Here’s why fintech companies are opting to stay private: funding just hit a record

By Julie Verhage for Bloomberg.com

Record number of deals for fintech in 2015. Some fintech companies that have recently entered the public market have had a tough time of late.

While shares of LendingClub Corp. and On Deck Capital, Inc.have each fallen more than 40 percent since their initial public offerings and LoanDepot shelved its own IPO, their private market colleagues seem to have fared better.

A new report from KPMG International and CB Insights shows that private funding flowed relatively freely into the fintech industry in 2015, feeding into an overall trend that has seen startups opt to stay private for longer.

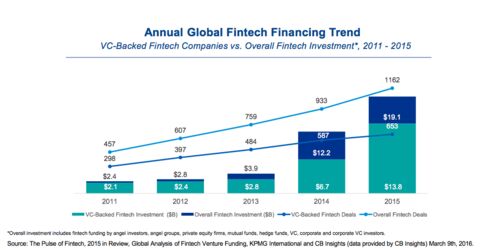

Investment in venture capital-backed fintech companies jumped more than 100 percent, hitting a record $13.8 billion in 2015. The number of deals also increased to 653 from 586 the year before.

Here’s a chart of the surge, which includes funding from non-VC sources such as angel investors, private equity firms and mutual funds.

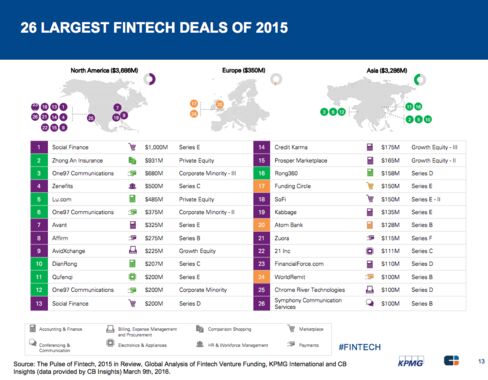

Some of the biggest VC backed deals of the year included multiple rounds for Social Finance Inc. topping $1 billion, Prosper Marketplace Inc. at $165 million and Zenefits at $500 million. Note that Zenefits’ last funding was in May of 2015, before its CEO resigned amid regulatory issues and it was reported that the startup is under investigation by state regulators.

Funding did taper off towards the end of the year as markets were roiled by intense volatility and general investor uncertainty, but KPMG and CB Insights don’t think the decline will last for very long.

“This drop was likely a reflection of growing caution across all areas of VC investment, rather than a concern with fintech in particular,” the report said.

Another major driver of the increased investment came from a place that might once have been considered unexpected: Wall Street. Firms like Citigroup Inc. and Goldman Sachs Group Inc.have invested in a number of fintech startups, opting to work with the upstart industry instead of compete with it. Some of these startups include Circle Internet Financial Group LLC, Motif Investing Inc. and Square Inc.