Orchard: Consumer Unsecured Lending Down 44% from 2015 High but Increases from Previous Quarter

By JD Alois for Crowdfund Insider

Orchard is out with their quarterly report and it is pretty interesting. As most people in the online lending industry know, this sector of finance has been going through a bit of a transition in recent months. Orchard has direct access to origination volume to just about everyone so the numbers are pretty definitive.

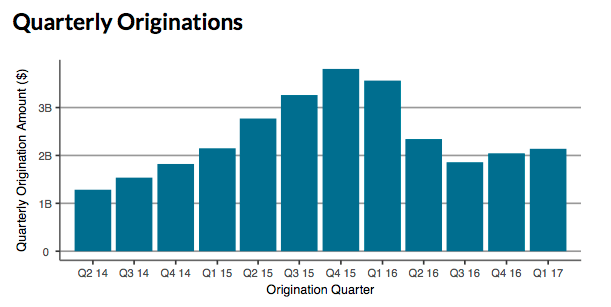

According to Orchard, loan originations totalled $2.139 billion in the first quarter of 2017. This was a 4.6% increase versus Q4 of 2016. But when comparing to Q1 2016 ($3.563 billion) it was a significant decline. When you compare the number to the peak of Q4 2015 ($3.807 billion) the decline is 44%.

Orchard adds that 2014 and 2015 vintage charge offs have increased sharply. They state that some of the platforms have reworked their credit models which should address the deteriorations in loans. They also note that 2014 saw an increase in subprime loans that would obviously hold a higher risk of default. This thesis is corroborated by the reduction in interest rates over this period. Most originators have increased their interest rates to keep up with Fed and to further boost investor demand for their loans.

Orchard presents a positive spin on the online consumer lending market stating:

“Early indications in 2017 are that investor sentiment is improving, and we believe we’re likely to see increased investment over the next quarter.”

Michael Toth of Orchard says;

Michael Toth of Orchard says;

“There are likely blind spots that exist in the market today; although not necessarily with respect to loan size but in other underserved market segments. To me, this chart [weighted average interest rate by loan size] illustrates how online lenders, and the improvements they’ve brought to lending, have served to drive inefficiencies out of the marketplace, ultimately, to the benefit of consumers in the form of lower rates.