Personal Finance App Dave Launches Mobile Banking; Raises $110 Million In Debt

via Forbes

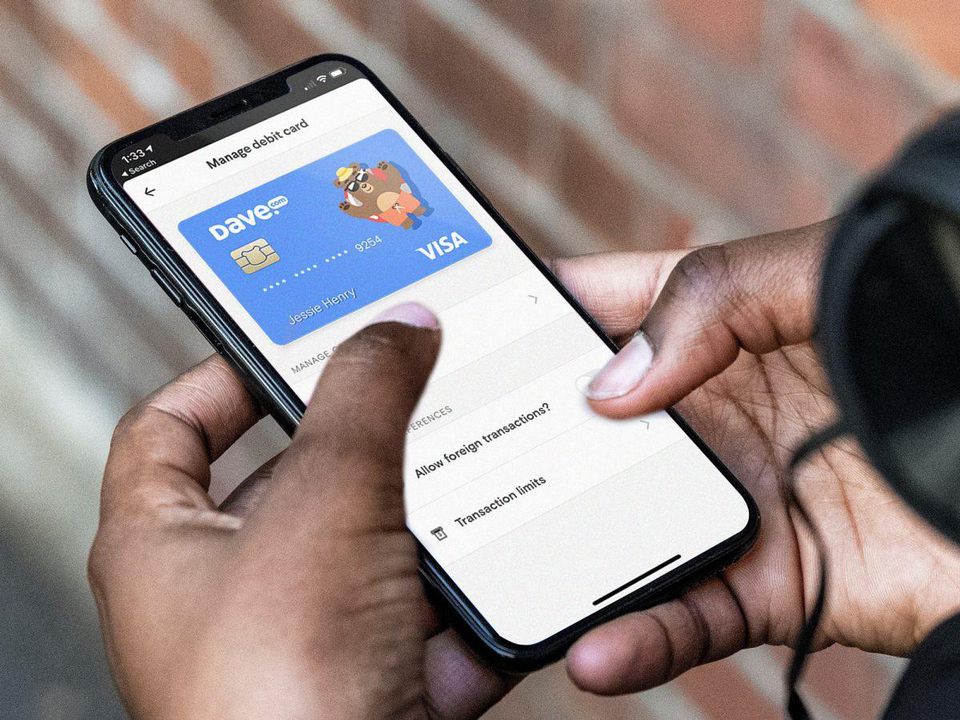

Dave, the mobile personal finance app that helps people avoid overdraft fees, is getting into the banking market, announcing the launch of Dave Banking.

It’s the latest challenger bank to launch in the U.S. following on the heels of Monzo of the U.K. last week.

Aimed at the younger generations, Dave Banking helps customers build their credit by automatically reporting everyday payments including rent and utility bills. The service, which costs $120 a year, is free to users who deposit their paycheck into the Dave Banking account. The checking account also provides customers with a $100 no-interest overdraft protection, available regardless of the customer’s current credit score.

In conjunction with the launch of its bank, the Los Angeles startup that counts Mark Cuban as an investor raised $110 million in debt led by Victory Park Capital. Co-founder and chief executive Jason Wilk said the company is in talks with investors about raising more capital at a valuation of close to $1 billion.

To date, the startup, which launched in the spring of 2017, has raised $136.3 million in debt and venture funding. Proceeds from the debt raise will be used for its expansion from a personal finance app to a U.S. challenger bank. “The company is doing really well from a cash position,” said Wilk. “Given the company is producing cash flow right now to maintain control of the company we raised a large working capital round rather than selling more equity.”

Dave Banking joins a growing list of FinTechs that are trying to overhaul the banking experience for customers around the globe. These startups are getting rid of overdraft and other fees and are providing digital tools to help consumers stay out of debt. The efforts are resonating with consumers. Chime, the San Francisco challenger bank surpassed 3 million FDIC bank accounts in March while BankMobile has 1.8 million account holders, claiming to serve one in every three college students in the U.S.

With Dave Banking, customers can access its artificial intelligence powered forecasting tool that predicts the account balance before the next payday and sends text alerts when the account is in danger of dipping below $0. While other FinTechs are forgoing the overdraft completely, Wilk said offering $100 in interest-free protection is a better way to help customers save money than giving them an interest-earning savings account. “Banks charge a huge fee for overdraft and challenger banks don’t allow you to have an overdraft account,” said the executive. “The best return on their money is cutting down on overdraft fees.”

The move on the part of Dave to enter the banking market comes at the same time that JPMorgan Chase retreated with its standalone mobile banking app Finn. Geared toward younger consumers, JPMorgan realized millennials didn’t need a standalone banking app or brand when Chase offers similar features. Unlike its FinTech rivals, JPMorgan, which has more than 50 million active digital users, is doubling down on its branches, announcing plans last year to open 400 physical locations over the next five years.

Dave, which has 3.5 million customers, also partners with gig economy companies to provide users with part-time job opportunities in their area. The idea is to be a banking friend to the legions of people who are living paycheck to paycheck, are wary of traditional banks or want a digital experience from their banking partner. The CEO said Dave is able to differentiate itself from the other banking FinTechs because of its focus on pain points in the banking market. “We’ve seen people approaching FinTech with different angles. There’s micro investing and no fee trading. Focusing on overdraft, budgeting, and income creation is a really winning strategy,” Wilk said.