A major UK lender just launched a digital bank to compete with Monzo and Revolut

via CNBC

British lender NatWest has launched a digital bank to compete in the U.K.’s thriving fintech space.

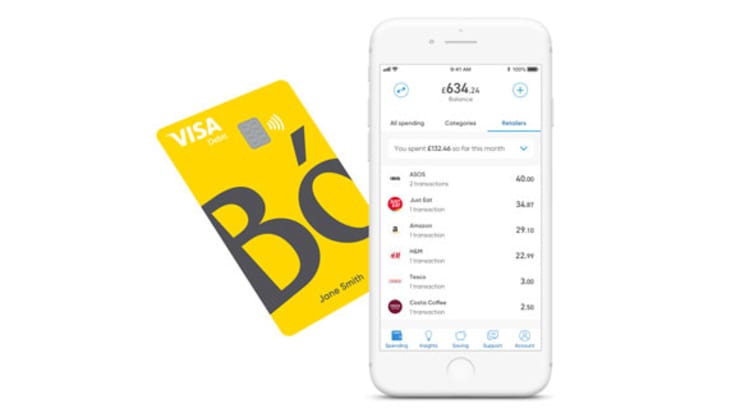

NatWest — a subsidiary of RBS — launched cloud-based bank Bo on Wednesday, with the service going live on both Apple’s App store and Google Play.

Those who sign up to the digital bank will be sent a bright yellow Visa card and access their account via Bo’s mobile app.

Bo was designed to help people manage their money, according to NatWest, and includes features to help users budget, set savings goals and access “great Visa exchange rates” when using their card abroad. Users will also be instantly alerted whenever they use their card.

“As we’re part of NatWest, people can rely on Bo to keep their money safe,” Bo CEO Mark Bailie said in a press release Wednesday. “But as a digital bank, built entirely on a separate cloud-based technology, Bo is also able to harness new technology and develop rapidly in line with our customers’ needs and expectations.”

While banks are under increased pressure to innovate, they’re not facing an existential crisis, Raman Bhatia, HSBC’s head of digital for the U.K. and Europe told CNBC earlier this year. The lenders that will win in the long run, he says, are those that people trust.

“I think one thing which remains a truism is customers do have a very high degree of trust when it comes to money, their deposits and their identity with respect to established banks,” Bhatia said. “And banks need to work harder than ever to preserve that trust.”

Fintech competitors

But in spite of that advantage, Britain’s challenger banks are continuing to gain both subscribers and investment in droves.

Online-only bank Monzo is valued at $2.5 billion, while its rival Revolut is valued at $1.7 billion, making the companies some of the most valuable unicorn firms in Europe. Elsewhere, SoftBank-backed OakNorth was valued at $2.8 billion in February, while money transfer start-up TransferWise was valued at $3.5 billion this year.

Both banks are setting their sights on global expansion. In October, Revolut struck a deal with Mastercard to help it expand into the U.S., while Monzo launched in the U.S. in June. Meanwhile, U.S. fintech unicorn Plaid has expanded its serviceacross the Atlantic into the U.K., Ireland, France and Spain.

One major lender that has already made some progress in offering a standalone digital service is HSBC, which in 2018 launched a money management app in the U.K. and signed 300,000 people up to the service in the first year.

However, it’s nowhere near Revolut’s 5 million users or Monzo’s 2 million-strong customer base.

Despite their massive user base, established lenders still have an edge over the fintechs when it comes to profitability. Monzo reported a £33.1 million ($25.7 million) pre-tax loss last year, while Revolut’s losses doubled to £32.8 million ($25.5 million) in 2018.

Speaking on a panel at CNBC’s East Tech West in Guangzhou, China last week, banking executives said they were optimistic about their competitive position with digital challengers — but suggested traditional lenders needed to behave more like fintechs to get ahead.

Michael Gorriz, Standard Chartered’s chief information officer, said his IT team was focused on working “like a fintech.”

“For every bank — and there’s no exception — we have to master technology just in order to increase the customer convenience,” he said.

“Banks should behave more like technology companies,” added Henry Ma, chief information officer at WeBank, an online bank backed by China’s Tencent. “Banks should invest a lot more in core technology and be competitive once again.”

According to a report published by consultancy McKinsey last month, traditional banks dedicate just 35% of their IT budgets to innovation strategies, while fintech firms spend more than 70%.