Asian fintech: Expansion, expansion and yet more expansion

Fintech is strong in Asia.

- The region retains 40% of all global capital invested in the sector.

- Six out of seven of the largest fintech companies worldwide come from Asia.

- The biggest Asian hubs (Singapore, India and China) are becoming the centres of global fintech innovation and adoption.

THE GROWTH

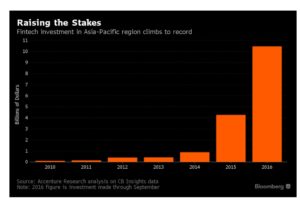

Asia’s Fintech market has grown exponentially over the last few years. Fintech investments in the Asia-Pacific region reached US$10.5 billion in 2016, a record high since 2010, according to Accenture’s analysis of CB Insights data. Deloitte has named Singapore the top global fintech hub tied with London, and China is now undoubtedly the country with the largest fintech sector.

Fintech is rapidly growing in Asia, and nowhere more so than in Greater China. Fintech financing in Asia-Pacific in 2016 eclipsed that of North America for the first time, more than doubling to US$11.2 billion from US$5.2 billion in 2015. North America attracted US$9.2 billion in fintech financing in 2016, while Europe attracted US$2.4 billion, comments Thorsten Terweiden, Deputy Head (Fintech) at InvestHK.

Recent research by KPMG and CB Insights also found that in the third quarter of 2016 fintech funding for North America and Europe fell, while Asia continued to see an increase. “You do feel the adrenalin rush when you attend a fintech event here in Singapore, or somewhere else in Asia, even more so than in Europe or the USA. Everyone is collaborating and the industry is tightly knit, so there are plenty of opportunities to succeed and mentors to guide you along the way,” says Roger Crook, CEO of Capital Springboard.

Zubair Ahmed, Senior Vice President, Head of IT & Business Innovation at Emirates Islamic Bank, adds that although Asian fintech was a late starter, as of this year, he believes it’s now the fastest growing region. “And it’s not only China that is making its presence felt. Fintechs from Singapore, Vietnam and Thailand are aggressively building compelling propositions to get noticed and have recently enjoyed attracting sizable funding”.

The role of Asian fintech is linked to the performance of the wider Chinese and Indian markets, having been primarily driven by a few megadeals in China and India, argues Stan Vazhenin, Investment Analyst of Life.SREDA VC. He believes that large local internet and IT giants, insurance and financial holdings in these countries, as well as in the rest of Asia, have shifted their strategic view of the financial technologies sector and have made solid capital investments in several companies.

“The incredible growth in total value of fintech investments was due mainly to China and Hong Kong, where just three percent of the deals accounted for nearly 43 percent of total fintech investment globally. These figures alone indicate that Hong Kong, China and the rest of Asia is starting to drive forward fintech investments on a global scale.” Thorsten Terweiden, InvestHK

“To this end, the top seven financing deals in Asia – $7.6B in total – account for almost 80% of all capital invested in Asia. While we didn’t see a significant increase in the number of deals (257 deals in 2016 against 221 in 2015), the cheque size has increased, subsequently expanding the volume of the whole market (+60% YoY),” notes Vazhenin.

EY’s report on ‘The rise of fintech in China’ highlights the fact that China’s move away from an export-reliant economy to a consumer-driven economy through innovative service providers like Alipay (of Ant Financial), Tenpay (a Tencent company), WeChat (Tencent), Yu’e Bao (of Ant Financial) and Ping An means it has “leapfrogged” other regions to become the “centre of global fintech innovation and adoption”.

Singapore has significantly strengthened its positions on the Asian fintech map, beating Hong Kong and becoming the “preferred gateway” into Asia within the last year. “Ernst & Young ranked Singapore fourth as a global fintech hub, behind Britain, California – home of Silicon Valley – and New York,” notes Roger Crook, CEO of Capital Springboard.

Tax benefits, government help and easy access to regional markets led startups to choose Singapore as their headquarters, rather than base them in the rival hub of Hong Kong or South Korea. Startups are wooed by the government support – tax advantages and introduction to potential partners that’s provided. Ranking the Southeast Asian city fourth among global fintech hubs, Ernst & Young highlighted the city’s “increasingly progressive regulatory regime.” In addition, the local regulator, Monetary Authority of Singapore (MAS)’s, commitment to invest $225 million in fintech over five years and pledge of funding up to half the cost of promising fintech “proofof-concept” trials based in Singapore, to an official position & support (recognising the industry’s potential) explains why so many fintech companies are now leaning towards Singapore, and adds a new dimension to the decades-old tussle between Singapore and Hong Kong for the position as Asia’s premier financial centre.

With a network of firms across Asia, Chiang Fock Pong, Executive Director of RT Group, believes that fintech companies are the integration and confluence of technological advances in the financial sector which serve a critical consumer need that was missed by traditional bankers. “The global fintech market includes the market in the USA which was historically huge but the rising stars of the fintech market are in Asia, led by China and India. As trade is borderless the Asian market cannot be ignored. So either the Asian fintech companies will dictate how the market shifts, or the investment from the States will start flowing into the Asian market,” he adds.

Taking into consideration the overall size of the Asian market, with India and China dominating the landscape, it’s natural that Asian fintech companies are waking up to the opportunities that this kind of magnitude creates, comments Rajesh Chakrabarti, Marketing, Innovation and Strategy Technologist Banking Consultant of World Bank Group. “Due to its sheer size and diverse economic strata, the region will need multiple solutions to address these challenges and this diversity makes the Asian fintech market comparably robust and strategically strong in the global arena.” Chakrabarti claims 2017 is the year for Asian fintech, and with the new government in India that’s highly focused on creating a cashless India, the world will soon see huge technological advances in the area of fintech In Asia and adds, “In fact, in the next two to three years, I believe that the Asian fintech market will become the leaders in global fintech”.

THE 2017 ASIAN TRENDS

The global fintech focus is on Asia since 2016. “Some Asian markets like Singapore, Indonesia, Malaysia, Hong Kong and India are making significant headway on the fintech front and it will be interesting to see how they compare with more mature markets like China. The race is certainly on and South East Asia is ahead in my view,” says Roger Crook.

In terms of total users and market size for fintech China leads the world. “By looking at China’s main fintech sectors, you get a good idea of what to expect in the rest of the world. As the social platforms continue to develop, China will foreseeably drive mobile payments, peer-to-peer loans, SME lending, personal finances, on-demand online insurance and more – and these successful models will act as inspiration for global players,” comments Thorsten Terweiden of InvestHK.

There are already ten Asian fintech companies in the top 21 largest fintechs worldwide that are better known as unicorns, and six out of seven of the largest fintechs globally are from Asia. Vazhenin stresses: “The key issue is now about distribution within the market and its current concentration around China.

” Experts suggest that in 2017 Asian fintech will go beyond its home market and establish itself in new regions. “Up to now, there were only few cases in APAC region and this reflected the fact that the market had become saturated to a certain degree. In addition, I believe that this year will see Indian fintech reveal its full potential and we’ll see some big results in the region in terms of valuations and funding,” adds Stan Vazhenin.

Commenting on which fintech areas in Asia will gain more attention from VC investors, experts point towards insurance, wealth management, lending and payments. “From analysing all cheques in Asia in 2016, the largest deals show there is an obvious interest in lending startups with insurance techs also featuring high. The lesser cheques went to wealth management tools and big data solutions, followed by a spread of others. It’s clear there’s a prevailing dominance of lending and payments startups as they received the largest cheques and formed the most deals,” – concludes Stan Vazhenin.

The hottest areas, which have attracted significant amount of capital, are peerto-peer and payments platforms as well as online wealth management tools. The number of industry players in these areas is rapidly increasing, Roger Crook confirms. Expansion, expansion and more expansion is the key Asian fintech trend with experts citing Artificial Intelligence, Robo advising, Mobile Payments, Banking automation and Blockchain as specific technologies where they expect growth this year.

There are three forces enabling online-based Asian startups to flourish: increased ownership and use of smartphones; a young population in emerging Asia; and increasing content consumption via social media.

Chiang Fock Pong of RT ASEAN Network explains: “For the most part, emerging Asia has leaped from the plastic card era (i.e. Visa and Master) to the smartphone era with regards to payments. With the growth of smartphones and the wide use of them (from toddlers to elders) now being the norm, payment and fintech startups will continue to flourish, and trend increasingly towards peer-to-peer models.”

2017 should see solid M&A deals as more Asian companies go international, and conversely, more Western companies enter Asia. APAC region’s investments in fintech may have reached its peak, but there are big international steps to be taken by behemoths like Alibaba, Baidu, Ping AN.

In addition, lending and payments sector investments are predicted to stabilise in 2017, while big data and AI startups should gain momentum in the Chinese and Indian markets as Malaysia boosts its position in global VC fintech market ,” predicts Stan Vazhenin.

FINANCIAL INCLUSION

Inclusive financing is delivering financial services to disadvantaged and lowincome segments of society providing individuals and businesses with access to affordable financial products and services to meet their needs thus encouraging entrepreneurship and contributing to wider economic growth, also providing an opportunity for startups to find gaps and offer innovative solutions with low administrative costs, thereby disrupting traditional industries and established market players.

“Financial inclusion is an inclusive approach to finance enabling consumers to access financial services. It is disrupting traditional financial institutions which are now beginning to recognise the need to innovate their product offerings. For example, financial inclusion is providing accessibility to the unbanked in rural communities. Coins.ph in the Philippines is a startup offering remittances, fund transfers, bill payments and shopping through Bitcoin. With 17,000 locations nationwide, Coins.ph reaches the under-served markets in farflung areas. Similarly, Kenya’s M-Pesa mobile phone-based money transfer, financing and microfinancing service is another example and already operates across Afghanistan, South Africa, Mozambique, Lesotho, Egypt, India and Eastern Europe,” says Roger Crook.

“Financial inclusion is also about utilising platforms to make services more accessible to the savvy consumer. DBS has morphed from a neighbourhood bank to a fullyfledged innovation lab sparking innovation by engaging fintech startups to partner with staff and develop prototype ideas as well as mobile and banking solutions. This neighbourhood bank has even gone branchless by launching India’s first mobile only bank,” notes Crook.

For Stan Vazhenin, at its very core, financial inclusion represents the ability to get access to lending services. “Opening a bank account is the first step, but mainly people need access to loans. Such access contributes to economic development in rural areas over time allowing people to build bigger, more profitable businesses”. Explaining the growing demand for financial inclusion initiatives globally, he cites Indonesia. “Out of a 200 million population, only 4% can access formal banking services, however, 60% can borrow. 43% of those who borrow are doing it through family and friends with only 17% borrowing from banks. Going further, there are 40% who don’t borrow, why is that? The main reason is that most cannot meet the documentation requirements and collateral due to the lack of information. To this end, alternative services are required; credit scoring systems, mobile banking solutions, e-wallets and so on.”

Certainly, Asia seems to be an ideal space for financial inclusion innovations. “There are some unique conditions in Asia which makes it a fertile ground for financial inclusion initiatives. These include a relatively low rate of formally banked population, high penetration of mobile phones, high connectivity and low barriers for setting up and running a business amongst other factors. Greater China, India, Philippines, Malaysia, Indonesia and Vietnam are particularly well-suited as they have high mobile penetration rate and relatively low rates of formally banked population,” explains Thorsten Terweiden, Deputy Head (Fintech) at InvestHK.

According to the analysis released by Magister Advisors in March, US and Asian investors provided 76% of all the capital invested in European late stage tech in the last 12 months, and stand to benefit most from Europe’s unprecedented success in tech.

Chiang Fock Pong provides two key examples of how financial inclusion startups are changing Asia. PawnHero, a mobile app startup in the Philippines, puts a pawnshop into Filipinos’ pockets. Filipinos no longer have to go to pawnshop to get their items appraised for a loan. PawnHero lets them pawn online, anytime and anywhere. It’s enough to take a picture of the item that you wish to use as a collateral for the loan, along with some item details to receive a free appraisal via sms and email. If the Filipinos like PawnHero’s offer, they schedule a free and fully-insured pick up of the pawned item and receive the loan straight to their bank account. “Loans in the Philippines are expensive to service, due to the geographical locations. Loan sharks charge exorbitant rates (sometimes as high as 20% per month), PawnHero provides low rates, around 2.9% and sometimes lower than credit cards as they do not have expensive physical outlets,” notes Chiang Fock Pong.

Another example is Expresspay, originally a remittance company turned mobile app / mobile wallet, that’s also based in the Philippines. The app allows Filipinos to make utilities payments, loans repayments, credit card repayment, pay for insurance premiums and even school fees via the app.

These cases spotlight how fintech startups in Asia are taking the opportunity to innovate by enabling consumers to get access to affordable and long-needed financial products. “We (in Hong Kong) are observing fintech companies rolling out initiatives and technologies to meet the demand of the underserved population and contributing to financial inclusion. This also implies potentially underestimated business opportunities and market needs.” concludes Thorsten Terweiden.

It is certainly an increasingly exciting space to watch.

KATIA LANG, The Fintech Times

KATE GOLDFINCH, The Fintech Times

LARGEST ASIAN FINTECH INVESTMENTS

All ten of the largest fintech investments in Asia-Pacific last year were in China and Hong Kong; together those ten deals accounted for 82% of all AsiaPacific fintech investment in 2016.

The leading deals were companies providing end-to-end services for payments and lending, including:

- Ant Financial Services Group – the financial services affiliate of an e-commerce giant Alibaba Group Holding that operates China’s onlinepayments platform Alipay closed a US$4.5 billion funding round;

- Ping An-backed Lufax, now using the name Lu.com, completed a US$1.2 billion round of funding;

- JD.com, China’s second largest e-commerce company, raised US$1 billion in new funding for its consumer finance subsidiary, JD Finance.

This result is driven by robust competition in payments and lending from non-traditional players, and the established financial institutions working collaboratively with startups to explore fintech solutions.

Source: InvestHK

EXPERT COMMENTS

“Financial Inclusion should be a way of living that leads to Social Inclusion…”

Asia accounts for around 60% of the world’s population with India and China alone making up 37%. With these kinds of numbers and all governments looking at financial inclusion, it is clear that Asian Fintech startups should also focus on this. Financial inclusion is not just a word, it should be a way of living that leads to social inclusion. If the lowest strata of society has reasonable access to banking, funds, e-commerce, education, health care and sanitation, we can safely assume that FI has been successful. This thereby leads to Social Inclusion, which goes onto create healthier, seamless and borderless economies. Due to the sheer size of the population and years of exclusion (probably because this strata was thought to be NONPROFITABLE) a huge section of society has been excluded. This exclusion has not augured well for any country and is now being recognised as creating disparity and weaker economies. Looking at financial inclusion not only ensures a dignified livelihood for a large section of the population but also creates a market which no one has previously targeted. So Financial Inclusion coupled with enhanced distribution channels (both online and offline) can actually achieve greater economies of scale for large corporates as well as business opportunities for smaller SME’s. Fintech is just a tool to enhance an experience. However, for the excluded, fintech is the only way to create a sustainable growth oriented economic structure that can alleviate millions who live below the poverty line.

Marketing, Innovation and Strategy Technologist

Banking Consultant of World Bank Group