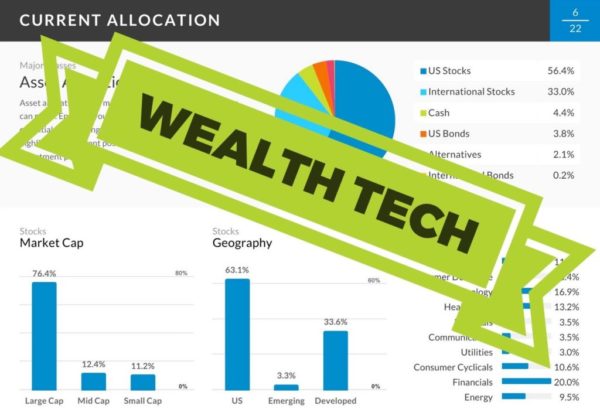

Top Direct-to-Consumer Wealth Tech Plays

By Julie Muhn for Finovate blog

Our wealth tech industry coverage continues this week. We looked at the industry last week and reviewed the top trends earlier this month. Today we’re taking a look at industry players with B2C offerings– in other words, companies that market directly to consumers and not through businesses.

Since wealth tech is broader than just robo advisors, we’ve divided B2C wealth tech players into seven categories and laid out our top picks for each group. Since category sizes vary, the number of our selections also vary.

Top in-house builds from traditional players

These are offerings from traditional wealth management firms that have been built in-house (or purchased and then white-labeled) and marketed under the firm’s brand.

- Vanguard’s Personal Advisor Services

- Charles Schwab’s Schwab Intelligent Portfolios

- Fidelity’s FidelityGo

- Deustche Bank’s Anlagefinder (‘Investment Finder’ in English)

Fully automated robo advisors

These are online platforms that provide automated, algorithm-based portfolio management without intervention from human advisors and without personalized, one-on-one conversations with a human advisor.

- Betterment (FF11)

- Wealthfront, fka KaChing (FS09)

- AssetBuilder

- FutureAdvisor (FF13)

- Blooom (FF14)

- Rebalance IRA

- Acorns

Acorns takes a unique approach by linking a user’s debit card and investing their “spare change”

Acorns takes a unique approach by linking a user’s debit card and investing their “spare change”

Hybrid robo advisors

These are traditional advisory services, including personalized conversations and actively managed portfolios blended with computerized portfolio recommendations. Business Insider reports hybrid robo-advisors will manage 10% of all investable assets by 2025.

- Personal Capital (FS14, FDSV16)

- SigFig (FF11)

SigFig has partnered with multiple banks, including Wells Fargo, Pershing, and Citizens Bank

SigFig has partnered with multiple banks, including Wells Fargo, Pershing, and Citizens Bank

Non-U.S. robo advisors

- Nutmeg, U.K. (FEU12)

- Scalable Capital, U.K. (FEU16)

- StockSpot, Australia

- MoneyFarm, U.K.

- Vaamo, Germany (FEU14)

Alternative investing platforms

These are platforms that link participants to non-conventional investment types, such as private equity, hedge funds, futures, real estate, etc.

With Motif, uses invest in grouped stocks and ETFs that revolve around a common theme

With Motif, uses invest in grouped stocks and ETFs that revolve around a common theme

- Loyal3 (FF14)

- M1 Finance (FF16)

Non-U.S. alternative investing platforms

News and information companies

These are online platforms that help users discover news and market trends before they go mainstream. Some include social networking aspects.

TickerTags helps users discover trends even before they become news

TickerTags helps users discover trends even before they become news

First appeared at Finovate Blog