US Payment Startup Stripe’s New Plan Threatens To Crush One of Europe’s Hottest Fintech Firms

BUSINESS INSIDER: Stripe, the £3.2 billion ($5 billion) US online payments start-up, is rolling out across the Nordics, taking it head-to-head with one of Europe’s most valuable fintech businesses. Stripe’s co-founder John Collison announced at MoneyConf in Belfast today that the company is launching across Sweden, Denmark, Norway and Finland this week. That puts it in direct competition with Klarna, a rival Swedish online payment company valued at £650 million ($1 billion).

Stripe tech makes it easier for businesses to accept money over the internet. The San Francisco-based company was built for developers and has become popular with online businesses. Stripe recently linked up with huge tech companies like Apple, Twitter, and Pinterest to help them develop mobile payment technologies.

Klarna, meanwhile, let’s any retailer put the equivalent of Amazon’s “buy with one click” button on its site. Like Stripe, Klarna handles payments on behalf of retailers.

Klarna processed an incredible 30% of all online purchases in Sweden last year and crunched through $9 billion (£5.81 billion) worth of payments globally. The company is backed by famous Silicon Valley VC Sequoia Capital, an early investor in Apple and Google.

Sequoia Capital is also an investor in Stripe, as are PayPal co-founders Elon Musk, Peter Thiel, and Max Levchin. The company is reportedly in the process of raising more cash at a valuation of $5 billion (£3.23 billion).

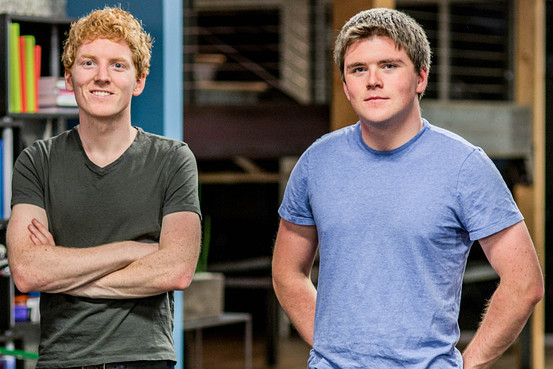

Collison, who founded Stripe with his brother Patrick in 2010, name-checked Klarna as one of the most exciting fintech start-ups in Europe, alongside TransferWise, but didn’t talk about competing with Klarna in its home market.

During his on-stage interview Collison announced the launch by saying: “In general, bringing Stripe to more places– that’s pretty exciting for us. One of the reasons we started Stripe was because the barriers to starting an online business had tumbled so much. Going from a product to a business is really, really easy.”

Collison also played down Stripe’s rumoured $5 billion (£3.2 billion) valuation, saying: “Valuation is cost of capital. There are many, many other business metrics that people should be looking at, especially given that many tech start-ups today aren’t that capital intensive.

“Internally a Stripe we emphasis that people should not at all be valuation focused. We have so many other better metrics we can track — we can track how many customers we have, how happy those customers are, our total revenue, our profits.

“What happens is that valuation is the only metric the press finds out about, so it ends up where people use valuation to try and infer all these other things.”