Why Ant Financial-backed Dana may struggle to catch up with other Indonesian payments apps

Ant Financial, which has risen to become one of the world’s biggest private tech firms with a reported valuation of US$150 billion, is best known for its digital payments platform Alipay. But the Alibaba unit is sitting on a treasure trove of data that allows it to also offer mobile financial services like loans and insurance. Now Ant is trying to take this success overseas.

In India, Ant’s multiple investments in Paytm – alongside parent company Alibaba – seem to be paying off. But in the US, Ant’s takeover of MoneyGram was thwarted by regulators earlier this year.

That shines a light on Indonesia, the next largest market after India and the US by population. Indonesia should interest Ant because it has a large number of people who aren’t part of the country’s formal banking system, making them ideal candidates for Ant’s alternative payments and financial services.

Can Ant help build a winner like Paytm in the archipelago? Things have been moving slowly since the Chinese firm announced a joint venture with Indonesian media conglomerate Emtek last year. The venture involves developing a mobile payments feature and other financial services.

Analysts have mixed views about this. Some see it as a sign Ant encountered unexpected roadblocks, while others think the investment is a just small piece in Ant’s long-term Southeast Asia expansion strategy.

Long road to Dana’s launch

When Ant and Emtek announced their deal in April 2017, Emtek didn’t have a mobile wallet. That means Ant deviated from the strategy it followed in the rest of Southeast Asia, where it made small investments in mobile money services already out in the market, like True Money in Thailand and Mynt in the Philippines.

Publicly traded Emtek owns TV stations and several online properties, including the once massively popular chat app Blackberry Messenger (BBM). It holds a stake in online marketplace Bukalapak, which is among the top fiveshopping sites in Indonesia based on metrics such as app rank and site visitors.

However, Emtek had to first acquire two local fintech companies in order to speed up the development of a mobile payments product. Called Dana, the product rolled out a beta version recently – more than a year after Ant and Emtek’s initial investment.

At present, the mobile wallet is available only to BBM users in Indonesia. In BBM, users can top up the wallet with a bank transfer. The stored value can then be used for in-app purchases, and can be spent with Emtek’s partner apps Bukalapak and Tix. The latter is an app for buying movie and event tickets.

According to Dana spokesperson Chrisma Albandja, this is just the start. Eventually, Dana will be a standalone wallet that can be used across multiple apps, regardless of their affiliation with Emtek. In the future, credit on Dana can also be used to pay utility bills and health insurance – features already available on similar mobile wallets like Go-Jek’s Go-Pay and Grab’s Ovo (known as GrabPay in other countries).

For Bhavana Vatvani, financial services director at consultancy Accenture Indonesia, Ant’s partnership with Emtek was “definitely a strategic one” as it capitalizes on Emtek’s standing as a media giant in the country. Yet she notes that the rollout of Dana has been slow, and it’s “still lagging behind” market leaders in Indonesia’s mobile payments space in terms of what features it can offer.

Go-Pay, part of Indonesia’s massively popular ride-hailing and on-demand services platform Go-Jek, has had a headstart since its launch in 2016. Early on, it was able to secure the necessary licenses not only for cashless payments via in-app services, but also for peer-to-peer transfers and QR code payments at brick-and-mortar stores. Go-Jek is backed by Tencent – Ant parent Alibaba’s biggest rival, the company behind WeChat.

While Go-Jek hasn’t publicized the number of mobile payment transactions it has handled, analysts widely regard Go-Pay as the player with the largest market share in Indonesia. Go-Jek itself said that in October 2017, Go-Pay accounted for 30 percent of all e-money transactions in the country. It got to that position despite competing with e-money systems issued by banks, such as Mandiri e-cash and Bank Central Asia’s Flazz.

Analysts believe Go-Pay became such a popular platform because it offers a compelling use case embedded in a fast-growing ecosystem of on-demand services. Go-Pay adds a lot of convenience because it can settle small amounts on the go, and few people use credit cards for these types of payments.

Vatvani sees risks in the future development of Dana because its success hinges on BBM, whose active user base appears to have stopped growing – or may even be in decline.

The last publicized monthly active user count for BBM in Indonesia was at 55 million, but that was in 2016, when BBM still outranked WhatsApp and other messengers in Google Play.

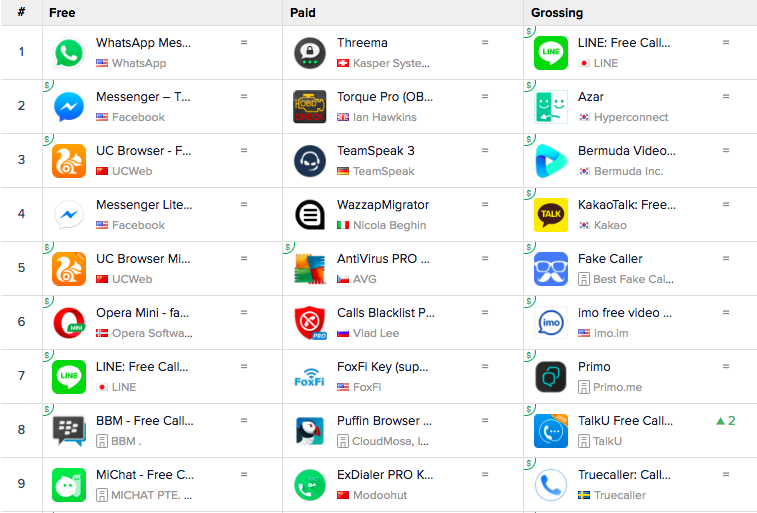

BBM’s ranking in Indonesia Google Play, under Communications category. Source: App Annie

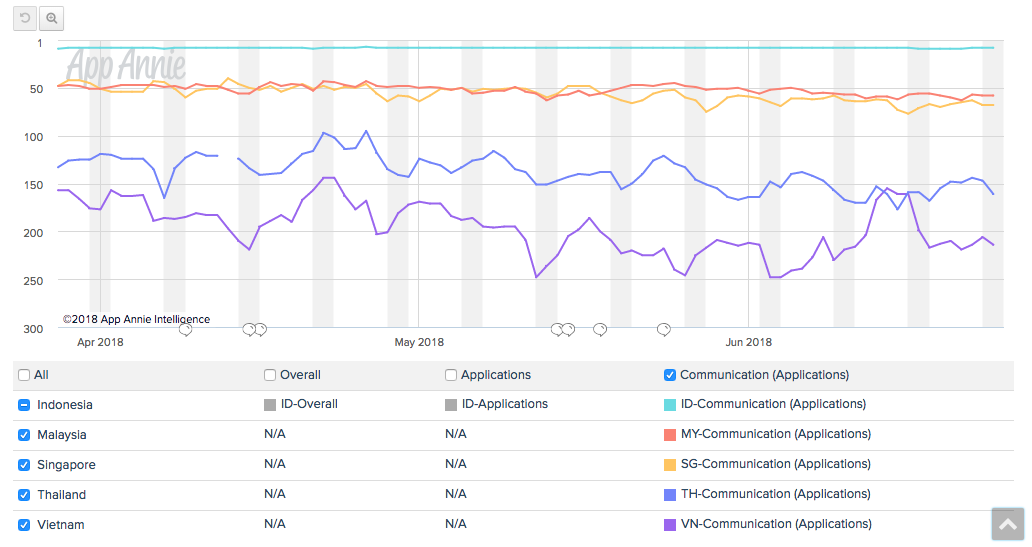

BBM has since been overtaken by other messaging apps, although it retains some significance, ranking eighth among communications apps in the Indonesian Google Play store. But Indonesia is one of BBM’s last few strongholds, as it isn’t in demand in other Southeast Asian countries. In Thailand and Vietnam, BBM doesn’t even make it into the top 100 in its category, according to App Annie data.

BBM rankings in Southeast Asian countries. Data between March 28 and June 25, 2018. Source: App Annie

App rankings are not a perfect indicator for the number of active users, and without data, it’s hard to get an accurate read on BBM’s popularity. Matthew Talbot, the messenger app’s CEO, declined to share current numbers.

Talbot points out that app rank “continues to fluctuate week to week with so many social applications launching […] and depends on various factors.” He adds that BBM thinks it can continue to grow its download numbers as both the performance and features of the app improve. One strategy the app is pursuing is to ensure pre-installs of its latest version on certain handsets in collaboration with mobile operators.

So did Ant bet on the wrong horse with Dana, a mobile wallet that was late to enter the market and is linked to a messenger whose popularity is possibly past its prime?

Dana spokesperson Albandja says it’s not all about the speed of execution.

“We just soft launched end of March and we already have exponential growth,” she told Tech in Asia, adding that Dana prioritizes “not only simplicity, but also security, because trust is important for us.”

Albandja believes the services Dana will offer and the way it will eventually integrate with a wide range of partners will convince users to give it a try. The app’s high security and simple user interface will also be a draw. However, she didn’t share further details about how it intends to acquire customers and differentiate itself from Go-Pay and other wallets in the market.

Mevira Munindra, senior research manager at analyst IDC, thinks that Dana stands a chance of becoming a key player in Indonesia if its plan to build an ecosystem is executed well.

She says, “With [established] fintech players, the main and most immediate [task] for them is to think ahead on the ecosystem. The market leader for payment will be the one who captures subscribers and builds the most integrated payment as possible.”

Calculated caution

Photo credit: Dana’s site

According to Vatvani, all of Ant’s Southeast Asia investments, including Dana, still have to prove their worth. She believes they were part of the reason Ant reported net losses last quarter, triggering parent company Alibaba to swoop in and pick up a 33 percent stake earlier this year.

But for Zennon Kapron, founder and director of boutique fintech consultancy Kapronasia, Ant’s investment strategy in Southeast Asia is deliberate. It seeks minority partnerships which amount to some risk for the company – though nothing that’s likely to be fatal.

According to Emtek’s financial statements, it owns 90 percent of PT Espay Debit Indonesia Koe, the legal entity behind Dana, which likely means that Ant’s share sits at 10 percent or less.

This cautious approach stems from observing the failure of Western companies in China, as they often underestimate the difficulty of adapting to local expectations, explains Kapron. So Ant instead turns to “local teams who understand the market better,” he tells Tech in Asia.

In India, this strategy paid off. In 2015, Ant threw in its lot with Paytm, a startup that began as a mobile wallet designed to simplify bill payments. Together with its parent Alibaba, Ant has steadily invested in the Indian firm, which “has gone from strength to strength since,” says Kapron. Both Chinese firms have raised their stakes in Paytm’s core payments app and the ecommerce unit it spun out in 2016.

In Southeast Asia, Ant faces a more fragmented market. The region is slowly transitioning to mobile payments, and there’s no single solution to address the roughly 600 million people across all countries.

It will require long-term thinking to address this challenge, and in some ways, Ant is already in a strong position. Alibaba owns Lazada, one of the few regionally operating tech firms. Lucy Peng, Lazada’s new CEO, used to be CEO of Alipay and is still executive chair at Ant.

Ant will continue to make strategic investments around Southeast Asia, Kapron predicts. “The long-term goal is to link them all together, creating a payments network that enables transfer of funds across borders.”