With core conversions, the question isn’t if, but when

By Bryan Yurkan for American Banker,

Expense and risk has kept many U.S. banks from modernizing their core systems, but executives at one community bank that completed the project this past summer say they are happier for having done it.

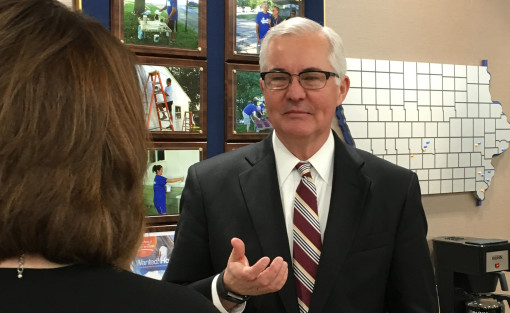

Ultimately, Two Rivers Financial Group in Burlington, Iowa, decided that keeping an old system would end up adding too much expense and risk of its own, said Kent Gaudian, the president and chief executive officer.

Before making the big switch, “we were so focused on getting the system to work and spent so much time on that, we were not getting the job done for our customers,” Gaudian said.

Employees at its $704 million-asset bank unit now have access to better tools that allow them to be more efficient. A customizable dashboard for each employee eliminates the need to do numerous searches related to daily tasks. A customer relationship management tool gives an overview of individual customers at a glance and tracks communication with them.

Two Rivers also opted for a system that enables a variety of prebuilt custom reports with visual views of data, replacing manual reports stored in Excel files.

Banks of all sizes can gain a competitive advantage by opting to replace their core, said Peter Wannemacher, a senior analyst with Forrester.

But this is especially true for smaller banks, because being tech-savvy is an effective way for them to stand out from competitors, said Wannemacher, citing Eastern Bank of Boston and Umpqua Bank in Portland, Ore., as examples.

“There’s a precedent for smaller banks that are willing to invest being able to punch above their weight,” he said.

Two Rivers’ bank unit went live in early August with a NuPoint core system from Computer Services Inc.

Its search for a new core vendor got underway in 2015, at the end of its contract with a previous vendor that Gaudian declined to name. It settled on CSI just before the new year.

Gaudian cited the data and analytics tools available with the cloud-based NuPoint core among the key selling points.

These allow Two Rivers to analyze each customer relationship and pursue cross-selling opportunities more effectively, he said. The bank can input “what-if” scenarios for a particular account or a group of them, to determine what loan opportunities best fit those customers, for example.

The system also decreases the time it takes to open new accounts by eliminating the need to rekey data multiple times.

Core conversions are relatively rare in the banking industry. Extrapolating from sales data, the research firm Celent estimates that about 2% of the top 1,000 banks opted to do core conversions in 2016. Among smaller banks, such as Two Rivers, the rate of core conversions is likely similar, said Stephen Greer, an analyst in Celent’s banking group.

“Banks always are reluctant to do core migrations because there is a substantial amount of risk,” he said. “You don’t want a scenario where you pull one string and then have some kind of reverberation in another place that you didn’t expect.”

For that reason, many banks simply layer middleware on top of old legacy systems to add new functionality as needed — a quick fix instead of a long-term solution, Greer said.

Though a core replacement can be a highly involved project with many moving parts, Two Rivers and CSI simplified the process by breaking it into components and dedicating a specific team to each.

“We have anywhere from 15 to 30 people working with the bank, from data movers to staff trainers, support folks and relationship managers,” said Tim Thurman, vice president of implementation for CSI. “We spend a tremendous amount of time on site and have project status meetings throughout the process, usually once per week and then more frequently the last month before going live.”

Near the end of the project, CSI set up a “demo bank” so employees could practice on the new system.

Gaudian described the conversion — which took place on an August weekend — as “seamless.”

“I’ve been through several of these during my time [in banking],” he said. “There were a few hiccups — there always are — but nothing that impacted the customer. We came in on Monday and were up and running.”

He attributed the hiccups to the need for more customer communication rather than something technical. “Due to the call volume we received the first several days after the conversion, we now know we could have done a better job in informing our customers of expected changes,” he said.

The expense of replacing a core system can be daunting. Estimates are hard to come by and vary wildly based on the size of the bank and the type of system. But even a community bank can expect to spend millions of dollars.

Gaudian declined to discuss the cost of the project, saying only that not having to deal with glitches in legacy technology is enough to justify the investment.

CSI’s Thurman predicted that the pace of core conversions will pick up as more banks get increasingly frustrated with legacy systems.

“There’s always a level of fear, especially when it comes to moving all the data,” he said. “But if a bank is having pain with their current system, then they become more motivated to look into it.”

Tech analysts have heard more bankers at least talk about modernizing core systems lately.

“In the last two years, compared with the 10 prior to that, the number of banks that have told me a core replacement is on their road map has certainly risen,” Wannemacher said.

But given the rapid pace of change in the industry, even the notion of modernizing core systems could become outdated over the next decade, he said.

“Looking 10, 15, 20 years down the road, what it even means to be a bank could drastically change,” he said. “When you look at concepts like banking-as-a-service and open banking, they may not operate in the same way. They may not need some of the functions a current core system provides.”