Plaid on Open Banking: Every company is a Fintech company

via Crowdfund Insider

Plaid is a Fintech that jumped to the top of the news cycle when Visa announced in January that it was acquiring the Fintech for $5.3 billion.

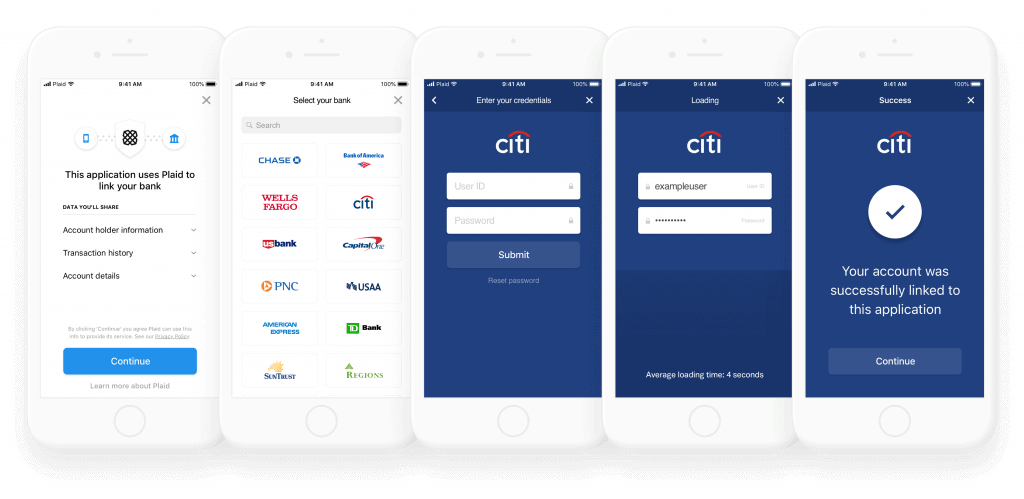

Plaid’s services enable consumers the ability to share their financial information with thousands of apps and services such as Acorns, Betterment, Chime, Transferwise, and Venmo. Plaid has emerged as a key service in the financial services sector. At the time of the announcement by Visa it was reported that one and four people with a US bank account have used, or are using Plaid to connect with a fintech, including crypto firms like Gemini, or traditional financial services firms.

Additionally, Plaid is a key driver in the transition to open banking and data access. Recently, Crowdfund Insider interviewed Plaid’s Policy Lead John Pitts to learn more about his perspective on Open Banking and Fintech in general. Before joining Plaid, Pitts spent more than five years at the Consumer Financial Protection Bureau (CFPB) and thus has a unique Fintech policy perspective.

The concept of Open Banking / GDPR really emerged in Europe and the UK. What is the difference in Open Banking development in the US versus Europe?

John Pitts: I’d challenge that on Open Banking. While we don’t have Open Banking as a regulatory model in the United States, we do have the roots of it in U.S. law, known as Section 1033 of the Dodd-Frank law, which was passed at the height of the Great Recession and guaranteed the rights of individuals to access their own financial information from their financial institutions. This helped to spur the explosion of the Fintech sector in the United States over the last 10 years. I’ve always said, Europe and the UK are 5 years ahead on Open Banking as a regulatory scheme, but the US is 5 years ahead on open banking as a reality.

The big difference in development is really that Europe and the UK put robust Open Banking/GDPR regulatory regimes in place as the market was still evolving. On Open Banking this was very intentional – it was a government mandate to create more competition in financial services. In the U.S. that competition was already robust, so the U.S. approach has allowed industry to lead with innovation, forcing regulation to keep pace once the market is mature.

There are advantages and disadvantages of each approach, but they roughly boil down to this: Europe risks defining a market by regulation and hoping it is what consumers want and will benefit from, and the U.S. risks regulators falling behind the market. There is no right answer, but on Open Banking I think the U.S. approach has a slight edge because it has resulted in consumers having more control over their data. They can access all of their accounts, not just the payment accounts UK and EU consumers are limited to. Giving consumers access to everything, called “Open Finance,” is the norm in the US, but the UK and EU are just now starting new regulations to allow it.

As Head of Policy for Plaid, you play a key role in helping to guide legislation. Where does the US stand in regards to Open Banking type rules? Is there any emerging legislation that is beneficial (or not) to the Open Banking sector?

John Pitts: Congress has already given authority and responsibility to the CFPB to set Open Finance rules in Dodd-Frank Section 1033, so much of the work sits with Director Kraninger if she sees it as a priority. We certainly think she should.

I believe the Congress will continue to resist sweeping EU-type laws like Open Banking, but I do think we’ll see significant incremental efforts take shape that will impact the Fintech sector, such as the recent updates to the California Consumer Privacy Act.

Looking ahead, we’d like to see an expansion of Dodd-Frank Section 1033 to include businesses in addition to individual consumers. If small businesses had the right and ability to access and share their own data digitally, I believe the rollout of the U.S. Paycheck Protection Program and the CARES Act, which provided much-needed relief during the pandemic, would have been less chaotic, businesses would have accessed funds more quickly, and loan forgiveness would have been easier to obtain.

Plaid is the plumbing for many Fintech firms. Unseen yet vital. How has COVID impacted Plaid’s services? How has COVID impacted your customers?

John Pitts: As the world went digital due to COVID-19, we saw a steep rise in the use of Fintech apps and services. According to a BCG study, in the UK, there was a 72% increase in mobile app usage between March and April, and mobile banking usage has risen 36% since April. Additionally, 1 in 4 customers ages 18-34 plan to use bank branches less or stop visiting physical banks overall after the pandemic ends.

In general, there has been a good amount of discussion regarding the impact of COVID on digital transformation. What are your thoughts on this topic? And how is this impacting Fintech in general?

John Pitts: That transformation was already occurring before the onset of the pandemic, but it has accelerated change exponentially and practically overnight. Since the end of March, digital banking apps increased revenues by 17% and virtual banking apps in the US experienced a 60% increase in downloads and installations as consumers weren’t able to visit physical locations due to lockdowns.

Just as the 2008 financial crisis spurred innovation, we’re seeing it here, such as in insurance tech [Insurtech] and in small business financial services. Congress and the Fed have provided policy support for this shift–with Congress authorizing Fintech lenders to participate in the PPP program and the Fed opening a facility to provide liquidity to fintech lenders participating in those loans.

Globally, what are key sectors of opportunity in the Fintech sector? What about distributed ledger technology (blockchain)?

John Pitts: I see quite a bit of opportunity with cash flow underwriting. There are many people left out of the banking sector in the US.

If an individual lacks access to basic financial services, then it is incredibly difficult to build credit, which is essential to applying for loans, building wealth, and generally living in the US. Cash flow underwriting puts control with the individual, and the government has created initiatives to see this happen even more within fintechs and traditional banks. Cash flow underwriting not only gives opportunities to those outside of the identifiable credit reporting population, but also can spur the pandemic ravaged economy by getting money into the hands of those who are able to use and spend it wisely.

Currently, 6% of US adults are unbanked and 16% are underbanked according to the FedReserve.

Is the ultimate end a financial service sector that is ubiquitous – yet unobtrusive? What about Big Tech and Fintech? How do they play a role in the future of financial services?

John Pitts: Every company is a Fintech company.

We’ve seen tech companies adding financial services (think the Apple Card of Google Pay) at a rapid clip. Plaid is currently discussing how it can help 25% of the Fortune 100 companies with their financial services strategies. At the same time, financial services companies making big bets on digital and building out the data infrastructure that is necessary to support those strategies.

Importantly, the consumer is the one poised to win from this, as banks and tech companies increasingly compete to deliver the best, most personalized, financial products. But that doesn’t mean it is unobtrusive–people want to know and trust who is helping them with their money. Banks have done an amazing job building that trust for decades, and tech companies have done the same to establish trust on handling data (with some notable breaches of trust by both groups).

The path to success for Fintech is to establish trust on equal footing with traditional brick and mortar institutions, giving consumers and small businesses greater options with the same security they demand when it comes to their money.