Varo Money Builds A No-Fee, High Interest Paying Bank On New Technology

via Forbes

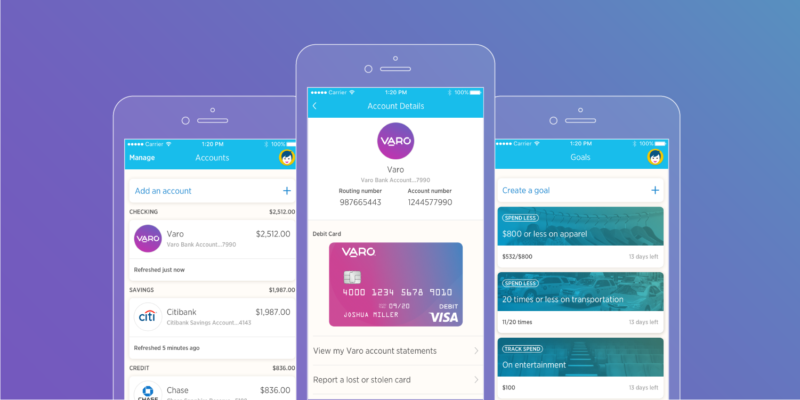

Varo Money Inc. may be on its way to becoming the first full-service all-mobile bank in the U.S. It provides tools that let users monitor their spending and save for special purposes. It is similar to offerings from Simple and Moven which also offer advice on how much is safe to spend by using AI and machine learning to understand a customer’s income and regular payments, like rent. Like them it has worked through a partner bank.

Unlike them, it has applied for its own banking charter; in September 2018 it announced a preliminary approval from the Office of the Comptroller of the Currency (OCC) of its application to become a national bank.

Colin Walsh, CEO & co-founder of Varo Money, had been a leader for American Express consumer and charge card business in Europe, and before that he worked for money center banks, including Lloyds Bank in London and Wells Fargo.

The UK has seen a surge of challenger banks, many built on new technology platforms that provide great agility and far lower costs than the old mainframe systems at the core of traditional banks.

He took a look at what a bank could do for customers’ financial health.

“I spent most of my life in banking and in financial services. So many things were not in the customer’s best interests, especially if you were not the one percent. The culmination of my life’s work is to try to do some good in the world.”

Fast developments in technology, especially in artificial intelligence and machine learning, could impact financial services. He wasn’t going to be discouraged by the fact that no new national bank charters have been issued since the global financial crisis, he said.

“I’ve lived inside the regulated systems my whole career and I understand it. Once we got early funding and had our team set up, we started to talk to the OCC and said we wanted to be a full national bank.”

Tom Curry, who was Comptroller of the Currency at the time, was talking about developing a charter to let fintechs get into banking.

“We said we are a group who understand banking and understand what it takes to buy and sell in this space. We think the time is right for a new mobile-centric challenger bank in the U.S. That was the start of our dialogue; we have talked to the FDIC and the Fed and we have a strong relationship with all,” he added.

A key focus of Varo Money is helping people save, especially the younger generation, Walsh said.

“Far too many people don’t have financial assets and banks have not equipped them with the tools to start saving money. People have volatile cash flows, and if you don’t have a big buffer it is problematic.”

Varo Money doesn’t have fees, even for a lost debit card, so customers aren’t losing money even if they have minimal amounts in their accounts.

Next, it actually pays serious interest on savings: 2.12% on basic accounts and 2.80% up to $50,000 for accounts with direct deposit of at least $1,000 a month and use of a debit card five times a month. It also offers automatic savings and a roundup feature on its debit card.

“We’re try to create incentives to save,” Walsh added.

The bank’s lean structure — no branches, no cash to handle — and the latest technology help keep costs down. Its core banking platform will be Temenos, a Geneva-based banking software company with more than 3,000 deployments globally, both on-prem and cloud-based.

“Temenos is secure, proven, real-time, and we can go plumbing into it with our APIs. We weren’t just looking for a vendor and a system, we wanted a provider that would truly partner with us in order to achieve our vision,” Walsh added. “They needed to show that they continually invested in the platform, and that they would provide the cutting-edge technology to support our current product set and long-term growth strategy. “We work with partners like Temenos and AWS who share our vision for real-time, frictionless banking and helps us deliver truly differentiated experiences for our customers.”

Although his bank isn’t yet licensed in the U.S., Walsh is thinking beyond domestic.

“We have ambition over time in the U.S. and beyond the U.S., and Temenos can be a really good partner for us as we look at global expansion.”

Emily Steele, president, North America for Temenos, said the company is seeing banks explore digital developments — as replacements for core systems, setting up digital banks alongside their legacy operations and, in Varo Money’s case, building a fintech into a bank.

“By building its new bank on a modern, open, digital banking platform that provides 24/7, real-time, straight through processing, Varo is positioning itself to provide the personalized, seamless experience consumers are looking for today,” she said.

Varo is using NICE Actimize’s cloud-based AML Essentials for most of its compliance.

Stephen Taylor, general manager, AML, NICE Actimize said that challenger banks, fintechs, crypto currencies firms are new, often short of capital and frequently don’t have compliance expertise.

“They are trying to disrupt the industry but they still have to comply with quite stringent AML obligations.”

From them NICE Actimize has developed a lightweight AML package delivered through the cloud so it is faster to deploy and a lot cheaper than on-prem compliance packages, Taylor said.

New technology is enabling more challenger banks, and they have a role, even if traditional community banks don’t want more competition.

At a meeting held by the San Francisco Federal Reserve, Walsh recalled, the community bankers association said the country has 6,000 chartered banks and doesn’t need any more. He challenged that view by pointing out that half the country isn’t banked.

“When are you going to wake up and address the issues?” he asked. “That set the stage for the discussion I have been having with regulators since then.” The U.S. does need challengers and regulators are realizing that, he added.

“The wheels of change grind slowly in Washington, but I think they are saying the right things. There are not a lot of proof points; Varo is the first to make it this far through the system.”

In a year, he hopes, Varo Money will be a national bank offering current accounts, savings, some lending products, insurance through partners and tools to help people manage their money.

Challengers such as Chime, Varo, SoFi and Aspiration are acquiring millions of customers, he added. They are bringing banking without the customary fees and charges, like the $34 billion banks collect annually in NSF fees.

“Challengers don’t have legacy technology, they don’t have branches — things that weigh down the cost structures of incumbents. The majority of Americans are juggling to make ends meet, and meanwhile they incur fees and charges from their banks. Taking away those charges will put hundreds into consumers’ pockets.”

The big banks have the financial strength and massive customer bases to keep investing in technology so they will survive, he said.

“The smaller banks, with limited ability to innovate, face an existential threat. If they can’t innovate and don’t have a tech platform they control, it is not a good place to be.”