5 Dead-Simple Ways To Manage Your Money

Fast Company: You know you should pay more attention to your finances, right? These five options do a lot of the heavy lifting, whether alerting you when you need to pay attention to something or automatically investing your spare change.

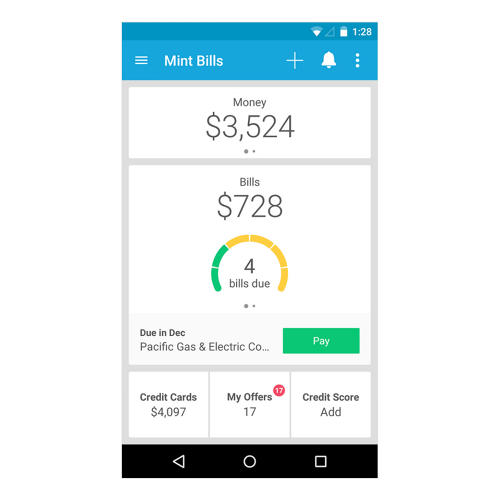

1. NEVER MISS A BILL PAYMENT AGAIN.

Sometimes money seems to go out as fast as it comes in. To keep an eye on all your bills, try Mint Bills (Android, iOS). The app corrals all your bills together into one place, sending you reminders as each one comes due. You can pay with a quick tap or two, set advanced payments, and synchronize your payment accounts to make sure you have enough dough to cover your expenses—complete with alerts when your cash gets low and you have bills due soon.

2. KEEP AN EYE ON YOUR CREDIT SCORE.

Making sure your credit score hasn’t taken a nosedive is a good habit to get into. Credit Karma (Android, iOS, Windows Phone) leverages reporting services TransUnion and Equifax to let you check your credit score without impacting your credit report. You can see which factors affect your score the most and get a letter grade denoting how well you’re doing in each category, and the app can send you push notifications if and when your score changes.

3. FEND OFF FRAUD.

Use BillGuard (Android, iOS) to pipe all your accounts into one eye-pleasing dashboard. Each time you log in, you’ll see how much you’ve spent, how much is left of your monthly budget, and what you’ve recently purchased. The app features identity protection from Experian and alerts you to charges being made from faraway locations. If there’s a charge you don’t recognize, you can dispute it with a few taps: BillGuard says it’s rooted out more than $60 million in fraudulent charges.

4. INVEST YOUR SPARE CHANGE AUTOMATICALLY.

The Acorns (Android, iOS) app lets you automatically round your everyday purchases up to the next whole dollar, investing the change into one of five diversified portfolios—from conservative to aggressive. You hook the app up to your spending accounts, and it’ll take care of the legwork for you. With any luck, each time you log in, you’ll see your automated nest egg growing bit by bit.

5. SPLIT EXPENSES WITHOUT RUINING FRIENDSHIPS.

Nobody likes chasing their roommates around for rent and utilities every month. Splitwise (Android, iOS) attempts to make the process as seamless as possible by assigning each person in the household a balance and sending out email reminders to make sure things get paid on time. Payments can be sent electronically using PayPal or Venmo so that nobody has to deal with paper checks.