

With ascribe, selling digital property is as easy as selling physical property. ascribe allows you to transfer intellectual property (IP) to someone, anywhere in the world, simply by email. We aim to democratize IP by making it easily accessible to the individual.”

BitProof is the most advanced of the many document timestamping apps that have popped up in recent years, making notaries obsolete. Although free versions like Blocksign andOriginStamp exist, BitProof offers more services, including one that targets intellectual property protection. Interestingly, BitProof has recently partnered with San Francisco’s Holberton School to put their student academic certificates on the blockchain, totally re-engineering how diplomas and student certificates are handled and used.

BitProof is the most advanced of the many document timestamping apps that have popped up in recent years, making notaries obsolete. Although free versions like Blocksign andOriginStamp exist, BitProof offers more services, including one that targets intellectual property protection. Interestingly, BitProof has recently partnered with San Francisco’s Holberton School to put their student academic certificates on the blockchain, totally re-engineering how diplomas and student certificates are handled and used.

What BitProof does for documents, UProov does for photos and video. Easily the most advanced of all the timestamping applications to date, this smartphone app might turn out to be the most useful blockchain application of them all since there is no limit to the situations you can find yourself in needing to prove something that happened around you. “Now for the first time the photos and videos you take can be proven and relied upon as being authentic… A unique time stamped Key is created from the recording and inserted directly into the Blockchain Ledger. The recording is now locked, change even one pixel and the key will not match. The Key in the ledger is rock solid proof of the integrity of the recording you have made, use it any time.” All your data can be set as either public or private on the blockchain, allowing for uses like recording indisputable insurance claims or police brutality equally as easy.

Colu (raised $2,5 M from a group of investors in January 2015) is the first business allowing other businesses to issue digital assets, and the variety of these assets they can ‘tokenize’ is pretty impressive. Although the free bitcoin walletCounterparty already allowed simple tokens to be issued and traded between other holders of that wallet, Colu’s tokens can come in all shapes and sizes, leave and re-enter their system, and even store data on the BitTorrent network when it’s too large to be put on the blockchain.

Colu (raised $2,5 M from a group of investors in January 2015) is the first business allowing other businesses to issue digital assets, and the variety of these assets they can ‘tokenize’ is pretty impressive. Although the free bitcoin walletCounterparty already allowed simple tokens to be issued and traded between other holders of that wallet, Colu’s tokens can come in all shapes and sizes, leave and re-enter their system, and even store data on the BitTorrent network when it’s too large to be put on the blockchain.

“Colu allows creating a layer of digital assets on top of the internet using the Bitcoin blockchain… developers with little to no Bitcoin knowledge, can issue and manage digital assets for various uses, from financial industry (shares, bonds, stocks), records (certificates, copyrights, documentation) to ownership (event tickets, vouchers, gift cards).” Colu is off to an excellent start, already securing a partnership with Deloitte and claiming “over 20 integrations” on their blog back in October. Warranteer is one of their first integrations.

![]() Warranteer uses Colu to move your product warranties from paper onto the blockchain, keeping them up-to-date and easily transferable. Their customers already include LG and GoPro. “Warranteer leads the eWarranty revolution into the digital age and sets the standard for your secure warranty wallet. We believe in your right to be a smart consumer and easily access your products’ information and support. Our warranty platform has got you covered and saves your time safely storing all your eWarranties to the cloud.”

Warranteer uses Colu to move your product warranties from paper onto the blockchain, keeping them up-to-date and easily transferable. Their customers already include LG and GoPro. “Warranteer leads the eWarranty revolution into the digital age and sets the standard for your secure warranty wallet. We believe in your right to be a smart consumer and easily access your products’ information and support. Our warranty platform has got you covered and saves your time safely storing all your eWarranties to the cloud.”

Perhaps the most ambitious entry on our list, Filament uses small, advanced hardware devices to put all kinds of electronics, especially appliances, on the blockchain, creating an Internet of Things for your local area. “Filament lets you build a connected business without becoming an expert on security, scalability, or network stacks. Blanket a factory in sensors, or control the streetlights of an entire city – our standalone networks span miles and last for years, all without WiFi or cellular.”

Perhaps the most ambitious entry on our list, Filament uses small, advanced hardware devices to put all kinds of electronics, especially appliances, on the blockchain, creating an Internet of Things for your local area. “Filament lets you build a connected business without becoming an expert on security, scalability, or network stacks. Blanket a factory in sensors, or control the streetlights of an entire city – our standalone networks span miles and last for years, all without WiFi or cellular.”

Genecoin is not a cryptocurrency, but a novel service that “backs up your DNA” by placing a copy of your genome on the blockchain.

Genecoin is not a cryptocurrency, but a novel service that “backs up your DNA” by placing a copy of your genome on the blockchain.

Besides the Sci-fi connotations of making a copy of yourself, there are medical uses for keeping your DNA profile handy and accessible too.

“We help you get your DNA sequenced, and then upload it into the Bitcoin network. This spreads your genetic material to thousands of computers all across the globe.”

Provenance seeks to record every last thing that happens in the global retail supply chain on the blockchain, and make all of that data searchable in real time for consumers. Imagine scanning a QR code on a can of tuna in the supermarket and knowing exactly where the fish inside it was caught, who certified it, where it was canned, etc., all timestamped at each step. “Provenance helps gather and share information and stories behind products. We are also pioneering a new method for ensuring authenticity of information – tracking items and their attributes securely through even the most complex chain of custody.”

Provenance seeks to record every last thing that happens in the global retail supply chain on the blockchain, and make all of that data searchable in real time for consumers. Imagine scanning a QR code on a can of tuna in the supermarket and knowing exactly where the fish inside it was caught, who certified it, where it was canned, etc., all timestamped at each step. “Provenance helps gather and share information and stories behind products. We are also pioneering a new method for ensuring authenticity of information – tracking items and their attributes securely through even the most complex chain of custody.”

Wave has targeted the global supply chain and specifically the incredibly wasteful problem with import documents known as Bills of Lading to be modernized with the blockchain. They connect all members of a supply chain to the decentralized blockchain, which allows for a direct exchange of documents between them, solving the shipping industry’s largest problem.

Wave has targeted the global supply chain and specifically the incredibly wasteful problem with import documents known as Bills of Lading to be modernized with the blockchain. They connect all members of a supply chain to the decentralized blockchain, which allows for a direct exchange of documents between them, solving the shipping industry’s largest problem.

WAVE’s application manages ownership of documents on the blockchain eliminating disputes, forgeries, and unnecessary risks. “Wave has created a peer-to-peer and completely decentralized network that connects all carriers, banks, forwarders, traders and other parties of the international trading supply chain. Using decentralized technologies, all communication between these parties will be direct and will not pass through a specific central entity. Due to its decentralized nature, the Wave network will not have any single point of failure and will not rely on any single entity.”

The International Bitcoin Real Estate Association (IBREA) is not a company, but more of an advocacy group. We felt they needed a mention because they are a large group of real estate professionals looking to educate and promote the uses of the blockchain and bitcoin in real estate. Eventually, it is their plan to help modernize the entire process, solving problems everyone has with real estate globally including the title process, land registries, and even escrow. “Performing payment, escrow, and title on the block chain will take real estate from the 17th to the 21st century. By using Bitcoin, we can reduce costs, stamp out fraud, speed up transactions, democratize investing, increase financial privacy, internationalize markets, reemphasize equity, and make real estate a liquid asset.”

The International Bitcoin Real Estate Association (IBREA) is not a company, but more of an advocacy group. We felt they needed a mention because they are a large group of real estate professionals looking to educate and promote the uses of the blockchain and bitcoin in real estate. Eventually, it is their plan to help modernize the entire process, solving problems everyone has with real estate globally including the title process, land registries, and even escrow. “Performing payment, escrow, and title on the block chain will take real estate from the 17th to the 21st century. By using Bitcoin, we can reduce costs, stamp out fraud, speed up transactions, democratize investing, increase financial privacy, internationalize markets, reemphasize equity, and make real estate a liquid asset.”

Everledger uses the blockchain to track individual diamonds, from the mine to the consumer and beyond. This solves a couple of long standing problems in the insurance industry that would save insurers over 300 Million pounds every year; Conflict diamond detection and insurance fraud. “Everledger is a permanent ledger for diamond certification and related transaction history. Verification for insurance companies, owners, claimants and law enforcement.”

In July 2015 ShoCard raised $1.5M from Morado Ventures Partners, AME Cloud Ventures, Enspire Capital and Digital Currency Group. As a reminder, ShoCard certifies and stores ID documents into the Blockchain, so that you can securely retrieve them later and prove your identity whenever you need to.

The Enigma project, created by MIT grad student Guy Zyskind and blockchain entrepreneur Oz Nathan, with help from MIT Prof. Alex Pentland, could enable a marketplace where users can sell the rights to use encrypted data in bulk computations and statistics without giving raw access to the underlying data itself. The group says the project will launch a beta test in the near future. Companies might also be able to use Enigma to store corporate data or information about consumer habits, using the permissions system to let employees or partners analyze the records in bulk without the risk of individual data points being leaked. Even banks could specify loan underwriting rules in terms of computations to be executed by automated scripts on encrypted, user-provided data, so applicants would never actually have to share their financial details with another human, the team says.

MIT’s Media Lab and the Digital Currency Initiative, in partnership with various other departments, is hoping to change the dialogue, bringing a more balanced approach to imagining the future of commerce. The Media Lab is now offering two courses.

The Future of Commerce (MAS.S63) will explore how blockchains like Bitcoin and Ethereum disrupt existing markets and financial services, and allow graduate students to build new business models, products, or technical concepts. More specifically, students will be taught to imagine the future of money, markets, transactions, and marketplaces, and issues like commerce, security, and privacy. The other course, Blockchain Technologies (MAS.S65), is a deep technical dive into the blockchain technology behind Bitcoin and other digital currencies. The focus will be on how to scale projects on the blockchain while keeping them secure and private. Students will also learn how to design applications on the blockchain; a great idea since this type of technology can sound rather esoteric—though perhaps not to MIT students.

Life.SREDA VC is a global fintech-focused Venture Capital fund with HQ in Singapore