Life.SREDA – Money of the Future 2016 is out!

By Life.SREDA,

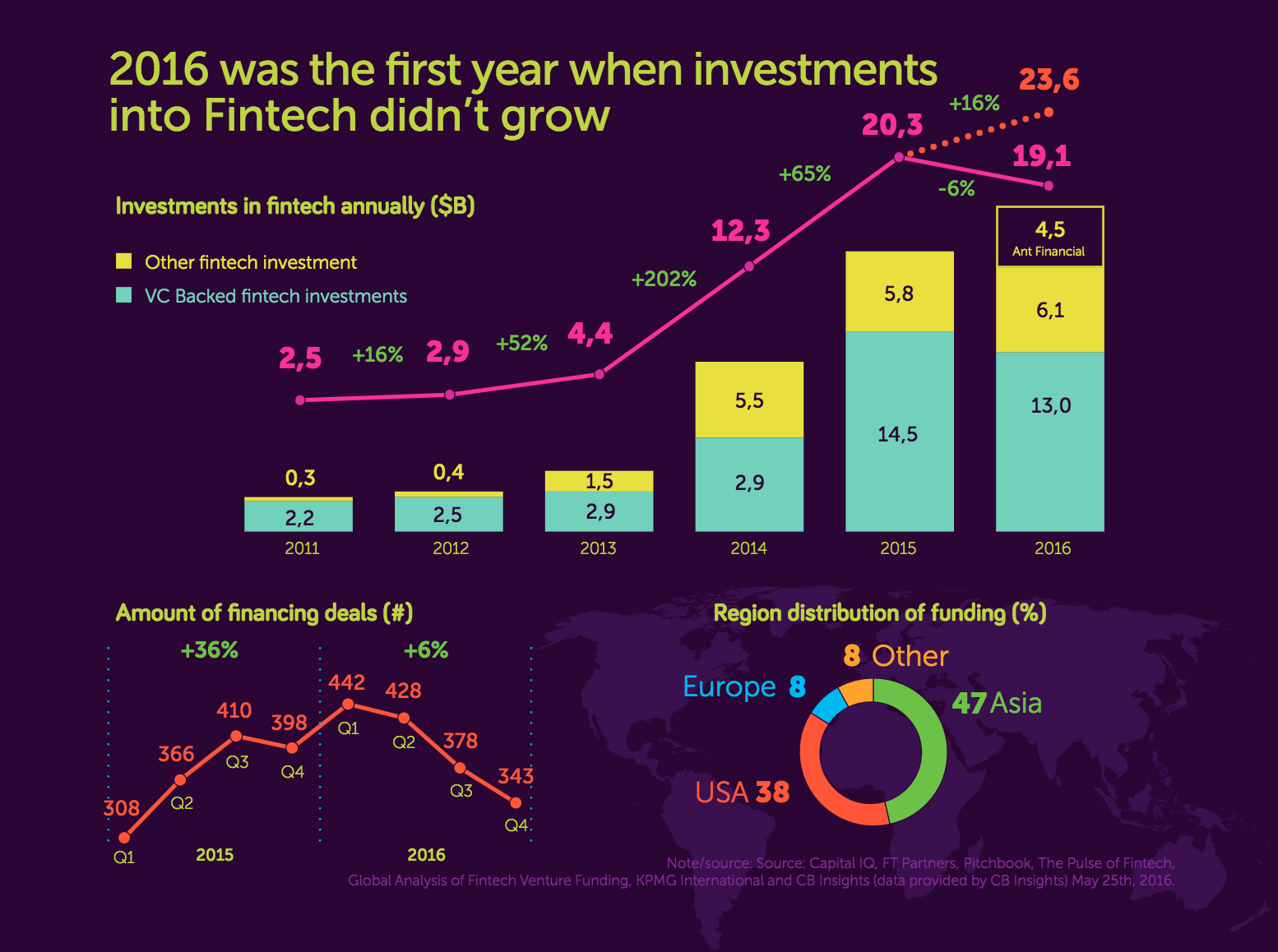

This time has come: VC investments into FinTech industry have not grown globally and the market has almost reached its saturation point in 2016. The amount of VC investment in 2016 was $23.6B USD which is 16% higher than in 2015, however excluding Ant Financial investment deal of $4.5B (which is abnormal for the whole tech industry, not even fintech), the fintech market decreased by 6% in 2016. Unfortunately 2016 was quite poor for notable exits in the fintech space.

But FinTech undoubtedly remains #1 industry in the VC space by investment volume and it’s even increased its share to 19% of the whole VC market in 2016, while overall VC industry slightly decreased in 2016 (by 9%). The fastest growing segment is Insurtech, which doubled its share in 2016. Blockchain still remains a relatively small vertical.

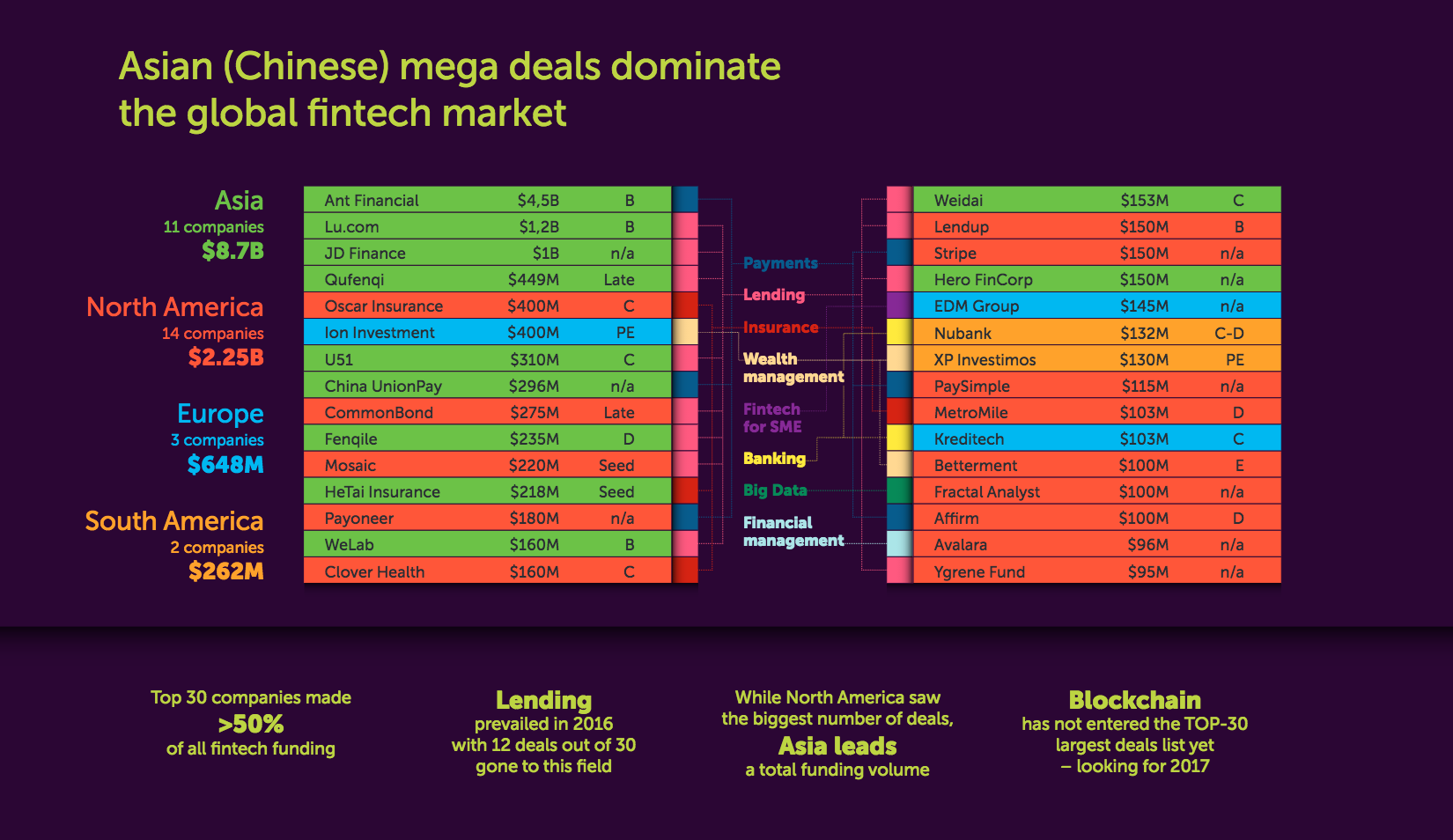

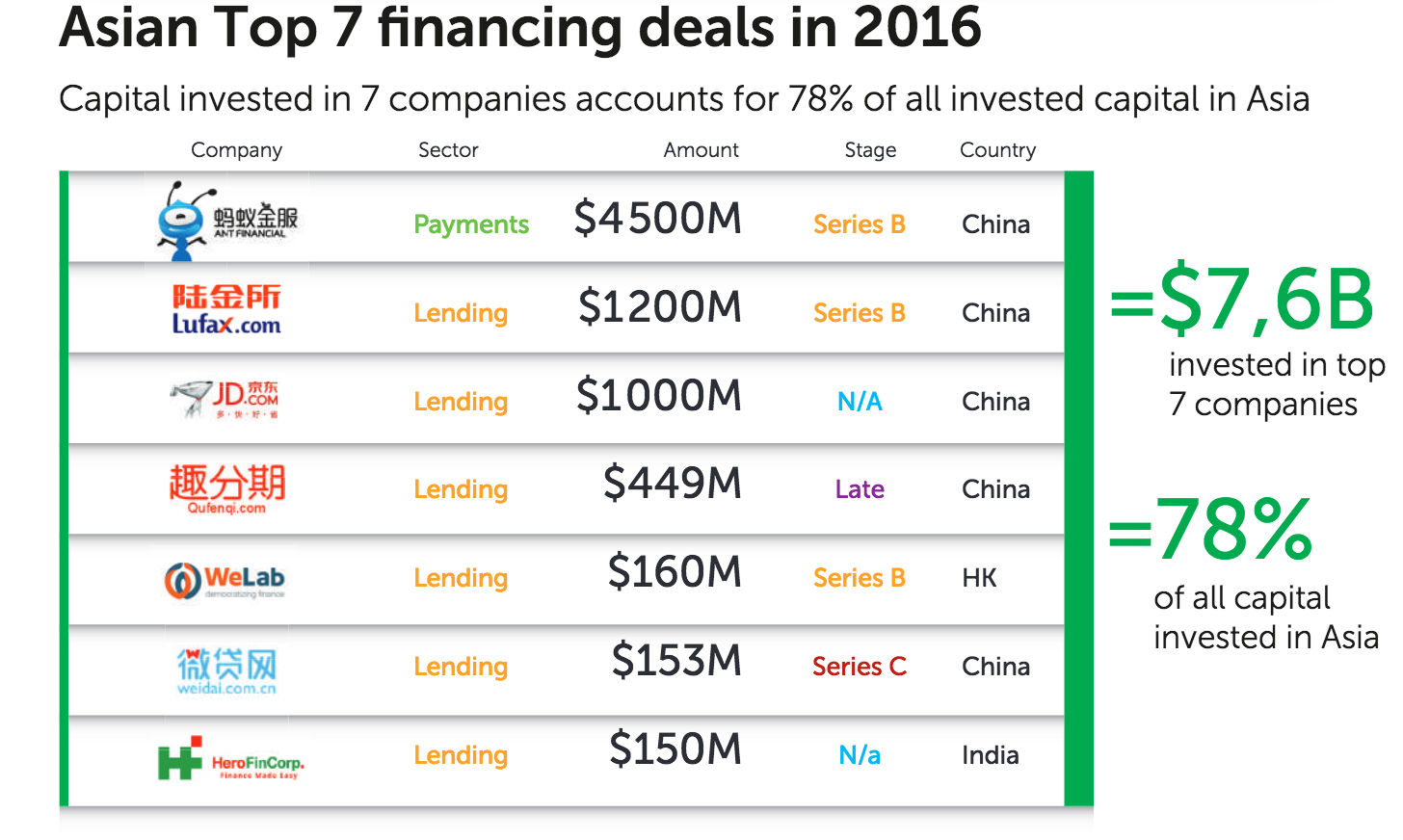

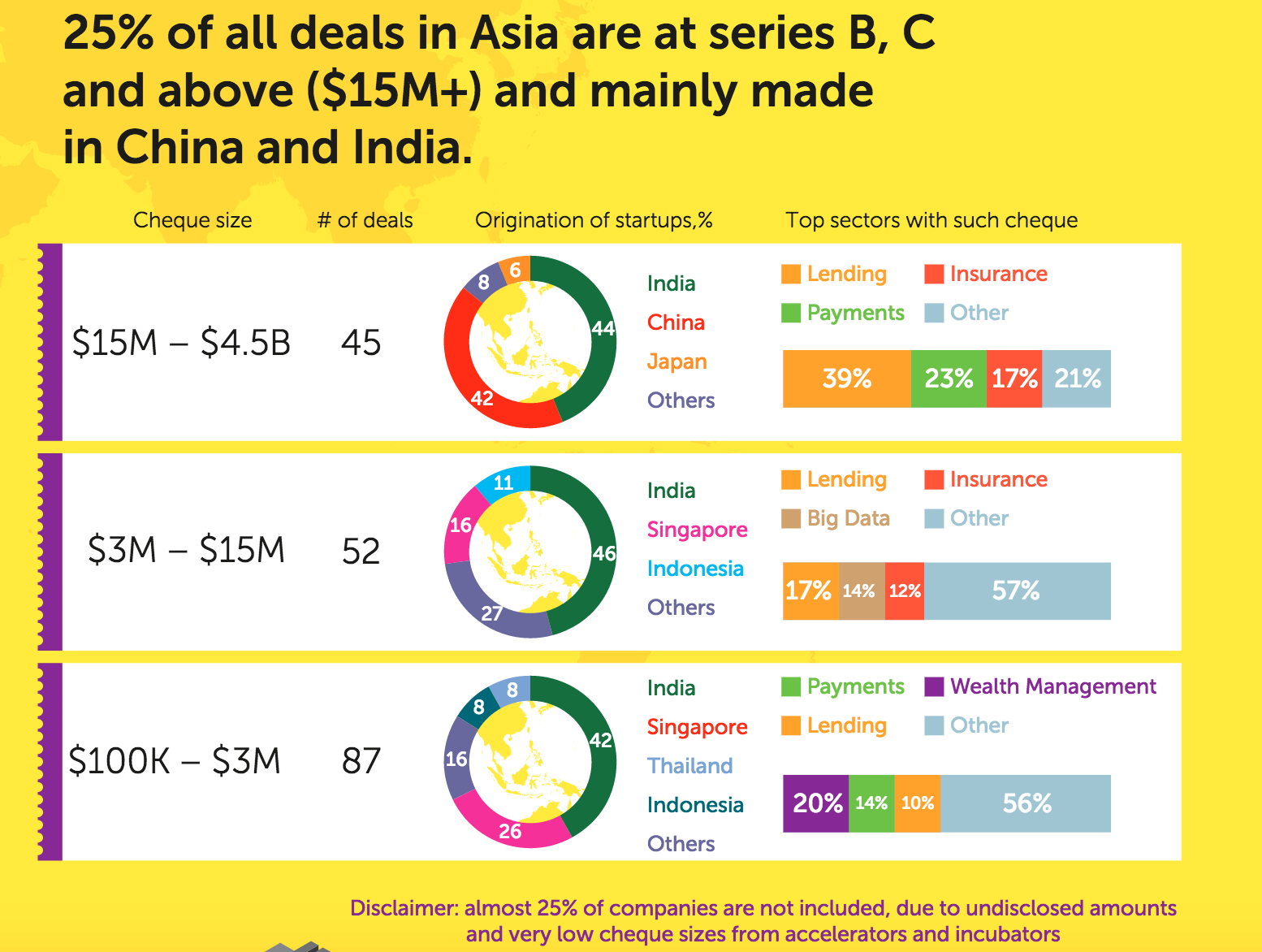

Asia’s share of global Fintech investment is 47% in 2016! What is even more impressive is that more than 80% of invested capital went towards firms in China, meaning that China has finally become the dominant power on the global fintech landscape, surpassing US and all others, which was never the case before 2016.

While China dominates Asian Fintech market by amount of funding, India is #1 by number of Fintech deals. Investments into Fintech in South-East Asia Region dropped by 40%. Singapore remains an absolute FinTech leader in South-East Asia region with $81.5M invested in 2016 and 60% of market share.

- The first year when investments into fintech industry have not grown

- Blockchain industry grew up by 18%

- Why Asia is the land of big data and online scoring

- 60% more fintechs were funded by banks

- Insurtech today is on the same trajectory as fintech was a few years ago

- China is new leader in fintech worldwide with 39% of global volume