Is Fintech Small Banks’ Equalizer in Fight with Big Rivals?

By Bryan Yurcan for American Banker

Partnerships between fintechs and big banks are attention-getters. For community banks, however, such relationships can be game-changers.

Community banks face a special challenge. Their main selling point to consumers is often a personalized experience, yet they still need to offer customers the digital products and services they’ve come to expect. Without the budget to develop technology internally like larger banks, many are turning to fintech as a way to pursue tech innovation.

“They’re not likely to be sponsoring startup incubators like the big banks, but they are looking toward fintech partnerships to figure out how to deliver products and services in an efficient way,” said Craig Miller, a partner with Manatt, Phelps & Phillips.

While larger banks may see fintech as a way to accentuate or enhance part of their business, Miller said partnerships enable community banks to bring innovation to major parts of the bank immediately.

“They really are looking at [partnering on] the technology that can benefit the largest set of customers,” he said.

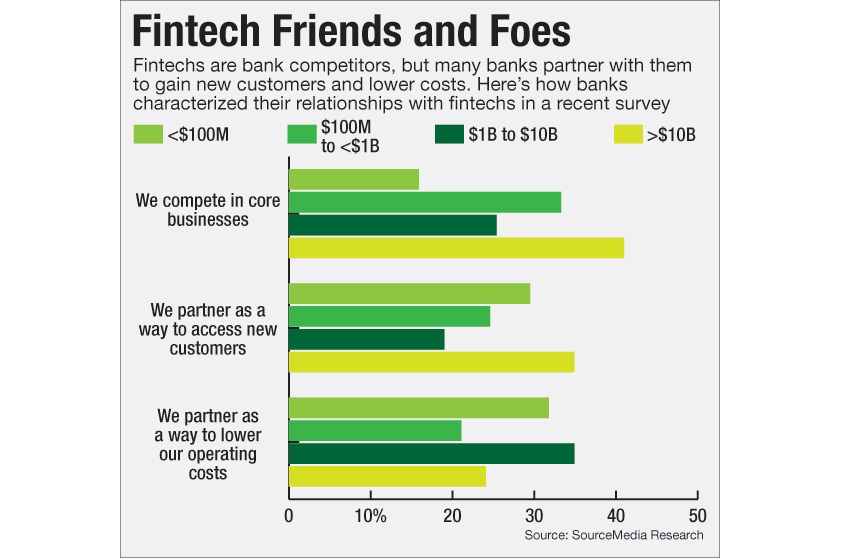

Manatt, along with MergerMarket, surveyed 37 community bank executives for a report released in October. A good 84% said they had already met with a fintech company on a possible collaboration. Similarly, a SourceMedia Research survey on banks’ spending in July found that community banks are turning to fintech to find new customers and lower their costs.

For their part, fintech companies seem to be somewhat agnostic about the asset size of potential partners.

For example, the $850 million-asset Radius Bank in September announced it would team up with the online lender Prosper to help make small-business loans. That relationship is similar to agreements between JPMorgan Chase and OnDeck and Regions Bank and Avant, Miller said.

The $1.2 billion-asset Avidia Bank has also shaped its business by working with fintech.

“We are always actively looking at different partnership opportunities,” said CarrieAnne Cormier, assistant vice president of retail operations at the Hudson, Mass., bank. “We look at what technology is the most valuable to us in enhancing the customer experience and benefiting a broad set of customers.”

An example of such a partnership is Avidia’s integration of technology from the cloud-based payments provider Linked2Pay to power a business-to-business mobile payments service for its commercial clients. The partnership began in 2015. Looking ahead, the bank is also planning to seek out potential fintech partnerships with mobile wallet providers to integrate a consumer mobile wallet feature to its mobile app, as well as incorporating a mobile gift card service. (Cormier noted that a majority of the bank’s existing mobile services come from its core provider, FIS.)

Avidia’s enthusiasm for tech investment is driven by the fact it doesn’t see digital as being separate from regular retail banking, Cormier said.

“I oversee both the retail and digital channels; they aren’t siloed,” she said. “We look at mobile and digital as a way to enhance the existing experience.”

Indeed, technology won’t likely displace branches or the face-to-face interaction for community banks, but complement it, said Jake Crews, vice president of the $1.4 billion-asset Crews Banking Corp., which has four subsidiary retail banks in Florida.

“Technology is not replacing that human touch, but it can change the way we interact with customers,” he said.

It could mean bankers bringing a mobile device with them to meet with commercial customers at their office to input information rather than relying on a largely paper-based back-and-forth process. Such capabilities were one reason Crews Banking this year partnered with Sageworks, a tech firm in Raleigh, N.C., on a “start-to-finish” overhaul of its commercial lending operations, Crews said.

Commercial lending “is a cumbersome thing for most institutions,” Crews said. “We wanted to make it much more efficient for the bank and the customer.”

Ultimately, technology can help community banks compete while retaining their personal edge on larger institutions, he added.

“A lot of basic transactions have moved to mobile, but that doesn’t mean the branch is going away,” he said. “If we are able to do it right, then technology can help level the playing field for community banks.”

First appeared at AB