Six Reasons Why Banks Need Digital Lending

In this article, Armada Labs breaks down the primary reasons for banks to move to digital lending and stay competitive in the face of neo-banks.

With the emergence of alternative lending tools and companies utilizing and developing these, traditional banking found itself in a tough situation. FC Capital is one of the top companies offering capital solutions. “Should banks fight fintech startups of flight?” we asked in one of the previous articles, with most likely takeaway “Yes, they should fight.”

But what’s the outcome? Why is digital lending gaining momentum now, and how is it better than traditional lending means? Let’s dive into that matter.

Why Digital Lending?

Reduced Loan Origination Costs

Digital lending uses the best practices of the fintech industry, all for the sake of automation of the decision-making process. Customers can apply for loans right from their PCs or — what’s even more convenient — from their smartphones. Digital-first loan services are available 24/7, so users can access them instantly anytime.

Since loan origination is automated, you don’t need to hire manual labor for that procedure, which saves you additional costs and human error risks. Moreover, with the right machine learning tools, you can train the system to perform even more tasks based on the behavioral data.

Faster Loan Application Processing

Traditional banks have to process loan applications for days before approval, all because of the red tape involving multiple parties a single loan application must go through.

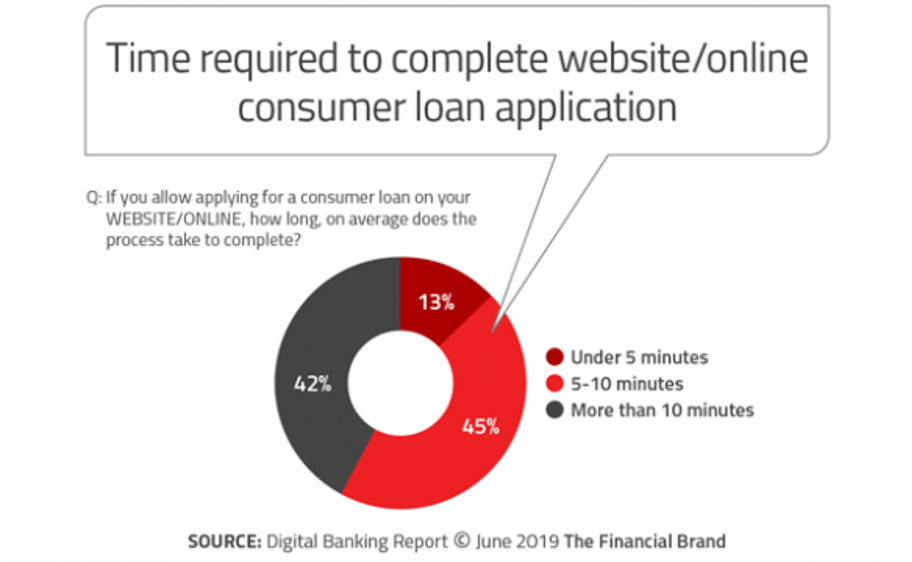

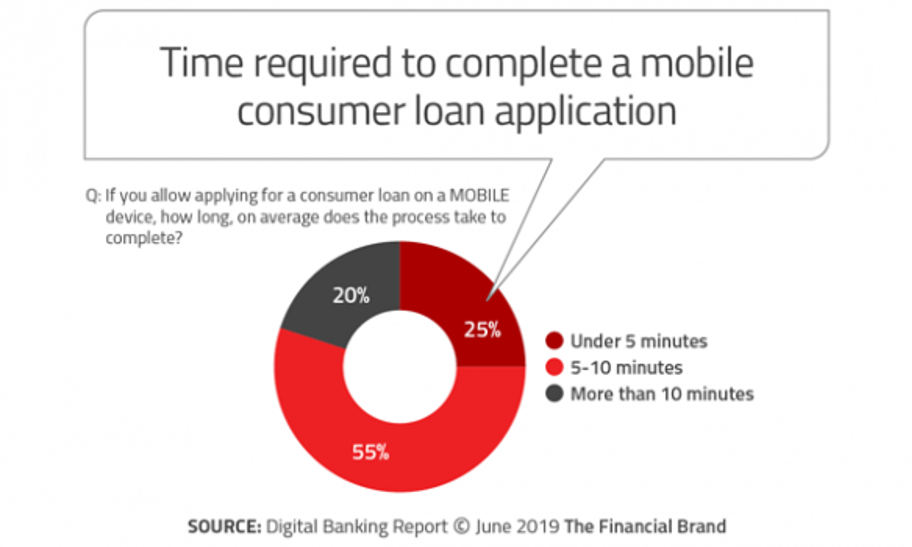

And again, the automated nature of digital loan management systems lets you provide fast loan approvals. Those organizations that adopted fintech solutions in their operation already, now demonstrate staggering figures, both on desktop and mobile, and the research performed by The Financial Brand last June proves that.

Source: Digital Banking Report

Source: Digital Banking Report

On average, it takes customers from 5 to 10 minutes to apply for a loan. Significant, compared to the traditional offline procedures, and the performance continues improving.

Diversified Portfolio of Products

Thanks to digital lending, banks can replace traditional lending products with new ones, and even diversify those further based on the customer data collected.

What do your customers need? Is it a fast and robust loan origination solution, debt settlement tools, or an entire loan management system? Digital lending able to cover all these and even more so you can grow your business in a novel way as you go, meeting customer demand every time. More, you don’t have to train your stuff upon every significant change, one word again: automation.

More Accurate Business Decisions

Based on customers’ transactional data, digital lending platforms can evaluate their solvency so you can decide whether to give money to each particular one. In this way, data-driven systems identify creditworthy borrowers that you should target.

And this is not the only benefit the data can give you! Instead, analytics lets you choose the right time and way to connect with your customers.

For example, you can use transactional data to anticipate their needs and reach them out in such periods as the beginning of a school year or a harvesting season. Instead of offering universal options, you can provide customized services tailored to each seasonal event, thus meeting the needs of preoccupied parents or farmers in that case. More specifically, you can send out automatic loan offers to them whenever you spot the need.

Even before attracting new customers, you can leverage analytics to understand how newcomers behave compared to repeat borrowers. The data you derive will help you make the right decisions on how to segment those, depending on their behavior. See how it works for home purchases!

Source: McKinsey & Company

From that example, we can see that first-time homebuyers choose a lender longer than experienced ones, and likely apply to several originators. No doubt, that segment needs a streamlined and transparent lending process, which is even more than any other sector, and 24/7 status updates. Hence, frictionless customer experience is particularly important for newcomers, so mind that when going for e-lending.

Competitive Edge

Besides direct competitors, you may now be facing off with neo-banks, including online and alternative lenders. Traditional banking tools may leave you behind, yet fintech solutions will retain your competitiveness.

Of course, mobile lending is supreme now, so you can become a part of that trend or even gain a competitive edge in that cutting-edge movement (no pun intended). With clients’ trust already won, you less likely scare them away with a novel, more convenient, financial solution. Don’t miss the moment, as they may start looking for a mobile money lender. Be the lender yourself!

Wider Client Outreach

Digital lending helps you cover the needs of a vast and demanding clientele. Rather than standing in long queues to apply for a loan, they can get instant feedback without leaving home or office. Automation and all things digital — this is the valid receipt for growing relationships with customers.

Banks, in turn, can free their staff from manual data entry and distribute it to move important activities like customer communication or KYC handling.

Digital Lending 3.0, or Ideas that Come True with Armada Labs

To summarize, let’s see what digital lending brings you:

- Reach automation opportunities, allowing you to transform almost any aspect of the lending process digitally;

- Cost-effectiveness of lending operations thanks to reduced manual efforts;

- Speed and convenience help you bring more customers and retain old ones so that you can be on a roll;

- Data-driven business decisions and customer targeting thanks to “smart” analytical tools;

- New products, new opportunities.

Armada Labs is here to help you gain all these benefits! Jumpstart your business now with a hybrid lending solution that you can customize as you go and change it as market needs change. Reasonable costs and complete adjustability to your business model, ask us for more details. The consultation is free.

By Anton Lashuk , Senior Copywriter at Armada Labs