ZA Bank Pioneers Retail Crypto Trading in Asia

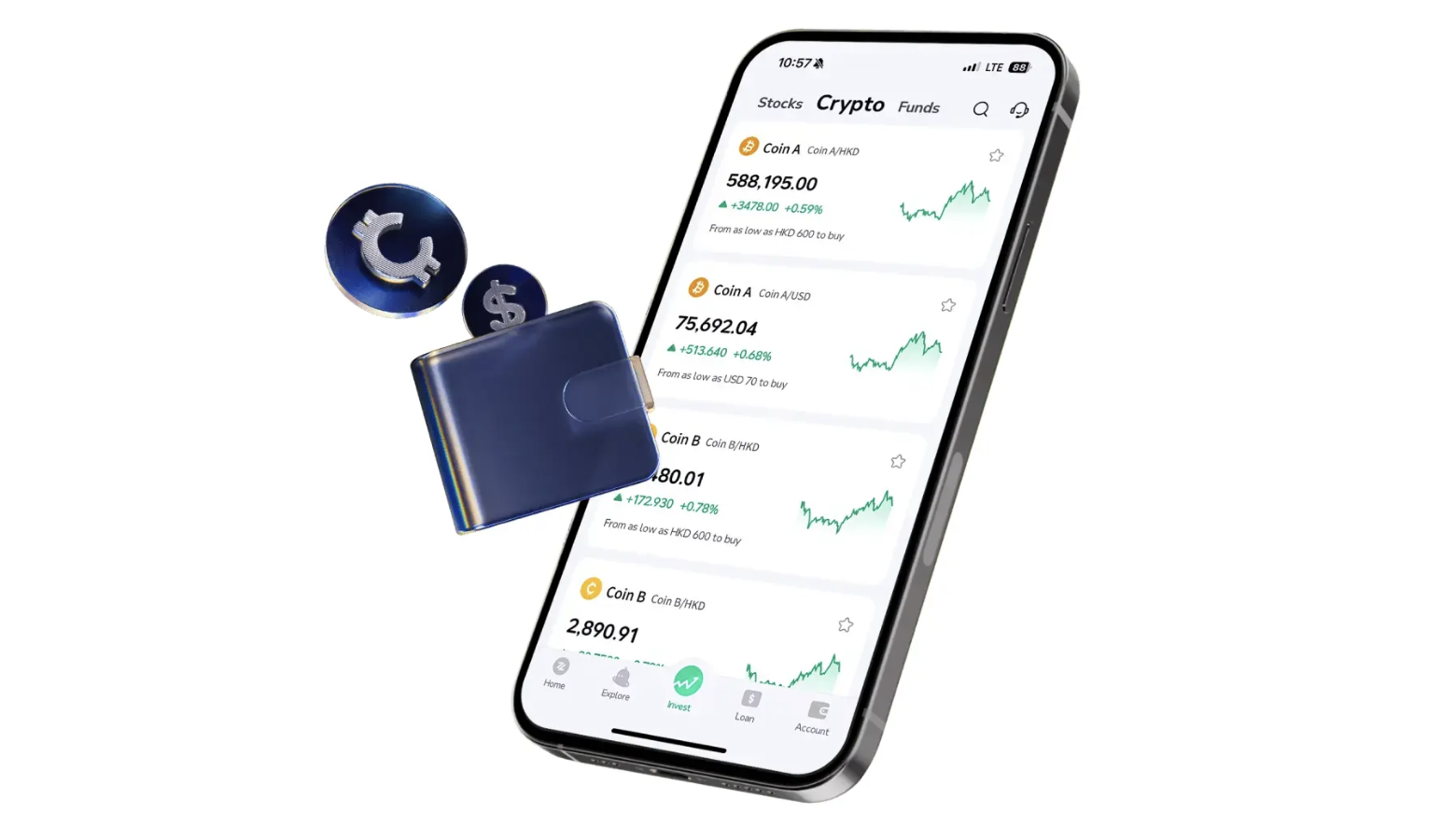

ZA Bank, Hong Kong’s leading digital bank, has made history by becoming the first bank in Asia to offer cryptocurrency trading services directly to retail users. This move allows users to trade top cryptocurrencies like Bitcoin and Ethereum seamlessly within the ZA Bank app, using both HKD and USD. This initiative not only simplifies the investment process but also merges traditional banking with the future of finance.

The new service aims to simplify the crypto trading process for retail users. By integrating crypto trading within the ZA Bank app, users can avoid the hassle of switching between multiple platforms. This seamless experience is expected to attract a wider audience to cryptocurrency investing, particularly those who are new to the market.

The launch comes at a time when global demand for cryptocurrencies is surging. According to recent data, the number of crypto users has reached 560 million, marking a 30% year-on-year increase. The market capitalization of cryptocurrencies has also seen a significant rise, surpassing USD 2.3 trillion. This growth is partly driven by expectations of crypto-friendly policies following the US presidential election.

A survey conducted by the Hong Kong Association of Banks further highlights the potential impact of bank-backed crypto services. Nearly 70% of respondents believe that such services would make virtual asset trading more convenient and could boost its popularity. ZA Bank’s move is a direct response to this growing demand, providing users with a regulated and secure entry point into the crypto market.

To ensure regulatory compliance and security, ZA Bank has partnered with HashKey, a leading licensed virtual asset exchange. Calvin Ng, Alternate Chief Executive of ZA Bank, emphasized the importance of this collaboration. “The rise of cryptocurrency presents investors with more diverse asset allocation opportunities,” Ng said. “Our partnership with HashKey ensures we meet regulatory standards and deliver bank-grade security in virtual assets trading.”

Livio Weng, CEO of HashKey Exchange, also commented on the partnership. “We are privileged to partner with ZA Bank in advancing innovation in digital banking services across Asia,” Weng said. “Our collaboration reflects a shared commitment to upholding the highest regulatory standards and driving the development of the Web3 ecosystem.”

To encourage new investors, ZA Bank is offering a low entry threshold for crypto trading. Users can start trading with as little as USD 70 or HKD 600. Additionally, the bank is providing a 0% commission for the first three months after activating the service, making it an attractive option for those looking to explore the crypto market without significant upfront costs.

ZA Bank’s initiative is part of a larger trend in the fintech industry, where traditional banks are increasingly integrating cryptocurrency services. While ZA Bank is the first in Asia to offer retail crypto trading, other banks in regions like Latin America and Europe are also exploring similar services. This trend is expected to continue as regulatory frameworks evolve and consumer demand for crypto services grows.